Today we cast our eyes towards the foreign exchange markets.

I have two trades to recommend.

And they’ve got me thinking about the world’s most important currency.

The US dollar has been the one-eyed king in the fiat kingdom of the blind.

But for how much longer?

Believe it or not, the euro is getting stronger

There have, I would say, been two broad trends in the foreign exchange markets over the last few years.

First, until the early part of 2015, the euro and Japanese yen have both been weak, particularly against the US dollar. Despite almost unanimous US dollar bullishness, both currencies have stabilised over the last few months, and that trend has flattened out. The euro, amazingly perhaps, has been creeping up and looks – I can’t believe I’m saying this – fairly strong.

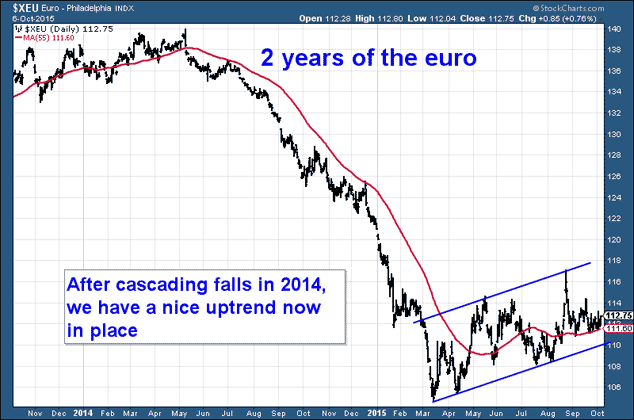

Here’s the euro against the dollar over the last two years. I’ve also plotted in red the 55-day moving average to give you an idea of the intermediate-term trend. It’s sloping up. I’ve also drawn some tramlines around the current trend, so you can identify the range.

Is it time for a bounce in the Canadian dollar?

The second and perhaps most striking trend in the forex markets has been the incredible weakness of the commodity currencies – the Canadian and Australian dollars, the Norwegian krona and, especially, the Brazilian real.

The reason for this weakness – that the bottom has all but fallen out of the commodity markets – is obvious. And, while the euro and yen stabilised against the dollar earlier in the year, the commodities currencies didn’t. They just kept falling.

The generational lows for the Canadian dollar – the “loonie” – came in 2002 at $0.62. The highs were in 2007 at $1.10. That’s quite a range. Here’s a 15-year chart. It’s quite volatile. The trends go on for some time.

Although the loonie actually topped against the US in 2011 at $1.05, the falls only really got going in 2012, as the chart shows.

I’d suggest that there is quite a lot of support in the $0.70-$0.75 range, and the loonie could move higher here quite quickly back towards the $0.90 area. If it doesn’t hold, the 2002 lows beckon.

So I’ve actually taken on a long position with my risk managed on that basis – if it falls below last week’s lows, I’m out.

Why I think the Japanese yen is set to rise

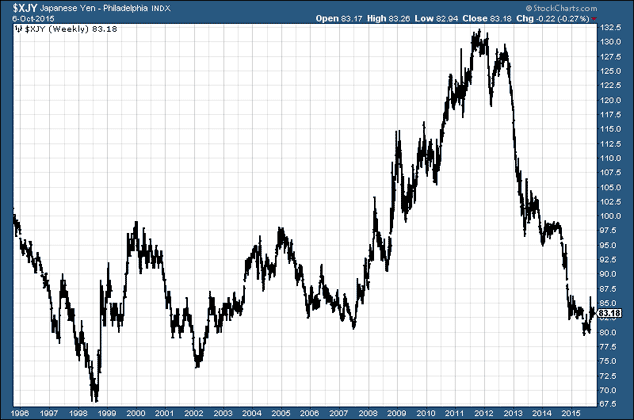

But the trade I really like here is the Japanese yen. Sure, I know all about Japan’s demographic, debt and crazy-economic-policy stuff. But one look at the long-term price pattern – below is a 20-year chart – had me itching to buy.

That thing looks like a dotcom stock. The falls since 2012 are enormous. Any rebound of substance is going to be big. I think we go from $0.83 (to ¥100) to $0.95-$0.97 pretty damn fast – assuming that $0.80 holds.

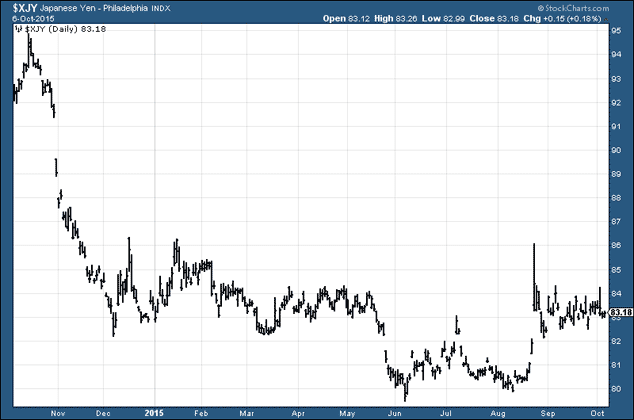

So I’m going to zoom in and see what the price has been doing over the past year. And you can see that, since December 2014, this thing has stabilised. It’s been flat. It flirted with moving lower in May, but the move failed – twice – and we have a perfect double bottom.

So I’m long the yen against the dollar. As for the risk management, my stop is just below the June lows of $0.795.

Are we heading for a period of dollar weakness?

So I’m long the yen, I’m long a commodity currency, and I’m praising the euro. The other side of that is that I must be bearish about the US dollar. I guess I must be – if I’m putting my mouth where my money is.

I don’t think any analysts are talking about a period of US dollar weakness ahead. Even with the largely flat action of the last few months, most are still bullish. In the fiat kingdom of the blind, the one-eyed US dollar has been king – and we’ve got so used to the idea that few of us have thought to question it.

Does this mean we’re in for a period of commodity strength? Possibly. It’s due. Blimey, how oversold can oil get? Perhaps we’re also due a period of inflation – and the deflation meme is about to take a hit. Perhaps rates start to creep up.

US dollar strength has coincided with stockmarket strength – perhaps this bear market has got further to go, despite the amazing rebound we’ve had since Friday.

This is just me speculating, of course, I don’t know what’s around the corner. My trades could all get stopped out and the US dollar could continue its assault on the sky.

But the trades I’ve placed are telling me that quite a significant change in trend is at hand – a change that almost no commentators I read (apart from my colleague John Stepek) appear to have picked up on.

The US dollar is arguably the most important single price in the world. What are the implications of a period of prolonged US dollar weakness? That bears some thinking about.

Category: Market updates