It always comes down to supply and demand in the end. Take the problems created by nearly $7 trillion in government bonds trading with a negative yield. Why would you pay to loan money to a government? And if you desire at least some return on your investment, how can you get it in a low interest rate world?

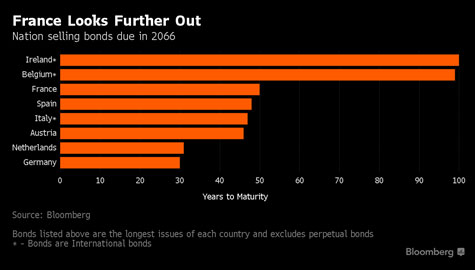

Governments have rushed in to solve the problem created by central banks. The answer: issue 20-year, 50-year and even 100-year maturity bonds. Those bonds will pay yields that attract investors who are not attracted by 2-year, 5-year and 7-year government debt with vanishingly small yields.

Mexico sold “century bonds” last year. The 100-year bonds debuted with a yield-to-maturity of 4.2%. Like nearly every other fixed income investment in the last 18 months, yields have been falling. Bonds being bonds, when yields fall, prices rise. Is it all making sense now?

Source: Bloomberg

Think about it. You don’t have to think that loaning money to Mexico for 100 years is a good idea. You just have to want a capital gain from the bond, plus the benefits of operating in a liquid market in an otherwise dangerous financial world.

France has €11.9 billion in 50-year debt already outstanding. It announced plans this week to sell another €6 billion in 50-year bonds maturing in 2036. It will test the waters with a €3 billion issue of 100-year bonds maturing in 2066. Any takers?

Don’t get me wrong. France – the land, the wine, the mountains, the coast and the food – is a great country. But it’s not exactly a model of political stability, seen through the long lens of history. It’s on its Fifth Republic right now. If you’re lending to it for 100 years, you aren’t just taking an investment risk and a political risk, you’re taking a kind of existential risk.

You might say that’s exaggerating. But is it? We live in an era where capital and labour are mobile. Long-term welfare state liabilities are not mobile. Governments face rising social welfare obligations at the same time they face a shrinking tax base. And it gets worse.

Without higher birth rates, you can only grow the tax base through immigration. That’s a political issue as well as an economic one. In Europe, growing the tax base through immigration means cheaper labour from the Middle East and North Africa. This whole process, a) creates additional welfare state obligations, b) threatens social cohesion, and c) is not something anyone voted on.

A discussion of benefits and costs of large waves of migration is beyond the scope of today’s letter. But back to my original question: would you be willing to lend to France for 100 years? The answer is probably no. But then, that’s not what investors are really doing.

Unless there is a major breakthrough in medicine/technology/longevity, nobody reading this will be alive in 100 years. The obligation to repay the debt will be someone else’s problem. France will enjoy the financial benefit of selling the bonds now. Investors will earn interest or sell at a profit in the near future. And the debt will be repaid… later… by the unborn.

This is the intellectual underpinning of the idea of perpetual debt. Government deficits don’t matter because they never really have to be repaid. Only refinanced. And as long as the government generates enough tax revenue to pay bondholders, the “market” will never really question the underlying quality of government credits.

Less philosophically, eurozone government bonds with maturities longer than ten years had a very good first quarter – up an average of 8% according to Bloomberg. German bunds were up 10%. UK gilts were up 7%. Long live the long bond bubble!

Category: Economics