Oil creates the illusion of a completely changed life, life without work, life for free. Oil is a resource that anaesthetises thought, blurs vision, corrupts…

– Shah of Shahs, Ryszard Kapuściński (1982)

Times have changed an awful lot since 1982. What Kapuściński described so elegantly back then… no longer seems a correct description of the oil world now.

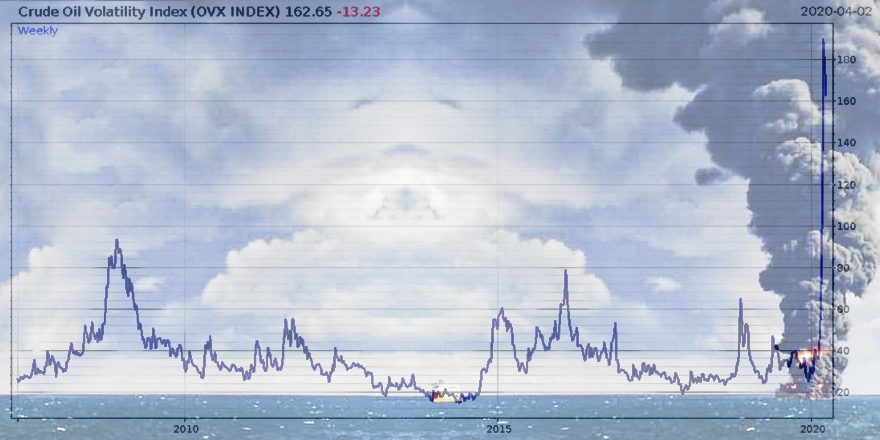

With Americans needing to pay people to take oil off their hands, oil no longer brings the “life without work, life for free” idea to mind. The blurry vision bit certainly applies though – remember this chart from earlier in the month (This market is belching smoke – 3 April)?

That was the cost of insuring against volatility (up or down) moves in the oil market a few weeks ago. I thought it looked pretty insane then.

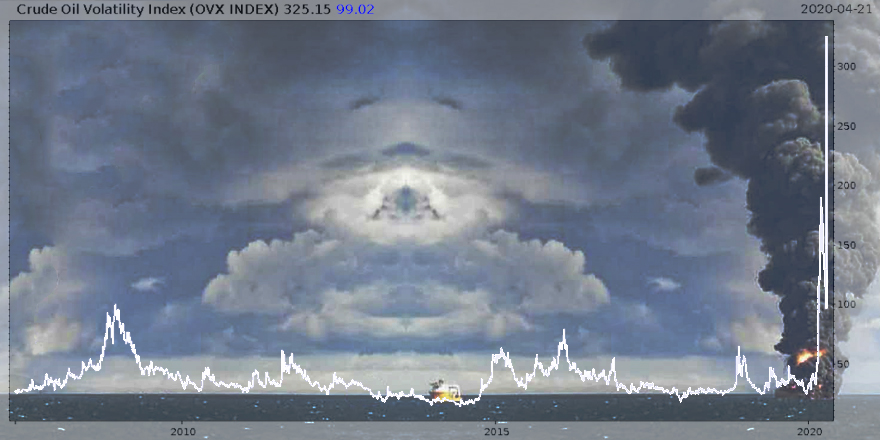

But now, well things have got a lot more insane. Twice as much, in fact…

The “fear index of oil” ($OVX) has more than doubled from where it was then. And that’s just using the level it sat at the end of trading yesterday. Intraday, the price went much higher than that…

As described yesterday, the issue presented in the US crude market is a lack of storage space. Some folks are looking at this as a “one-off” event due to extenuating circumstances, but it appears the Kingdom of Saudi Arabia has other plans. Despite bleeding heavily itself, it grips its scimitar tight, grimly determined to make the most of the situation while its competitors are on the ropes.

Saudi Arabia has generally managed to keep OPEC and the global oil market roughly where it wants it, thanks to its geology. By naturally having the lowest cost of oil production in the world, it can take more pain than any other oil-producing nation when the oil price gets low. Pump more oil than the Saudis would like you to? They’ll flood the market with their product, and as it costs you more for every barrel you pull out of the ground, you’ll suffer more than they will.

But while Saudi Arabia dominates the supply side of the oil price, it has no control over the other half – oil demand. And the WuFlu lockdown has seen to that. People driving around accounts for 40% of oil demand alone, and as you’ve probably noticed, barely anybody is driving about these days. Hell, I saw one fella pushing his kid in a pram in the middle of the road the other day without a care in the world – this town is so quiet now he would’ve heard a Fiat 500 roaming around from a mile off.

Now that oil demand has fallen off a cliff, the Saudis have decided to see the silver lining of this crisis and turn it into an opportunity to crush their competition and put them out of business for the foreseeable future.

With few exceptions, oil extraction operations cannot be turned on and off at short notice – they have to be shut down. This is very expensive and time consuming to do and undo; forcing their competitors into these actions by applying even more selling pressure on top of the lack of demand is what the Saudis aim to do. This will give them at least a few years of unchallengeable dominance in the oil space.

As we described yesterday, the lack of space to keep all the oil in the US has made the price negative. There are two dozen supertankers laden with Saudi oil heading to the US right now to fill what remains of the storage capacity, with similar quantities heading into Europe and even more heading into Asia. A great flood of Arabian oil is heading in supertanker slow-motion to Rotterdam, Suez, Singapore, and Korea, with the intention of washing away the Saudis’ competition for good.

I don’t blame the Saudis. They’re acting in their national interest, and with the end of globalisation at hand, it’s every man for himself. I respect their decision – it appears to be a great play. Willingly taking a hit to their country’s economy and government finances now… to crush their competition for years and to emerge resplendent and dominant in the world to come. One might even call it “investing for the future”…

But this will have vast and severe global implications for higher cost energy producers – including the unofficial capital of Europe, my bonnie Aberdeen.

But whatever the case, there will be casualties in the immediate term…

Struck by the scimitar

This great deluge of oil, the scimitar of the Saudis, threatens to cut many oil producers very deeply.

I’ve written before about how I think the collapse of the oil price due to WuFlu may finally tip Venezuela into total collapse. It already had a high cost of oil production, and that was before the wonders of socialism (cheered on from Blighty by none other than Jeremy Corbyn) made PDVSA – Venezuela’s state-run oil company – pathetically inefficient: oil production once the commies were in charge fell by two thirds, while employment at the firm more than quintupled.

We’ve seen chaos there for several years now, and harrowing tales of suffering and brutality brought on by the regime. In this country we have the luxury of worrying about getting fat during the lockdown, but they certainly aren’t over there – the average Venezuelan has been losing weight for years thanks to the poverty brought on by socialism.

The further collapse of the oil price could be the last straw before we see a total collapse of the country. I’m becoming increasingly convinced we shall see some form of military intervention there as a result of this crisis, overtly led by the US or not.

Moving to areas where the oil collapse doesn’t threaten to collapse the country (or at least, I hope not), one of the most pressured parties right now is the shale oil drillers, or “frackers”, in Texas. As Charlie Morris over at The Fleet Street Letter Monthly Alert wrote yesterday:

The US is pumping oil out of the ground at an unsustainable rate, and this negative oil will keep on happening until we consume oil again. President Donald Trump cannot do a US OPEC and price fix/limit supply because of anti-trust laws. These come courtesy of Standard Oil at the turn of the century. You may find it hard to believe but monopolies aren’t welcome.

The only way to reduce output is via the harsh economic realities of high supply with low demand. The price will force action and the oil fields will have to close. So far, the Federal Reserve is keeping the funding open by buying their junk bonds. It is a ridiculous policy that will leave the taxpayer with a hefty bill. For what?

Trump wants to ban (or apply tariffs) Saudi crude. Will Saudi Arabia, and the Middle East, break their pegs with the US dollar? This will get nasty. This Covid-19 crisis is moving way past the initial fears over death tolls…

Though the frackers attract a lot of attention, there’s another “unconventional” oil producer the Saudis aim to crush – the boys wearing Canadian tuxedos (denim everything) in Alberta, who extract very heavy, very sour oil from “tar sands”. This is an incredibly high-cost exercise (not to mention environmentally taxing) which is only profitable at high oil prices. These guys are going to get hit hard, and this will have a big impact on the Canadian economy.

The Canadian dollar, or “loonie” (named after the common loon, a bird featured on the coins), is a commodity currency, meaning that it generally strengthens and weakens in line with demand for the commodities it exports. The largest of these? Oil.

Lack of demand for Canadian crude, lack of demand for Canadian currency. The scimitar of the Saudis may cut deep into this one…

The pound has fallen heavily against the loonie since Brexit. But having bounced three times off lows and now with the Canadian oil industry getting whacked, this may now change.

An ace up Canada’s sleeve is that it also exports a lot of gold thanks to its mines, while the UK does not – and while the tar sands will be getting wrecked, the North Sea will be under pressure from the Saudi offensive too.

Back tomorrow…

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Category: Market updates