Donald Trump’s mastery of Twitter to bypass the media and control political narratives is unprecedented, and will go down in history as a symbol of our time.

We’ve argued in this letter before that his Twitter feed contains glimpses of the future which investors should heed (Bitcoin is CANCELLED, 12 July).

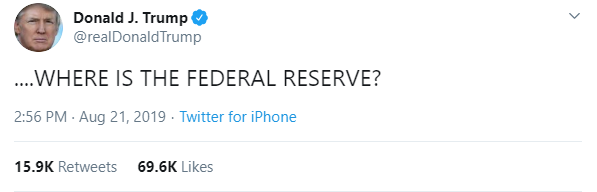

One such glimpse was revealed yesterday. It’s become a favourite of mine, surpassing even this gem from 2012:

(Yes, that is a genuine tweet)

(Yes, that is a genuine tweet)

But all joking aside, yesterday’s tweet, just five words in length, encapsulates an attitude that you will soon see adopted by politicians in developed countries all around the world.

Where, indeed..?

Simple. Blunt. To the point. A classic.

I may even get this printed and mounted on the wall by my desk.

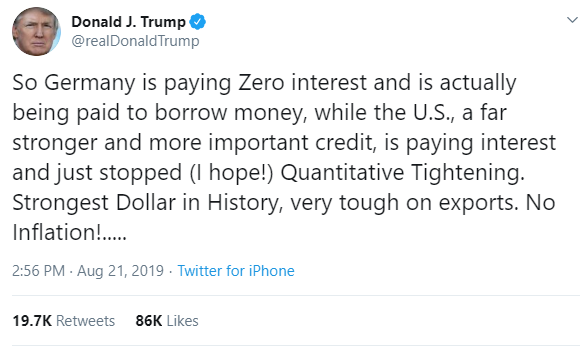

But before we dissect this, let’s provide some context. The tweet above preceded this:

Trump’s unceasing urging of the Federal Reserve to begin quantitative easing again and cut rates could be to try and ensure the wheels don’t fall off the US economy with the 2020 election on the horizon. Luke Gromen, a macro expert, begs to differ.

He argues the need for further support from the Fed is because the US government is running out of cash and needs lower interest rates just to stay solvent. He made a compelling case for it to me earlier this year.

But in today’s note I’d like to dwell on the shorter tweet, the sentiment it embodies, and how that argument will be used to justify ever more control over the money supply by the government.

“WHERE IS THE FED?” is a persuasive cocktail, combining a question, a demand, and an appeal to the reader’s sense of justice. It not so subtly declares, “Why is the central bank not helping me do my job as president, and serve my country?”

What fuelled Trump’s ascent to the political world was his willingness to say things which the electorate believed but wouldn’t dare say aloud. In that short five-word tweet, he goes one step further. He says aloud what ambitious politicians are afraid to say aloud.

Ie, “Why can’t my local central bank print the money for my government spending scheme? The bailout of the banking system and the quantitative easing measures since have not produced hyperinflation, and have made the rich only richer…”

Now that Trump has blazed the trail and said what was spoken only in whispered tones on the fringes, you’ll only see such rhetoric go mainstream as hungry politicos follow his lead. And central bank “independence” (if that ever existed in the first place), will stare down the barrel of an incensed electorate.

Central banks go quasi-fiscal

This “ever closer union” between government and central bank will not be limited to the US.

Trump’s template can be copied and pasted pretty much anywhere – eg, “We have a terrible [homelessness/lack of jobs/underfunded pensions/underfunded welfare system/low public sector wages/insert as appropriate] problem in this country… WHERE IS THE BANK OF ENGLAND?”

The risks this poses was outlined by former Bank of England governor Mervyn King in an interview with Real Vision not long ago (emphasis mine):

… the range of responsibilities of central banks have expanded enormously since the financial crisis a decade or so ago. And as [a result] central banks get drawn into what you could think of as quasi-fiscal areas. So, for example, we came under pressure to buy particular private sector assets, and I was asked to buy financial assets issued by motorcar firms. And I said, no. I said, that’s a decision for government, not for the Bank of England. If you want to buy instruments issued by car companies, you buy them, and we’ll buy your debt. But we’ll decide what we do.

But whatever we do, we’re not going to get into the business of making decisions about the allocation of credit. And I think the central banks have crept into that area a little bit too much, certainly in the euro area.

And I think the pressure to- once you become responsible for a wider range of responsibilities, the case for independence gets weakened because if you made independence in respect of a specific set of policies, to keep inflation low and stable, that’s one thing. But the more areas of policy [we] are given, whether it’s macro financial policy, or asset purchases, or regulation of banks, the more you accumulate, the harder it is to justify that you should be independent in respect of all of these. And I think that’s going to be a big challenge over the next decade or two. That combined with the fading memory of inflation will, I think, be the biggest sources of pressure on central bank independence over the next decade.

While Trump is pushing for more government control over his central bank… our own Mark Carney is pushing the Bank of England to act more like a government, by using it to take an active role in fighting climate change. It’s almost as if we’re set to watch the two forces meet in the middle.

Will the independence of central banks die not with a bang, but a willing whimper..?

More tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates