The British government is taking in more money through taxes than ever before. Yet the deficits remain and the debt gets bigger. Nobody from any of the major political parties is serious about reducing the UK’s £1.6 trillion national debt. If you’re going to pretend to worry about the debt, you could at least do a half good job of it.

You’ll see the actual debt numbers in moment. But let’s begin with Japan. There’s no way around it: the Bank of Japan (BoJ) is not pulling its weight, at least in terms of inducing investors to risk even more money buying stocks. Come on BoJ. You can do more! Put your back into it!

The bank announced no changes today. Target rates did not get even more negative. And the size and scope of the asset purchase program wasn’t changed. But Governor Haruhiko Kuroda defended his previous foray into negative rates. He also coined a new term, “minus rates”. According to the Financial Times:

Since we brought in minus rates, short and long-term bond yields have fallen and that has clearly fed through to falls in mortgage and lending rates — so on the interest rate side the effects are already clear… From here, I anticipate the effects will spread to prices and the real economy.

Right. Good luck with that Kuroda-san. It’s not going to happen.

What we’ve learned from “minus rates” so far is that they hurt bank profitability, which further destabilises the banking system. We’ve also learned they cause savers to hoard cash, not spend it. And most of all, we’ve learned that if you want to disincentive saving and cash, you’re going to have to use technology to punish thrift.

Technology can compel people in a way that persuasion can’t. With technology, you don’t ask. You do. And as Yoda told Luke, “Do, or do not. There is no try.” Below, you’ll see how the Bank of England is planning to “do”. But first, back to George Osborne and his incredible growing government debt.

The blue line of Budget shame

What can I say here about George Osborne’s Budget measures that you won’t read in the news or see on the BBC? Not much. Some revenue will be raised. It won’t be called a tax increase. Some spending will be cut. Targets will be revised. Mistakes will be made. Carry on.

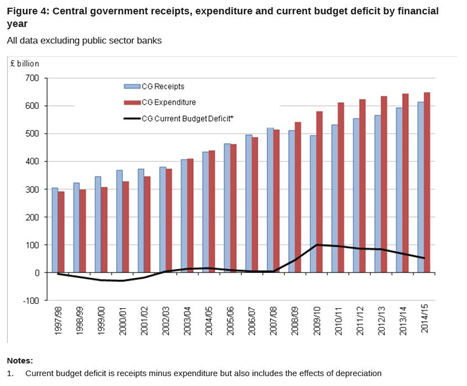

But it’s not as if the British government isn’t taking in more of your money year after year. Government receipts doubled between 1998 and 2015, according to the Office for National Statistics. You’ll note that during that period, receipts declined only twice on a year-over-year basis. Spending (in nominal terms) increased every single year. See how that works?

These tax and spending trends measure up as a percentage of GDP. That’s a trick rhetoricians use to justify higher taxes or bigger spending. And meanwhile, the revenues increase and so does the debt. Keep that in mind. Why?

The central premise of modern Keynesian economics is that you can run deficits forever because they never have to be repaid. You pay the interest on the debt and roll it over (issue more of it). It’s perpetual debt! I also call it “the blue line of shame” because running up debts for other people to pay off is something we ought to be ashamed of. Nobody really is, though. We’ve become used to it.

And some people have no shame when it comes to spending other people’s money. There are also some economists who think that governments should run even larger deficits. As “minus rates” get thrashed by the banking sector, you’re hearing calls for a return to “fiscal policy”. That means more and bigger deficits with increased government borrowing.

A growing economy generates larger tax receipts. If tax receipts grow faster than spending, you can reduce your net borrowing (while still spending more than you earn). But if debt grows faster than GDP, you have to borrow again to make up for the “missing” revenue. That’s the dilemma George Osborne faces this year.

Osborne will solve the problem by selling more debt. Gilt issuance will increase by 9.1% this year. That’s the median estimate from analysts surveyed by Bloomberg. It adds up to £139 billion in new government borrowing. It would also be the largest annual increased since 2009, when debt issuance increased by 55% as the economy tanked.

And so the debt train rolls on year after year, little boxcars of billions that future Britons will have to repay. You can see the problem. Deficit reduction is not debt reduction. It’s borrowing growing less fast. But when a crisis hits, or a perceived crisis, the debt explodes quickly.

Who owns this debt? Or, to whom is it owed? Foreigners own 25% of it. It will be interesting to see if the appetite for British government debt wanes as the uncertainty over Brexit waxes.

Category: Economics