Happy Easter Monday!

I hope you’ve been enjoying the break as much as you can in these circumstances. I’ve been taking the time to get my thoughts in order, do some reading, and listen in to what the folks at the fringe have been saying.

Though Southbank Investment Research is shut today, Capital & Conflict continues with a little help from my friend and colleague Akhil Patel. This is a recent note he sent to his subscribers at Cycles, Trends and Forecasts. This piece is not quite his normal fare – it’s very reflective and takes a bold look into how emotions run in cycles, and how that affects markets.

According to him, you can count forward from emotional events in markets and even in your own lives to see when future emotional events will take place. I’m pretty curious about the idea – and we don’t have to wait long to see if he’s right, for by his predictions, as you’ll see below, we should be in for an emotional market firework show on 17-19 of this month…

I’ll let him make his case.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Time and emotion

One of my friends who works in television suggested to me the other day that I diarise the extraordinary times we are living in. Her feeling was that when we get back to “normal” (whatever that will end up being) our memories would be coloured by whatever narrative takes hold to explain events retrospectively. So it was important to get thoughts down now in their uncontaminated form.

It was a good suggestion; but I am no diarist, I have to admit. My only attempts in the past were when I was about ten years old at a school camping trip in Snowdonia. It rained the entire week and I was fairly miserable, and homesick, and so the diary came in handy to document how much I was missing my mother’s cooking. My next attempt was when I was travelling around South America after university; I wanted to mark all of the wonderful experiences I was having, but this lasted all of three days.

But it was a good idea and so I have belatedly made an attempt. There’s no particular structure to my writings; I am trying to capture my typical day and note anything novel about what I am seeing in the brief moments I am outside, interspersed with the odd reference to the news or markets. It’s a bit of a jumble but hopefully in the future it will help me remember things more clearly.

I am also trying to capture shifts in sentiment or mood. Now, these are highly subjective and of course only based on my limited perspective. But one thing I’ve found quite interesting is to look at the flow and tone of messages I am getting from friends on WhatsApp groups. I am also trying to take in the tone of the news and the mood of people on the streets.

True to the finest traditions of the British weather, as soon as the prime minister announced the lockdown on the evening of 23 March, the weather turned decidedly better. (Actually this was no coincidence: weather trends often turn on seasonal dates, in the same way that markets do.)

But because the sun was shining, the first week of the lockdown was interesting. I think a lot of people that were stuck at home were rather enjoying the experience. I am referring to salaried employees who saw some benefits of avoiding the morning commute on a packed train and getting to spend a little more time with loved ones (clearly there were a lot of people worried about job security and loss of income for the self-employed).

In my circle, I was forwarded a lot of jokes on social media, far more than normal. “This is rather fun and different”, would be the phrase that seemed to capture the mood. In addition to the weather, it also probably helped that we weren’t being bombarded with constant news about collapsing markets, as they had turned just before the lockdown.

However, the constant flow of jokes and good humour all but dried up the second week. My interpretation of this was that reality was starting to bite: social isolation involves a sacrifice of many more things than we had appreciated in week one. Remote working systems can never replicate being able to wander by a colleague’s desk for a chat. And there’s a reason why people like to work outside the home – to maintain a separation between home and work life, which can become blurred when working from home for days on end.

This week, the third, I am sensing more acceptance (or resignation) to our new circumstances, a shift in mood that was captured (and to a certain extent perhaps even driven) by the Queen in front of the cameras on Sunday night, 5 April, reminding us all of our duty in these times.

It’s quite noticeable how much more careful people are being about observing strict distancing rules, whether they are walking, running or standing in a queue to get into a shop. It apparently takes 21 days for a new habit to form – and we are fast approaching that point, so perhaps this is not surprising.

I suppose it is also a consequence of the fact that the prime minister was rushed to hospital on Sunday evening and then moved to intensive care on Monday evening (6 April). This may have brought home the impact of the virus to many people, who may have previously only thought about it abstractly.

I have a number of friends and family in the medical profession, and as the number of those hospitalised grows, they can see how the system is coming under huge pressure. A friend of mine, an experienced consultant, has told me that the service is now overloaded with some of the sickest patients he has ever seen, experiencing a severe malfunctioning of several body systems at once. While the virus may only ever affect a very small minority of people, and even then only mildly, it’s certainly not something to be taken lightly.

Another reason it shouldn’t be a surprise there was an apparent shift in mood over the weekend, nor that we got an event of significance around 6 April (the PM in intensive care), was that this was 30 days (or degrees) precisely after the first coronavirus-related death in the UK on 6 March.

Count forward from important events in markets and even your own lives to see when future emotional events will take place.

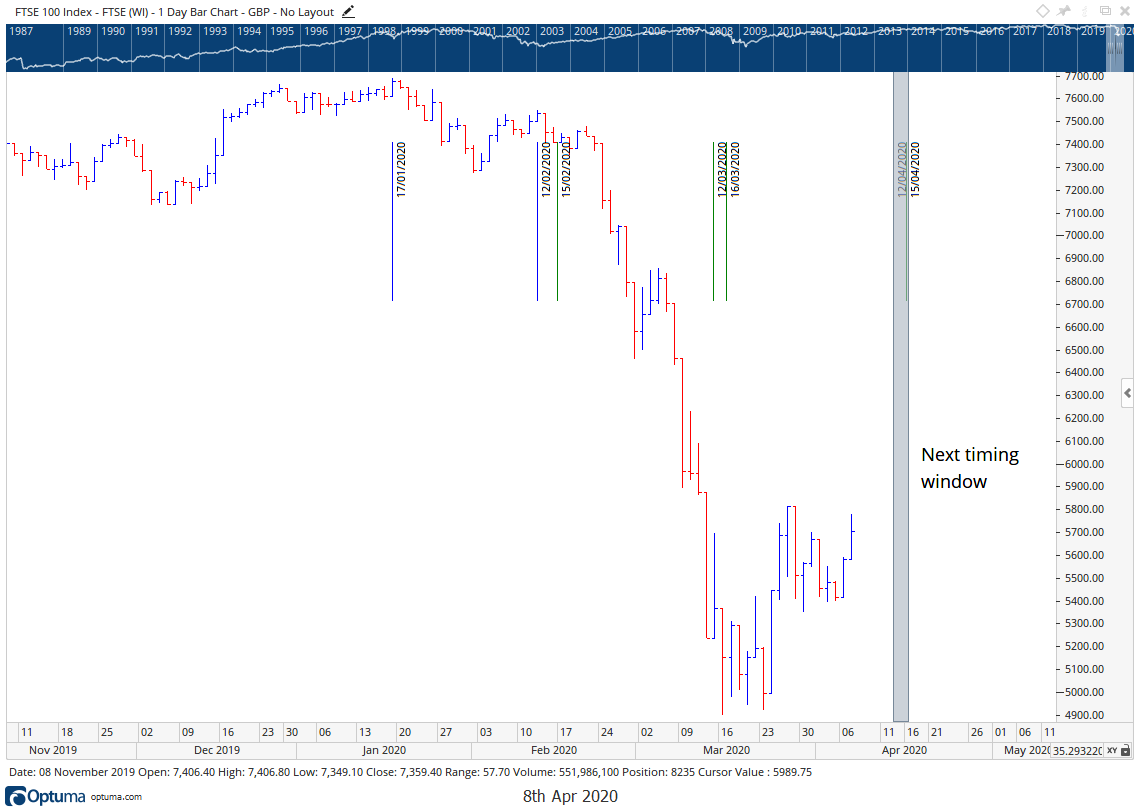

The FTSE 100 high was on 12 February (a lower high); so we now watch out for a potential turn, or market emotion on 12 April, or a day or so either side, 60 days on. Similarly we’d count from the low on 19 March, which was 60 days from the yearly high on 19 January, and look for 17-19 April as another point.

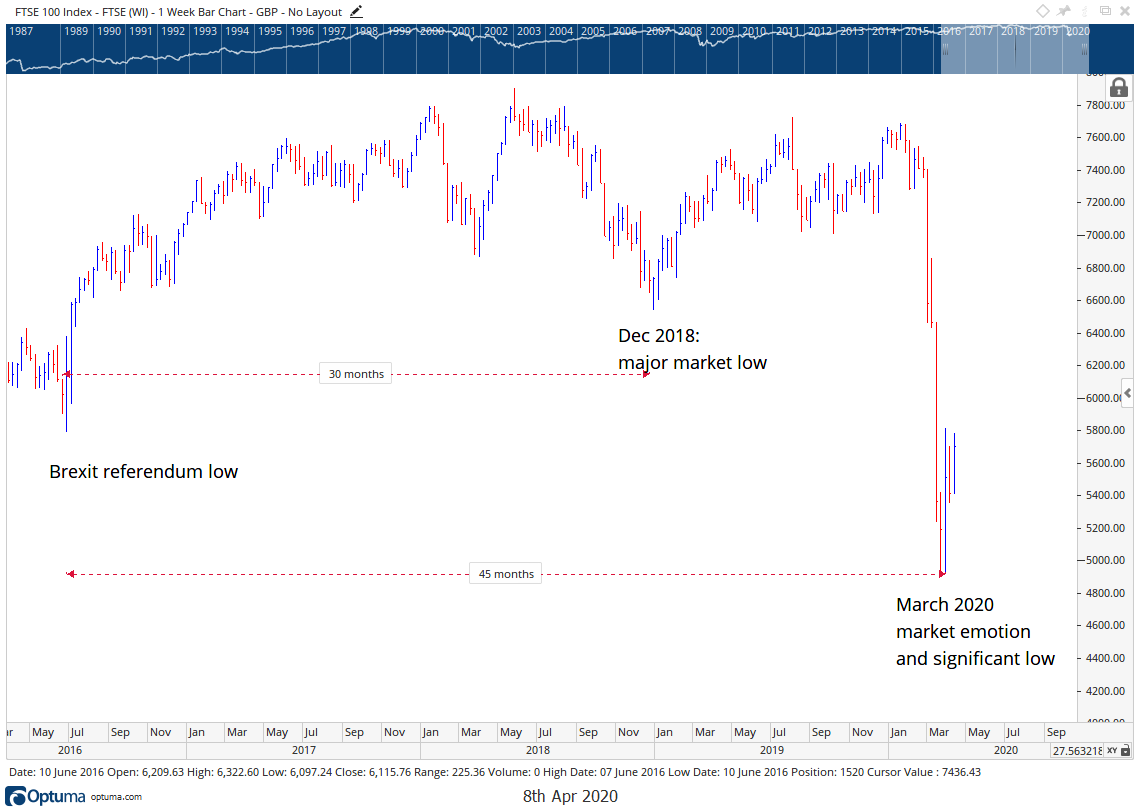

These counts also work in different timeframes as I have mentioned before. For example, you could count in weeks and months from the extreme emotion of the Brexit referendum result in late June 2016. Thirty months on from that brought the 2018 lows in markets – a hugely emotional low. There was a lot of panic in the air then, if reader questions were anything to go by.

Forty-five months on from that brought the market crash and the current low. I can’t remember a more emotional period in markets. This would now alert us to June 2021 being another emotional or volatile month for the UK market, and 60 months on from the referendum.

Time and emotion drive markets and, it seems, much of our lives.

Until next week,

Akhil Patel

Editor, Cycles, Trends and Forecasts

Category: Market updates