I had almost forgotten the madness of the crypto market. In late 2017 I was endlessly squinting at my monitor to make sure I hadn’t misread the figures I was seeing – the sudden changes in price were so extreme.

A year and a half later, following a brutal crash, we are – very suddenly – back in business.

Damn.

In just a week bitcoin is up more than $2,000, with half of that occurring in one cathartic push higher yesterday.

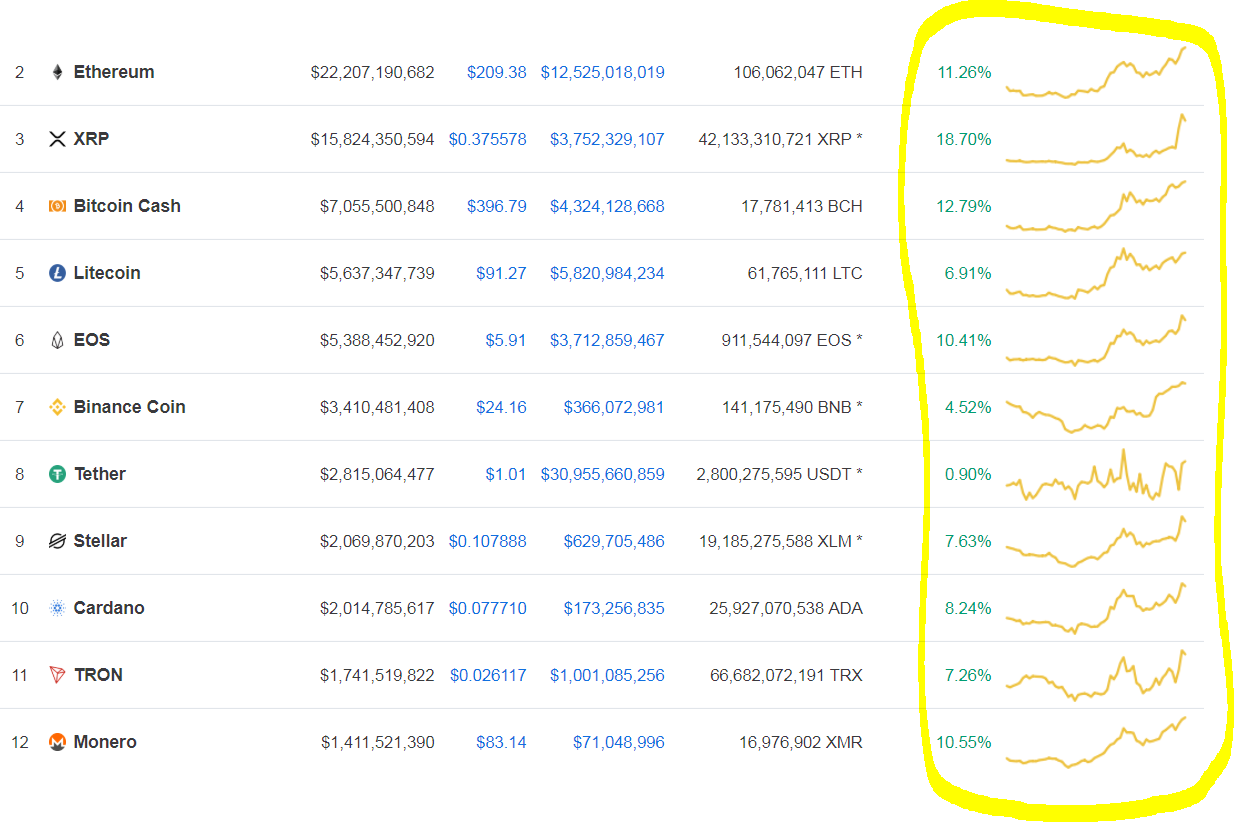

And the rest of the crypto market (the altcoins) is following the leader:

Disregard Tether, as its purpose is to have a stable value: $1

Disregard Tether, as its purpose is to have a stable value: $1

Source: CoinMarketCap

I’ll be hosting a podcast with our tech editors tomorrow to see what they think is going on. But in the meantime, let’s examine the backdrop for some clues.

With the US and China announcing tariffs on each other’s goods, global stocks (led by the US) have taken a sudden clip to the chin:

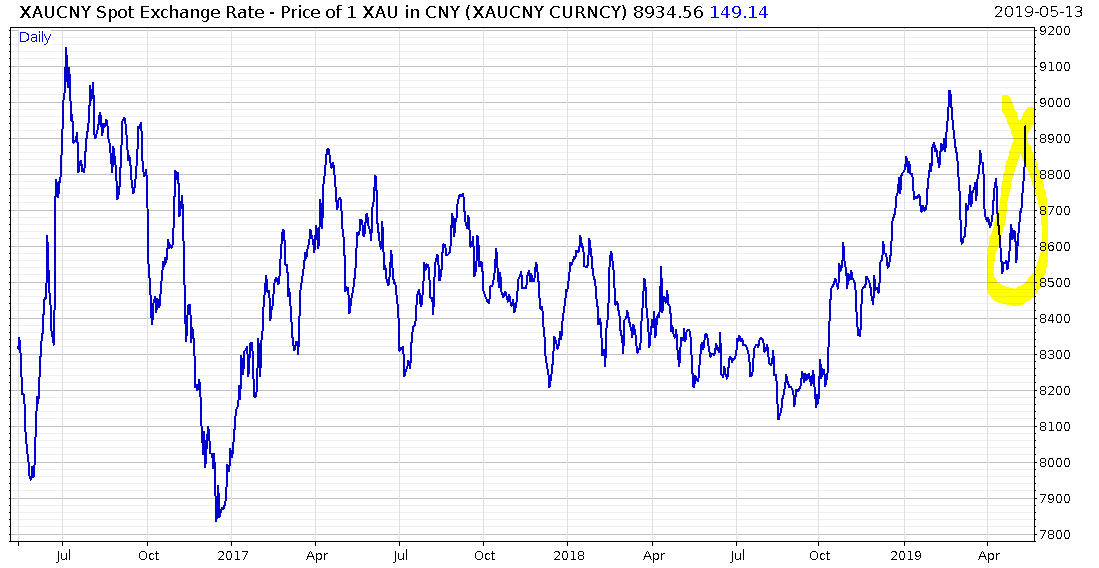

With more tariffs on the way, some believe the CCP will devalue the renminbi to keep China competitive on trade, and the currency has abruptly fallen in value:

With markets taking risk off the table, gold has risen in dollars, pounds, and euros, but especially in yuan, as the Chinese seek to protect their wealth:

Chinese flight capital was one of the key drivers of the 2017 bitcoin boom – an incredible 95% of bitcoin settlement was in Chinese yuan. Interestingly, the date at which the CCP shut the door on this crypto escape route coincides almost perfectly with the end of the bitcoin bull market – January 2018.

With the threat of a devaluation on the cards, perhaps the wealthy Chinese have found a way of funnelling vast quantities of yuan into bitcoin and driven its price skyward once again…

I’ll see what our crypto experts have to say on the matter tomorrow, and share that podcast with you soon as I can.

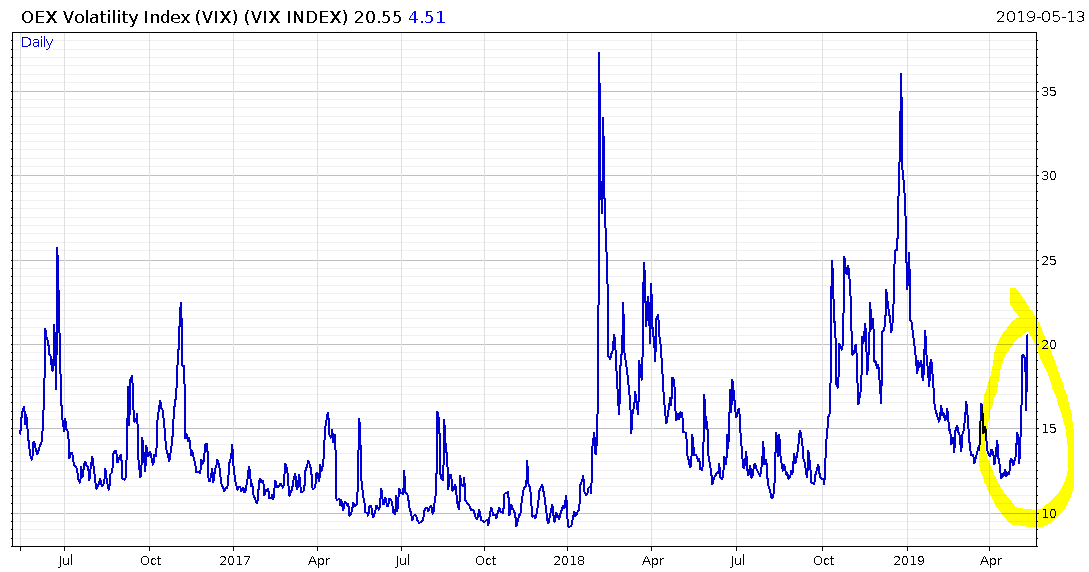

Meanwhile, amid all the chaos, the US stockmarket volatility index, the VIX, is once more on a tear.

I expect this to lead to another “volmaggedon” event like we saw during Christmas and February 2018; there were record bets on US stockmarket volatility staying low at the beginning of this month, and I think there’s a short squeeze in the making.

But that’s just the volatility index for the US stockmarket.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates