A truck chugs slowly through a street in Shanghai, spewing bulbous great clouds of disinfectant powder into tower upon tower of apartment buildings.

It’s like the crop duster scene from North by Northwest. Except instead of taking place in a quiet field in the middle of nowhere, it’s in the centre of a megacity, some 24 million people strong.

And that’s just in Shanghai. 400 miles west where the coronavirus is reported to have originated, an entirely separate megacity, Wuhan, has been completely locked down: nobody gets out unless they’ve a “special reason”.

It tells you a lot about China’s scale, when you’d be hard pressed to find anyone who had heard of Wuhan prior to the outbreak unless they’d been to China – and yet the city contains more people than Scotland, Wales, and Northern Ireland combined.

And now the whole thing has been blockaded and contained. I can barely imagine the hysteria if this were to happen to London – which has a smaller population.

Speaking of which, I’m surprised there have been no reported cases of the virus in the capital yet as there have in Glasgow, Edinburgh, and Belfast.

And all this occurring right on time during Chinese New Year, with citizens flying from all over the world to return. The upcoming Lunar New Year will be the Year of the Rat, one trader observes. The last time it was Year of the Rat was 2008 – and we all remember what happened then, he comments wryly.

It seems a perfect storm. But so far at the time of writing, the global stockmarket has simply shrugged – it’s roughly in the same place it was a week ago.

It’s been a wild January so far – but not for the stockmarket. Not the raging of bushfires, the high-profile assassination of generals on foreign soil, or impeachment theatre has put a dent in it.

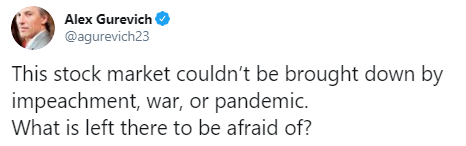

Hedge fund manager Alex Gurevich mischievously asks:

Source: @agurevich23 on Twitter

Source: @agurevich23 on Twitter

What indeed?

Perhaps the pandemic will finally reinject some fear into the market: volatility in the options market (the cost of insurance against sudden moves in either direction) as illustrated by the VIX index, seems to have stopped lying on the floor at least.

But to my eyes, any correction here instilled by a pandemic panic – provided it can be contained, and that we’re not all goners – will simply be an intermission before the melt-up resumes.

The forces at play that I believe are driving this market don’t care for politics, pandemics, or pilotless bombers. From the Federal Reserve printing billions into the short-term lending market… to Christine Lagarde’s greenwashing plan to print cash for environmental projects (apparently if you show up to a press conference wearing a massive owl brooch you look wise)… to the share buyback complex, corporate serpents devouring their own tail for short-term satiety and long-term destruction.

(IBM has spent $140 billion dollars buying back its own stock over the last 20 years. The value of the company at market now? $127 billion.)

The approach being taken by these actors can be seen in graphic detail in the Boeing debacle.

Boeing, one of the few S&P 500 stocks that has managed to go down, has been cutting back on costs (like axing its space flight programme called Phantom Express) to flush more capital into the 737 Max programme.

But despite all the issues the company faces, and the billions in credit it’s manage to beg from Wall Street – it’s made sure that it won’t be cutting its dividend.

Just keep the party going. It doesn’t matter what goes in the punch – just make sure it doesn’t run out. A comment on the Financial Times’ reporting of the coronavirus was already describing it as a buying opportunity – even when the market has barely moved.

And so we return to Gurevich’s question: for investors, what indeed is there left to be afraid of? Well, Nickolai Hubble has been warning that this Sunday will be a bloody one in Bolognese town…

But if I’m right and the melt-up resumes, and asset prices just continue to rise higher… investors have wealth itself to fear. Or at least, the appearance of being wealthy.

Steve Diggle, another hedge fund manager, who made out like a bandit during the last Year of the Rat, said a while back that “there is never a good to be poor. But now is a really bad time to be rich”.

We wrote yesterday how the Davos crowd has gone from being revered to being reviled yesterday, but you no doubt will have noticed in our politics how bashing billionaires and taxing wealth has become popular, if not yet by the majority.

I spoke to a young Oxford University student the other day, who was overflowing with stories of the “wokeism” that has taken hold in what’s supposedly our world-leading light of higher education. If you have a skin colour/sexual orientation/religion/academic background deemed “privileged” and representative of inherited wealth, you are expected to renounce them before those who don’t – it’s the “oppression Olympics”, with its own scoring system to boot.

Funnily enough, apparently the Bullingdon Club no longer really exists, as being a member now has negative utility – it’s akin to having a criminal record on your CV.

Those forces conspiring to raise asset prices may feel like a boon to investors. But it’s tainted. Cursed…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates