One of life’s underrated joys is finding a pound note in a pocket that you’d completely forgotten about. Suddenly discovering you own something of value is almost like winning a competition.

But turn that feeling on its head. How does it feel to find out something you owned, that you thought was valuable, was actually rotten?

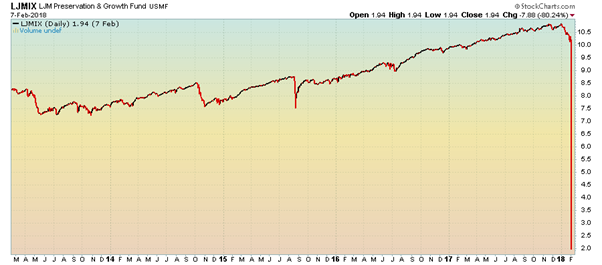

Something tells me investors in the fund below know this feeling very well. Believe it or not, this is the LJM “Preservation and Growth” fund.

As you can see, those who bit off a piece of this bright apple suddenly noticed there was half a maggot remaining in it last week. How many more maggots are there out there, infesting personal pensions and investment accounts, bearing innocuous names like “Preservation and Growth”? Quite a few, I’d wager…

The chart may give some Capital & Conflict readers deja vu, as last Friday’s letter included a similarly disastrous investment, the diabolical exchange-traded product known as XIV. This fund crashed at the same time and for the same reason (being punished for “selling vol”, as I’ll explain), but it’s different for one crucial reason. The XIV was an esoteric and niche investment product, for speculators. This was a mutual fund marketed to traditional asset managers – sovereign wealth and pension funds, who were encouraged to “make volatility their asset”.

The fund made money by selling volatility, or “vol”. This means making bets that volatility would stay low. For those interested in the detail, they would sell put options on the S&P 500 expecting the majority of the options never to be exercised. Effectively this is just like selling insurance, and expecting nobody to claim on it. And in this case, they had not set aside money or assets to deal with such a claim; they were selling those put options “naked” – that is, without having set aside collateral to deal with such a claim.

The results speak for themselves. When volatility spiked, the fund got keelhauled. Whatever “risk management strategy” the fund managers had promised their investors was useless.

Thankfully, the fund did not attract a massive amount of capital – less than a billion dollars – so the damage won’t be too widespread. But the fact that such a fund existed is a testament to how dangerous the investing world has become once more, that traditional asset managers are being tempted to dabble in such risky strategies.

A bull market in volatility

Markets have been too still for too long. And this stillness has seduced investors and asset managers alike into taking much more risk than they would have before. Just as the mythological siren tempts sailors into the sea and to their demise, the stillness in the markets has lured investors into taking on excessive risks.

Hedge fund manager Alan Fournier (who rode the wave of sub-prime lending in the early 2000s before shorting the market as the credit bubble came close to bursting) said in an interview late last year that he thought the absence of volatility, this stillness, must be reaching the end of its cycle. He had come to this conclusion after finding out that large European pension funds had been selling volatility (in the same fashion as LJM had) for income due to the lack of returns on bonds.

“… the central banks have succeeded in pushing people out on the risk curve. They’re taking people that are managing the pensions of state pensioners and they have them in negative earning sovereign instruments. And now… they’re so desperate for some yield, they’re systemically selling volatility, which is remarkable.”

The goal of quantitative easing was to force investors to take on more risk. In this regard they have very much succeeded. And if the bear market in volatility has ended, the stillness shattered (as it seems after the great spike in the VIX earlier this month), then we may begin to see who fell hardest for the siren’s charms.

An unexpected owner

I’m no longer a financial adviser, but I like to keep an ear to the ground and stay in touch with some of my old contacts. I meet a friend I was trained with fairly often, and over time I’ve seen him become almost as jaded as I was before I left.

He told me recently about a new fund his network was recommending the advisers sell to their clients. The adviser network has reduced the paperwork advisers are required to fill in when they recommend this fund to their clients to make lazier advisers more likely to recommend it. It’s worth noting that the network runs this fund, and collects management fees on it.

I was curious, and decided to take a look at what exactly the fund – which had a suitably generic name – contained. Among the top holdings were loans to a utility company due to be paid back in a hundred years. How many of those who were advised to invest in this fund know they own corporate century bonds, I wonder?

This is not to critique the funds choice – the fund managers may have a very sound argument as to why they think century bonds are a great investment.

But it’s worth knowing what you’re invested in, if only to know where you stand. So if you’re not familiar with the investment apples you’ve bitten into, be they company pensions, offshore/onshore bonds, stocks and shares ISAs etc… it may be worth giving them a look – hopefully you won’t find any maggots there.

All the best,

Boaz Shoshan

Editor, Southbank Investment Research

Related Articles:

Category: Economics