Today I want to consider the amazing technology that is 3D printing.

3D printing could change the world. It could transform the manufacturing and construction industries in the same way that the internet has upended the publishing and music industries.

Sounds like the sort of business we should be buying into, right?

Well, I’ve got news for you – the revolution may be coming, but the backside has fallen out of the market…

The jaw-dropping possibilities of 3D printing

My son and I were in Maplin’s the other day (living the dream), and he was trying to persuade me to buy a 3D printer. The item in question – an UP! 3d Mini Printer – was £549.99.

Ever the eager parent, encouraging his son to embrace the wonders of new technology, I put forward the argument that there are far better ways to spend £549.99.

He argued that at that particular moment there weren’t and from there I was able to distract him into a conversation about the relative merits of saving versus spending.

“Maybe we’ll get one in a year or two”, I suggested, “when they’ve come down in price”.

He shrugged in the way that 14-year-olds do. He wasn’t persuaded – and, probably, he was right not to be.

I’ve always been very excited about 3D printing. Shoes, toys, figurines, musical instruments, even human body parts – you name it, you can print it. I remember reading somewhere about 3D-printed guns being sold on the dark net. “Blimey”, I thought, shaking my head.

And, yesterday, a YouTube video I was watching when I should have been writing, elicited an even bigger blimey from me. A Chinese company called WinSun printed ten houses in 24 hours at a cost of $5,000 each, using nothing more than ground-up industrial and construction waste on a base of quick-drying cement.

By some estimates, about 75% of China’s wealth is thought to be tied up in real estate or related financial products. The ability to print a $5,000 home in 24 hours is going to do wonders for that.

At present, it couldn’t have much impact here in the UK, unfortunately, because of the great piece of legislation that is the 1947 Planning Act. This conferred the right to build away from landowners and onto regulators, with the consequence that just 1.2% of land in the UK now has domestic housing on it.

Meanwhile, we have an acute shortage of affordable housing in desirable areas and 50% of people born after 1980 believe they will never own a home. Any Tory policy-makers reading this – make your first piece of new legislation some kind of repeal of that act!

3D printing has already succumbed to the boom and bust of the hype cycle

Anyway, back to 3D printing.

My stepfather collared me with a cup of tea the other day and demanded I look at some 3D printing investments with him. It’s not a sector I’d been paying much attention to – I didn’t feel I’d got to the story early enough, which matters with innovative tech – and I told him so.

“I don’t really follow 3D”, I said, “But I generally don’t recommend investing in new tech unless you’re early. And the 3D story’s kind of old news now. What’s more your finger has to be kind of on the pulse – things get outdated very quickly.”

He was insistent. “I know that, Dom, but I saw this video about nasal implants. And I read about a $50 3D-printed hand that outperformed a $42,000 device. The things these guys are doing. It’s just amazing. I want some exposure to it.”

He’d written names on a piece of paper. One was French software company, Dassault Systèmes (Paris: DSY). We looked it up. “I’m not sure I’d buy that”, I said. “It’s gone up so much – from €50 to €70 just this year. It’s been pumped up by all that eurozone quantitative easing.”

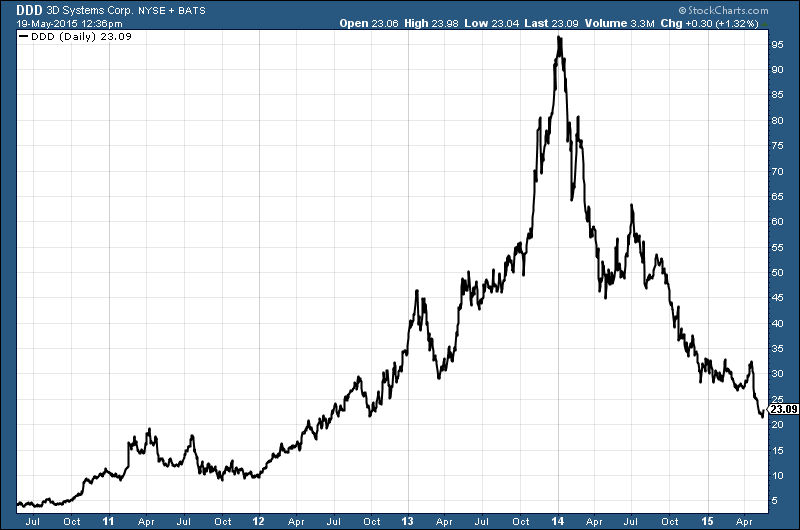

He sort of agreed. He put forward the name of another 3d printing company, 3D Systems (NYSE: DDD). The chart had collapsed by so much I thought there was a software glitch.

“That can’t be right”, I thought, “we’re supposed to be in a tech boom”. I started looking at some of the other big names in the sector: ExOne (Nasdaq: XONE) and Materialise (Nasdaq: MTLS). The bottom’s fallen out of all of them.

In short, I realised, (and I know I’m late to this) the 3D bubble had already burst.

Here’s a five-year chart of 3D Systems:

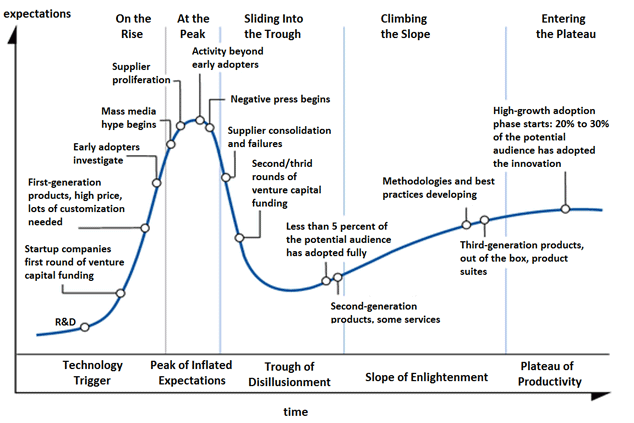

It’s classic hype cycle stuff. All new tech seems to go through it, from dotcom to bitcoin.

First, you have this exciting new tech and some early adopters get on board. Then it gets some mass media attention, everyone gets over-excited and valuations get overblown. Venture capital pours in, there is a spate of new listings and all the rest of it.

Then some reality sets in – we’ve a great new tech here, but in the real world it’s going to take a lot of work, time and money before it’s going to go mainstream – and the stock sells off.

Then, gradually, the sellers die away and the stock starts climbing the long hard road to the mainstream. Here’s the idealised chart from Gartner.

I’m sure 3D printing is going to change the world. It could even do something no one has been capable of for a generation or more – bring affordable housing to the UK.

But not just yet. It’s in that sell-off phase – ‘the trough of disillusionment’ – as reality sets in. As yet, it brings no benefit to people like you and me. I’m looking at printers and going wow – guns, houses, amazing. But I don’t want to spend £549.99. What would I use it for? Where would I put it?

Eventually, I’ll be buying a new one every year and printing iPhones or something with it. And by then, 3D stocks will be a lot higher. But for now we face the reality of a post-bubble contraction. This doesn’t yet look to me like a buying opportunity.

Meanwhile, there are still plenty of tech bubbles floating about that haven’t burst – biotech among them, as I wrote last week. There may be life in the old tech bull yet, but that chart of 3D Systems above is a useful and sobering reminder of what happens when the thing pops – and how quickly the slide comes when it does.

I recommended the Nasdaq late last year and was ridiculed in the comments section for doing so. But it has broken to new highs, as I thought it would. It’s still in an uptrend, so I wouldn’t sell yet – there’s no telling how long it will last. But fewer and fewer companies are propping the index up. The bull market is mature.

Category: Investing in Technology