“But I don’t want to go among mad people,” Alice remarked.

“Oh, you can’t help that,” said the Cat: “we’re all mad here. I’m mad. You’re mad.”

“How do you know I’m mad?” said Alice.

“You must be,” said the Cat, “or you wouldn’t have come here.”

– Lewis Carroll, Alice’s Adventures in Wonderland

It’s almost over – the end is in sight for 2017. I’m heading back to Aberdeen to enjoy the festivities with family and some old friends. There’s been a fair amount of snow this year – with any luck, we’ll have a white Christmas.

Although Winter Wonderland plays endlessly on the radio and in stores across the country, I’m convinced we exist in a different kind of wonderland.

Earlier this week, I came across a video of somebody’s exploits in a virtual reality simulation. As the powerful headsets went mainstream last year, users are beginning to scratch the surface of this technology’s potential – with odd results.

The virtual environment this user was exploring was a rainy and futuristic world, with cars flying overhead – not out of the ordinary for a video game.

But what made the video so strange was what the user was doing – they were painting the landscape within the simulation.

On a virtual easel that floated in mid-air, they were painting a picture of an artificial and strange world… while inhabiting it.

Sometimes when writing to you, I feel I’m doing something similar. The world is becoming increasingly fake and engineered, but wild sights abound everywhere. And at the fringes, we paint picture.

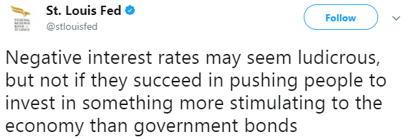

But there are some within this environment that insist everything is really quite normal, like the Federal Reserve for example:

Yes, apparently negative interest rates aren’t actually mad at all… provided they succeed in punishing people for the heinous crime of investing cautiously.

The article the tweet above links to, is titled “Looking for the Positives in Negative Interest Rates”, and is written by an economist and his research assistant at the St Louis branch of the Federal Reserve System.

It concludes that negative interest rates are “not so far-fetched, after all” and can stimulate the economy, provided that paying a negative rate is more affordable to large corporations than holding cash.

Mainstream economists consider commercial banks and their customers engines of economic growth. So when economists suggest that bleeding both parties with negative interest rates will lead to an economic expansion, I’m a little confused.

And then there’s this at the end:

Negative interest rates may seem ludicrous since why would an individual buy a government bond with a negative yield, but this is what a central bank would like you to think.

Negative rates are ludicrous. But apparently this is exactly what central banks want me to think – even after I’ve read an article published by one trying to argue that they aren’t ludicrous.

Understandably, the tweet and article were widely mocked and criticised. A common response was that it was articles like this that are driving people to buy bitcoin.

There’s certainly something in that – bitcoin was created as a reaction to the follies of the traditional financial system after all.

And when you take inflation into account, interest rates in every developed economy in the world are already deeply negative. Is it any wonder that people look to alternatives in such an environment?

The madness has been observable for a while.

More than a year ago now (how time flies!) on the night of the US election, markets predicted doom for the American economy as it became progressively more apparent that Donald Trump would become president. Nasdaq and S&P 500 futures were hammered down, while Dow Jones futures were halted from trading after they plummeted more than 5% in hours.

But the next morning, Dow Jones futures began a sharp rally, recovering their losses and shooting up over 6% by the end of the day.

Nothing had changed.

The news was no different. There hadn’t been any developments, or events to colour the story in a different light. The market had crashed and rallied over the same event in 15 hours.

These are not rational markets. But if traditional financial markets are irrational, digital asset markets are downright insane.

Boaz Shoshan

Editor, Southbank Investment Research

PS If you’d like to see what painting in virtual reality looks like, click here.

Related Articles:

- Bitcoin offers you a holiday in South Korea

- How the Fake Boom Ends

- The Crime of Banking, Russian Style

Category: Central Banks