Another month, another $100bn in burned foreign exchange (FX) reserves in China. I say “burned”, but what I really mean is a combination of capital flight from China and the People’s Bank of China selling US dollar-denominated assets to defend the yuan from further disorderly devaluation. You can see why I said burned. It’s a lot more direct.

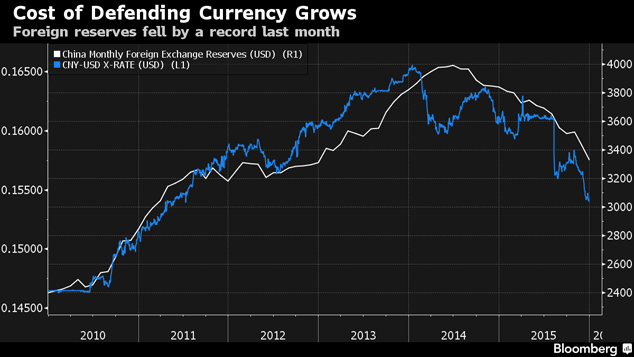

China still has $3.2trn in FX reserves. But you can see from the chart below, that’s down from almost $4trn at the start of 2014. At this rate, China could bleed reserves for another three years. But you have to wonder just how much money would already be out of the country if capital controls weren’t in place.

If another yuan devaluation is on the cards, its puts pressure on the competitiveness of other Asian economies. Once the great engine of global growth, China becomes the great force behind global deflation. That depresses commodity prices, emerging markets and oil, and drives capital into a narrow band of assets (high quality government bonds and blue chip stocks).

Category: Economics