The chancellor George Osborne presents his budget on Wednesday at 12:30pm GMT. Before he does, it’s worth wondering whether Britain has real Conservative economic managers at the helm. They’re Tory in name. But are they really Conservative? I’m talking about men and women who genuinely believe that free enterprise, private property, sound money and the rule of law create wealth, not a government budget.

To the chancellor’s credit, he’s halfway to his target of eliminating the budget deficit he inherited. When he took the helm, the annual deficit was over 10% of GDP. It’s now around 5% of GDP. His target for this year was to run a deficit of around £75.5 billion. The early numbers leaked to the press look like it might come in about £5 billion higher than that.

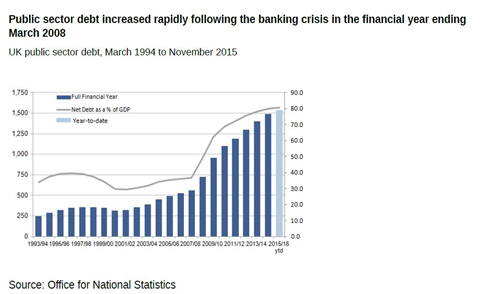

But here is an important point to remember: lower deficits don’t reduce the total debt. They add to it. It seems like an obvious point to make. But smaller deficits are still deficits. And every month Britain’s government runs a deficit, the long-term deficit grows larger. See below.

When debt grows faster than GDP, the net debt as a percentage of GDP gets larger. If only GDP were growing faster, then maybe the debt wouldn’t be such a drag. It certainly isn’t stimulating the economy. And it complicates Osborne’s pledge to run a surplus by 2020.

Given that he’s a politician, the simplest course of action is to renege on the pledge. He could blame China and its currency devaluation. Or the Bank of Japan and negative interest rates. Or the European Union and the huge trade deficit the UK runs with a slow-growing, sclerotic economy. Most people would accept that and move on.

But if he’s fair dinkum about hitting his smaller deficit targets then he must either raise taxes or cut spending. In November, the chancellor was saved from a costly political decision by the Office of Budget Responsibility (OBR). Thanks to lower interest rate charges and a change in the way in calculated future returns from VAT, the chancellor found a mere £27 billion extra he hadn’t expected.

This time around it may not be so easy. OBR is set to revise down its expectations for 2016 GDP growth from 2.4% to 2.2%. The debt may once again grow faster than the economy. Osborne’s response, reportedly, is to go after tax evaders. That’s always popular!

It’s also a bit ironic. You have a Conservative government going after people who are minimising their tax. And the people minimising their tax appear to be mostly people in the public service!

These normally public-spirited servants of the BBC and NHS have set themselves up as “personal service companies”. As such, the papers report that they pay less in income tax and national insurance than they would as full-time employees. It’s a clever and perfectly legal tax dodge, so far as I can tell.

But Osborne knows an easy target when he sees one. Just remember this, under a Conservative chancellor, the UK’s net debt stands at £1.58 trillion. Deficit reduction is not the same as debt reduction. Meanwhile, total spending climbs each year.

Category: Economics