Promising plunder was as much a skill for a pirate raising a crew back in the early 1700s as it is today for a politician.

However, while pirate captains had literal skin in the game, losing their captaincy and often their lives if they failed to deliver booty to their crews, politicians have the benefit of not having to be around when their promises fall short and it turns out there isn’t nearly as much “plunder” to go around as was originally promised.

But though the original captain has fled the ship… that doesn’t mean there won’t be a mutiny. And you’ll likely have already begun to hear the unrest from below deck.

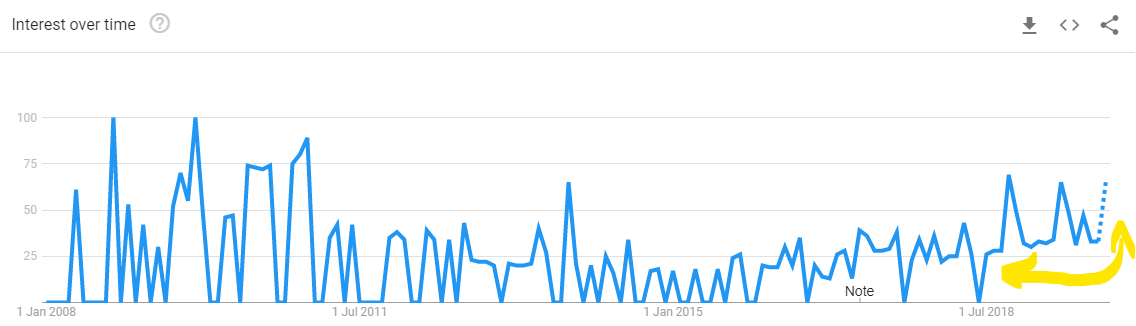

Lift off: usage of the term “pension crisis” in news stories worldwide has not returned to zero since June last year

Lift off: usage of the term “pension crisis” in news stories worldwide has not returned to zero since June last year

Source: Google Trends

Mutiny aboard the USS Ivory Tower

The Universities Superannuation Scheme (USS) – a scheme with an acronym fitting of a tale of mutiny – is the largest private pension fund in the UK, with over £60 billion in assets. It has performed well, beating its benchmark for similar funds on a three-, five-, seven-, and ten-year basis, and is ranked among the top quarter of UK pension funds by Mercer, the pensions giant.

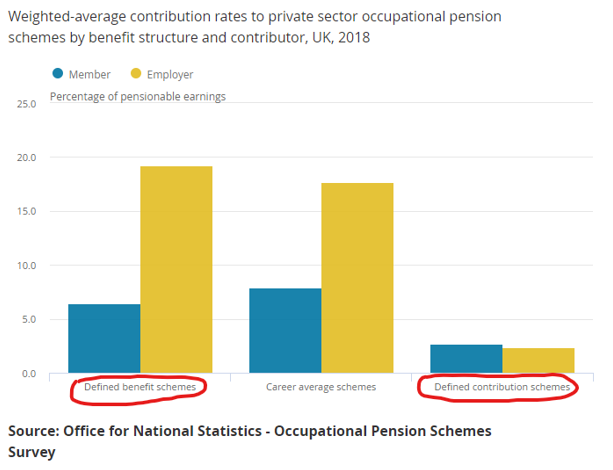

And not only is the fund backed by strong performance, but by vast quantities of cash flowing in. For every member, employers pay an incredible 21.1% of their salary into the scheme, while members contribute 8%.

But for all that strong performance, and all those contributions… it’s not enough.

For the USS is a defined benefit pension scheme. And defined benefit pension schemes – pensions that promise to spit out a guaranteed income to its members for the rest of their lives upon retirement, and possibly then their widows – are permanently taking on water when they sail into oceans of low interest rates.

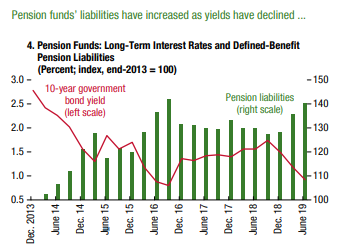

These promises of future payments require low-risk funding, and as that low-risk funding is removed from the market, the problems grow ever greater. This chart from the International Monetary Fund (IMF) is a little busy, but take a moment to inspect it as it illustrates the problem perfectly.

Note how every year interest rates (in the form of government bond yields, red line) have fallen, the liabilities of these pensions (green bars) has increased the following year.

Yet another argument that 2019 is a repeat of 2016

Yet another argument that 2019 is a repeat of 2016

Source: IMF

Guarantees of any kind come at a cost. And there’s nothing quite as expensive as guaranteed money for the rest of your life.

The former UK pensions minister Baroness Ros Altmann has estimated that for every 1% interest rates go down, the liabilities of a defined benefit scheme increase by 20%. This is countered slightly by the value of pension assets increasing by 10%, but that obviously doesn’t solve the problem. The lower interest rates go, the less plunder there is to go around.

But a lot of plunder was promised. And thus the mutiny begins between the employer already paying vast sums into the pension scheme, and the employee who believes they’re being stiffed.

The University and College Union strikers are contributing 9.6% of their salary to the USS, but don’t want to pay more than 8%. They want all the funding shortfall to be covered by their employer.

Academia has a reputation for often being out of touch with the real world (apologies to readers who work/study in universities, I know you’re out there), and it’s tempting to dismiss the story as lecturers in ivory towers having no idea how lucky they are to have a defined benefit pension in the first place.

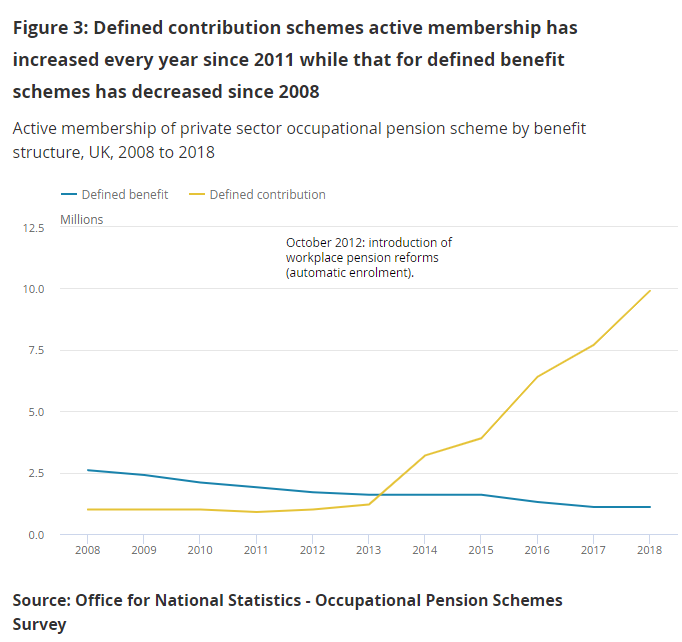

Such pensions are after all, going extinct, and for good reason. Employers have realised what a colossal liability they are, and are rolling new employees into defined contribution schemes which have no guaranteed benefits instead:

The strikers are insistent on their employers paying ever more contributions into their pensions, when their employers already pay vastly more into their pensions than the overwhelming majority of people who only have a defined contribution plan:

Lectures on communism at the picket lines and supportive Guardian articles like the one below certainly aren’t helping the image.

Lectures on communism at the picket lines and supportive Guardian articles like the one below certainly aren’t helping the image.

Yes, students. Don’t complain that the lecturers you have got into debt to purchase services from are not providing you with said services. Instead, support them in their protest to receive a boon that, unless you are very lucky, will not be afforded to you by merit of its inherent unsustainability.

Like I say, it is easy to dismiss this as Ivory Towerism.

However. These strikes are an important signal, that shouldn’t be ignored.

The mutiny aboard the USS Ivory Tower is an indicator; it’s yet another thin end of a very large wedge labelled “pension crisis”. And as we’ll explore tomorrow, there isn’t nearly as much plunder to be divided as the captain first promised all those years ago…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates