2019 is beginning to feel an awful lot like 2016.

Just as then, heralded by stalling global growth and low inflation figures, the central banker’s nightmare – deflation – is back.

The same dynamics are playing out – the prices are just more extreme. The German government now gets paid to borrow money for over 17 years, with the ten-year bund reaching an all-time low of -0.33%:

And it’s not just the German government that’s benefiting – an incredible 40% of all eurozone sovereign debt now trades at negative yields.

Globally, there’s an unimaginable $13 trillion worth negative yielding debt now outstanding.

Think that’s wild? The central banks haven’t even had “the courage to act” yet. When they start cutting rates and expanding their balance sheet again, bond prices will become progressively more insane.

The US ten-year bond is falling once again, following two years of hopes that the Federal Reserve would be able to normalise monetary policy. Those days are gone now, as we take a ride back to 2016 territory. Once we get to new rounds of quantitative easing, I expect we’ll see the ten-year go negative.

The first wave of monetary stimulus may be arriving as soon as next month – fed funds futures are pricing in a 100% chance that the Fed will cut rates at its July meeting.

UK government bonds, or gilts, are also taking a trip down memory lane, and are another candidate for the negative yield club:

Just like in 2016, gold is breaking out once more, as real interest rates (interest rate – rate of inflation) are poised to plunge:

And that’s just in pounds. In Australia, gold has never been so expensive:

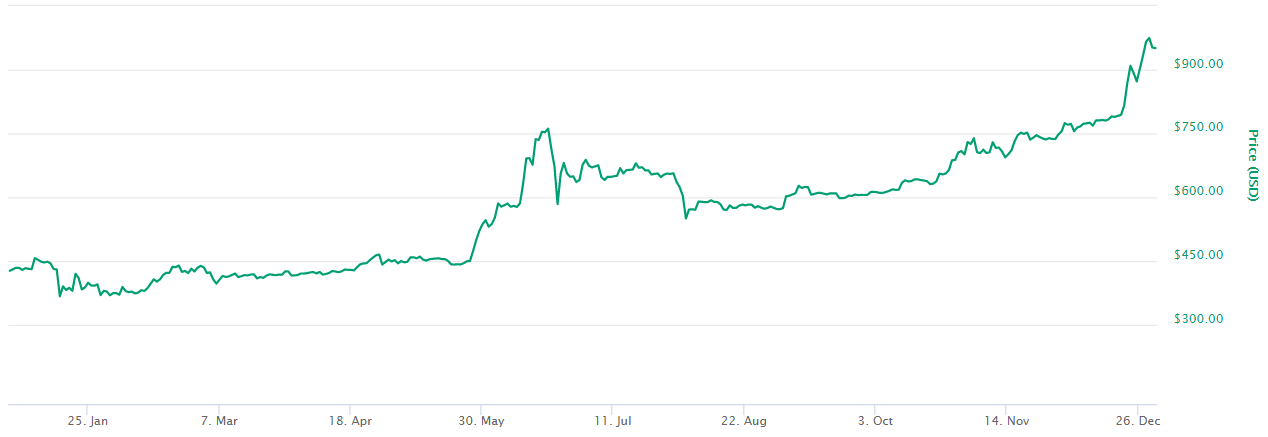

The recent resurgence of crypto (BTC is now over $11k) is in harmony with the move to a “lower for longer” interest rate environment. Low interest rates push investors to the fringes in search of returns, and though crypto wasn’t nearly so well-known at the time, bitcoin had a great 2016:

The central banker’s fear of deflation was kept at bay over the 2017-18 period thanks to tax cuts in the US, Brexit’s devaluation of the pound over here, and further Chinese fiscal stimulus pouring into Europe via Germany.

But those days are over, and Japan’s past decades of monetary extremes in pursuit of inflation (resulting in little growth or inflation) is looking ever more like our future…

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates