At 0%, Bitcoin has a higher yield than government bonds in 18 countries whose central banks are attempting to debase their currencies and inflate asset prices.

In unrelated news, Bitcoin is up 112% year-to-date.

– Charlie Bilello, on Twitter

That’s 128% now in GBP terms.

Bitcoin did indeed close the weekend higher than it began, though it had a typically violent sell-off in the early hours this morning:

BTC price action since Friday. Source: ByteTree

BTC price action since Friday. Source: ByteTree

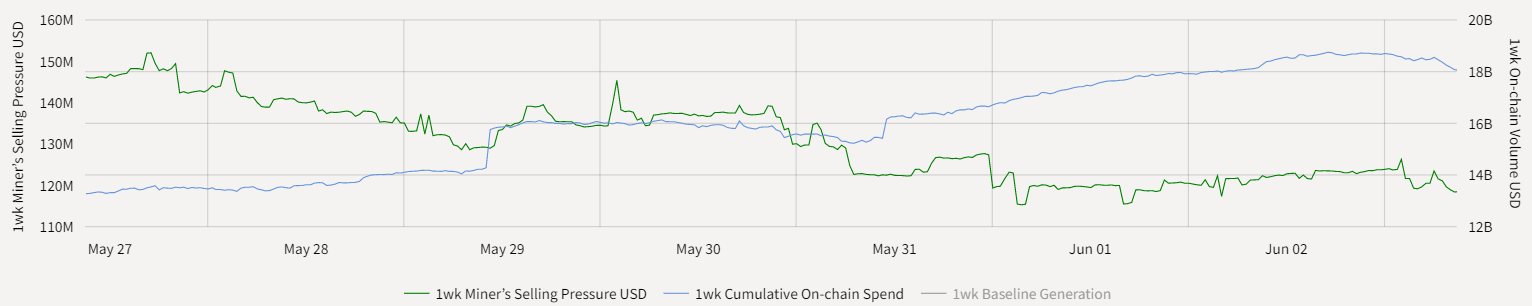

Though BTC price has taken a clip to the chin this morning, the “fundamentals” (if we can call them that) of the Bitcoin network are looking positive. The miners have been reducing their selling over the last week, and the network spend is on the up. By “spend” I mean the value of BTC being transacted across the network – effectively how much life there is in this digital ecosystem:

Miner selling in green, network spend in blue. Source: ByteTree

Miner selling in green, network spend in blue. Source: ByteTree

I was introduced to the “network spend” metric for valuing bitcoin by Charlie Morris, who also founded the website through which you can monitor it – ByteTree.com.

Charlie uses the network spend to see if bitcoin is being over or undervalued by the market. I’ll let him fill you in on the details, emphasis mine:

General spend is the combined on-chain transaction value measured in US dollars. This is the single most important metric in crypto analysis… General spend takes the price and net spend at the time of each block to get an economic transaction value for that block. It is then added to all of the other blocks over the past rolling week, which eliminates the weekday bias (weekends are consistently weak). If general spend is rising, then the network is growing and vice versa. A growing 5 or 12 week general spend line would be a more stable measure of network growth than a single week. General spend is to a crypto analyst what sales/revenue/turnover is to an equity analyst…

…[There is a] strong, and highly correlated link between the price and network spend. There is some circularity here as network spend is calculated using price, but “this is crypto”. The hype cycle sees new users, that transact, spend and tell their friends. The stronger that force is, the greater the network growth and the bitcoin price follows. This goes a long way to explaining bitcoin’s high volatility. Each cycle has seen more transactions and general spend than the last, and the intrinsic network value is building over time.

Last week we argued that the recent spike in BTC was the product of Chinese capital flight (and possibly a few rich residents of tax havens), and that when central banks begin cutting rates and ramping up their asset purchases (under the label of “QE” or some other acronym) we’ll be in for another crypto ride.

With the market now pricing in almost three interest rate cuts by the Federal Reserve before the end of the year, we may be witnessing the crypto train arriving in the station right now. How BTC performs before the central banks have “the courage to act” and bring us to even further monetary extremes will be interesting.

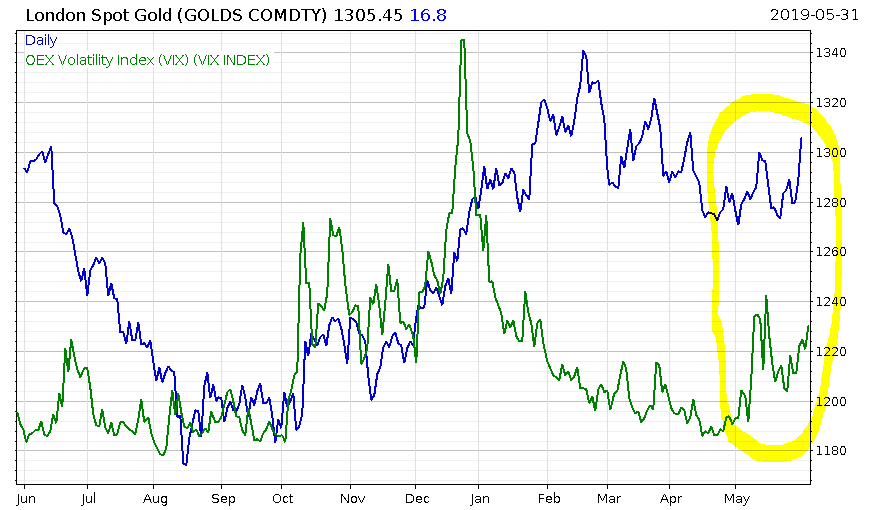

Of course, it’s gold that is the traditionally rises during periods of monetary extremes – but it’s on the up, too. For the moment it’s assumed the form of a crisis hedge, moving up in line with the US stockmarket volatility index, or VIX…

… but the next round of central bank bond buying and sub-zero interest rates will no doubt put gales in its sails. As financial writer Jim Grant said recently, “gold bullion, yielding only nothing, nonetheless yields more than $10.6 trillion of notes and bonds that yield less than nothing. It’s all about relative value.”

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates