My perception of time is becoming increasingly distorted by the isolation… but it doesn’t feel all that long since our last bank holiday. Spending every day alone in my flat has made life a blur – as most weeks are so similar it’s events that mark the passing of time.

The last bank holiday was during the run-up to the bitcoin halvening, and I sent you an issue I had written earlier in the year on the upcoming event. This time around I’d like to show you a glimpse of Harry Hamburg’s recent work in Coin Confidential on what’s happened in crypto since – taking an amused look into what happened when a certain children’s author entered the space…

I’ll leave you with that, and will be back tomorrow. In the meantime, I hope you’re enjoying the bank holiday as best you can.

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

Harry Potter and the curse of crypto Twitter

Harry Hamburg, Coin Confidential (published Monday 18 May)

For the last few months most crypto chat has been about the bitcoin halving. But now that’s been and gone, what now?

Well, although the halving has dominated most crypto debate to date, there are still two upcoming events that I’m personally much more excited for. Neither of which involve bitcoin.

Afterall, there’s a lot more to crypto than just bitcoin… as gravitating as it is.

Those two events are: Ethereum 2.0 and IOTA’s Coordicide. You can read about them here: Thee major developments coming to crypto in 2020 – and what they mean for your money.

In the long run, these will have a much bigger effect on both the real world and the world of crypto than the latest bitcoin halving.

But given the halving has just happened, let’s take a quick look at how it went down before we jump into those topics next week.

Is bitcoin building to $15,000?

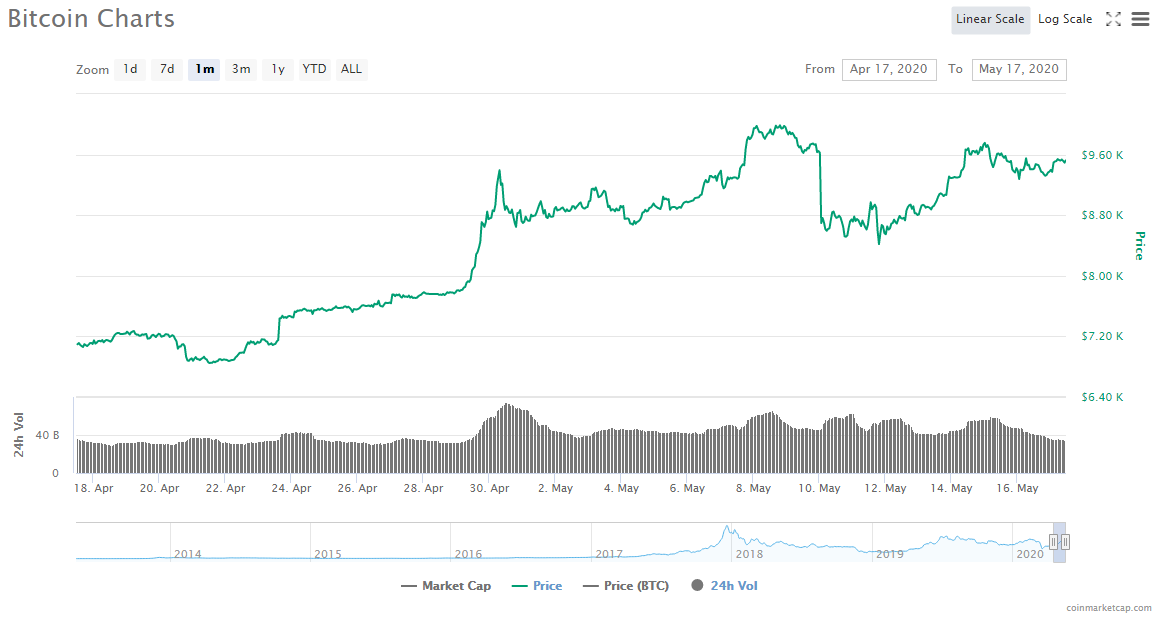

Here’s a chart of bitcoin’s price over the last month.

Source: CoinMarketCap

Source: CoinMarketCap

That big drop happened about a day before the halving. Bitcoin fell 10% in just 30 minutes… something that in any other asset class would spell disaster and decades of debate. But in bitcoin it’s just par for the course.

After the halving – which actually ended up taking place on Monday not Tuesday – bitcoin steadily regained its steam and today (Sunday 17 May) it’s sitting at around $9,500.

And it turns out that $9,500 number is now extremely significant.

According to Coin Telegraph, before the halving the breakeven price for bitcoin mining was around $7,000.

But now, it’s somewhere between $12,000 and $15,000. Although I’ve also seen other places calculate it as around $10,000.

Either way, that means many miners could soon be going out of business if bitcoin prices don’t settle above $10,000 fairly soon.

But as Coin Telegraph writes, if bitcoin doesn’t stay above that level, miners may flood the market with their accumulated bitcoin in order to finance their operations…. which would then bring prices down further.

From Coin Telegraph:

A theory has emerged that miners tend to sell before the halving to accumulate enough Bitcoin to finance their operations for many months after the halving occurs, allowing them to hold onto the majority of Bitcoin they mine.

Theoretically, such a practice would be beneficial for miners because the break-even price of Bitcoin mining spikes significantly when a block-reward halving occurs. According to James Todaro, head of research at TradeBlock, the break-even price of Bitcoin mining is expected to surge from $7,000 to anywhere between $12,000 and $15,000 after the halving.

“Following the Bitcoin halving, miners’ estimated breakeven costs will rise from ~$7,000 today to ~$12,000–15,000 per BTC after. I would not be surprised if we see Bitcoin prices rise above these levels so that miners remain profitable.”

Because the halving drops the amount of BTC that is mined as Bitcoin approaches its fixed supply of 21 million, miners will earn less BTC after the halving for performing the same work. If the Bitcoin price does not increase substantially after the halving, and if the difficulty of mining remains put, miners will see a higher break-even price with similar revenues as before.

Or, as James Todaro says above, bitcoin’s price may end up rising to between $12,000 and $15,000 – right in line with mining’s breakeven price.

Or perhaps we’ll see a drop and then a steady rise to $12.000-$15,000… which could be beginning now, looking at that chart.

JK Rowling asks about bitcoin – cryptosphere doesn’t disappoint… even Elon Musk chimes in

What happens when the richest and most famous author in the world publicly asks about bitcoin?

This:

Source: Reddit

Source: Reddit

A couple of days ago JK Rowling of Harry Potter fame (no relation) asked a CoinDesk writer and a Silicon Valley consultant to explain bitcoin to her.

Source: Twitter

Source: Twitter

As you can see, the top reply is by non-other-than Vitalik Buterin (the creator of Ethereum) himself.

But the thread – which you can read here – went on and on, with all the big crypto names chiming in… as well as some notable shysters and scammers.

After a few hours JK had had enough and tweeted this, which as you can see even earned a very pro crypto reply from Mr Tesla, Elon Musk.

Source: Twitter

Source: Twitter

However, the best thing to come out of this whole episode is not that JK Rowling may or may not at some point write about or buy bitcoin… but the memes the crypto community created off the back of it.

My favourite is probably the one we started this section with. But these two also deserve honourable mentions:

Source: Reddit

Source: Reddit

Source: Reddit

Source: Reddit

Okay, that’s all for this week.

And if you’d like to know the cheapest, easiest and safest way to buy bitcoin and other cryptos, you can read my free guide here.

Thanks for reading.

Harry Hamburg

Editor, Coin Confidential

This article originally appeared on coinconfidential.com

Category: Market updates