It’s tempting to write about the Bank of England’s ambitious plans for your cash today. But the world keeps turning. And it’s hard to go past events in China over the last 24 hours. China, rather than the Fed, has become the ‘prime mover’ in global capital flows. And you can bet the Chinese know that, based on what I’m about to show you.

First, the news that everyone now knows. China’s factories sputtered in September. An early reading of the Caixin China Manufacturing Purchasing Manager’s Index has an early reading of 47 for the month. It was 47.3 in August. A reading below 50 indicates contraction.

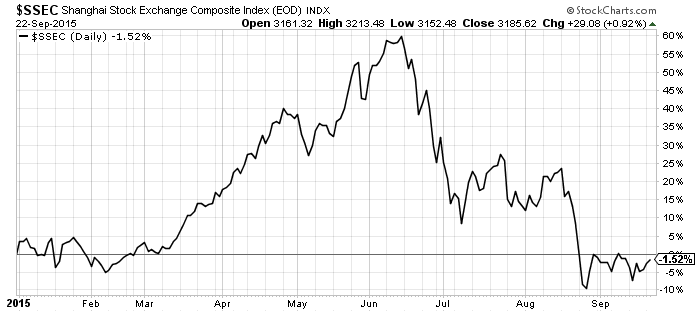

It was the lowest reading since March 2009. And that, if you have a good memory, brings up an interesting moment. The S&P 500 hit a diabolical intraday low of 666 on 6 March, 2009. It was the bottom from the fallout of the world financial Armageddon/panic/crisis/meltdown. The S&P is up 191% since then. And that’s after falling 8% from the July 2015 highs to yesterday’s close at 1942. And the Shanghai Composite? Not so flash. See below.

Source: www.stockcharts.com

On a year-to-date basis it’s a push. The index is down 1.52%, as of yesterday’s close. But that’s hardly a calamity if you bought any time before January. If you bought in March, when the Chinese Communist Party was pushing ordinary people to load up on stocks, you might even be OK. If you bought at the peak, though, in early June, you’re down 38%.

A 38% drawdown is a serious blow to most retirement plans. You can survive a drawdown like that if you have enough time – and the emotional fortitude to believe in ‘stocks for the long run’. But if you had your doubts about the authenticity of price signals in China, the revelations overnight from the China Digital Times are not reassuring.

Reader beware. I can’t vouch that the China Digital Times isn’t, itself, propaganda. But it claims to be in possession of instructions from China’s state-owned media company Xinhua. The instructions were issued by ‘the authorities’ to ‘the media.’ They call for media outlets to ‘properly interpret economic data,’ and for ‘guiding public opinion.’ Here is some of the text of the two messages the Digital Times claims to have (emphasis added is mine):

Communist Party of China Central Propaganda Department

Notice 2015 #320

Notice Regarding Increased Economic Propaganda and Guidance in the Near Term

To the People’s Daily, Xinhua News Agency, Guangming Daily, Economic Daily, China Daily, China National Radio, China Central Television, China Radio International, China News Service, and subordinate emerging media outlets:

According to instructions from central leadership comrades, all news media outlets must continue to deepen their study and transmission of the spirit of Secretary-General Xi Jinping’s series of important speeches, revolving around the strategic positioning of the “Four Comprehensives,” combined with deep concern for public opinion. The focus for the month of September will be strengthening economic propaganda and guiding public opinion, as well as overall planning for domestic- and foreign-facing propaganda and Internet propaganda, in order to take the next step in promoting the discourse on China’s bright economic future and the superiority of China’s system, as well as stabilizing expectations and inspiring confidence.

1. Properly interpret economic data. In September, the National Bureau of Statistics will successively release for circulation important information on changes in means of production and market prices and the monthly reports on the consumer price index, industry production price index, above-scale industry production, and total value of retail sales for consumer goods. In the near future, listed banks will also successively announce their annual reports for the first half of the year. Every news media outlet must interview representatives and experts from the National Bureau of Statistics of China, the China Banking Regulatory Commission, and other relevant organizations; properly interpret economic data; and correctly report on new changes in economic market conditions and relevant industry management.

2. Strengthen propaganda related to economic highlights and their effects. Closely follow economic market conditions, and diligently.

That seems pretty straightforward. In a one-party state with central planning, it’s the job of the Ministry of Truth to tell the media what to report. You could argue that Janet Yellen’s Federal Reserve is only slightly different. The Fed manages expectations through an extensive communications programme. It’s less coercive and draconian than outright censorship. But most of the financial medial plays along anyway.

Another note was published by the Digital Times in a similar vein (emphasis added is mine):

In keeping with the spirit of notifications from superior authorities and Agency leadership requirements, the focus for the month of September will be strengthening economic propaganda and guiding public opinion (the related notification is in the attachment that follows).

This includes taking the next step in promoting the discourse on China’s bright economic future and the superiority of China’s system, as well as stabilizing expectations and inspiring confidence. We request that your departments take immediate action to plan related reporting; identify individuals to take responsibility; and confirm reporting topics, individuals responsible for those topics, and publication dates.

If these leaked memos are true, they show the breathtaking confidence of Chinese central planners. But I guess when you can jail people for not toeing the party line, you have every right to be confident. Power does sometimes come from the barrel of gun, as Chairman Mao once said.

But the regulation of media outlets is just the start. China is cracking down on state owned enterprises (SOEs) as well. The Communist Party of China must take firm control of state owned enterprises in order to ensure “the socialist direction of their development” according to the Central Committee of the General Office of the Communist Party.

“State-owned enterprise reform has now reached the critical deepwater zone and Communist party leadership can only be strengthened, it cannot be weakened”, according to an article on the memo published earlier this week by the Financial Times.

I’m no China expert. And it’s hard to say how much of this is intended for domestic political consumption in China. A crackdown on fraud and corruption could be part of the drive by the Party. The Party’s image with the public has been damaged in recent years. This whole campaign could simply be designed to repair that image, rather than to lead to more control of business by the State.

Either way, it’s an interesting time for Chancellor George Osborne to be in China trying to make friends. Plans are being made for Chinese companies to sell renminbi-denominated bonds in the City. And links between the London Stock Exchange and Shanghai could see continuous trading in some UK listed stocks.

It’s not exactly ever-closer union with Europe. But it’s increasing physical and financial ties with China. To break out the Latin, cui bono? If you can’t understand why something is happening, the quickest way to find out is to ask yourself who benefits. More on that tomorrow.

Category: Economics