Southbank Investment Research is shut today, but with everything going on out there and as it’s Eastertime, I thought we should send out something special in today’s note instead of my normal scribblings.

Following the strong feedback we’ve had for the insight Robin Griffiths and Rashpal Sohan have brought to our market broadcasts, I thought I’d show you a redacted version of what their subscribers at Dynamic Investment Trends Alert have been getting every fortnight.

I’ve removed the trading recommendations (that’s for paying subscribers only I’m afraid), but the guts of the piece are below – economic and market insight, illustrated. And I get the feeling you’re going to want to read this one. Rashpal writes that the world has now suddenly entered wartime conditions – and that investors must now step forward with a matching attitude if they are to survive…

I find the pair’s work rich with valuable insight, and – grim as the subject may be during what should be a much happier time. I hope this finds you safe and well, and wish you a happy Easter.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Virus War

Dear Readers,

I hope you and your loved ones are managing to stay safe at this very precarious time. I would like to begin by taking a moment to appreciate the incredible work being done by all the scientific experts, healthcare professionals and medical workers who continue to work selflessly in order to keep all of us safe during this watershed moment. I also extend my deepest sympathies to anyone who may have lost a loved one to this cruel virus.

Coronavirus has come out of nowhere and changed all our lives in unimaginable ways. In just over a month, the world has been forced to hit the pause button and self-isolate. When we last wrote, the virus didn’t seem to be much of a global concern, and we were banking on policymakers remaining on top of the situation.

However, the facts were quite different back then with 96% of the cases concentrated in China. Since then, the virus has spread to all corners of the earth and the world has been flipped on its axis. Around 70% of the cases now reside outside of China, making it a global concern.

Governments have been forced to take drastic actions to try and stop the virus from spreading and killing a large number of people. Social distancing, self-isolation, widespread quarantines, complete city lockdowns and border closure are just some of the techniques that have been widely implemented across the globe to try and stop the virus dead in its tracks.

Whilst these measures are necessary to “bend the curve” and save lives, the sudden stop in economic activity is unprecedented and carries huge economic and social costs. Equity markets have caught on to this fact and sold off precipitously as they try to recalibrate from being priced for perfection to being priced for recession.

The real economic and financial effects of this containment strategy will become apparent in the months ahead. For now, however, the best that governments can do is to buffer this shock by providing critical life support to keep businesses from collapsing and the unemployment rate from soaring.

Our top priority is firstly to stay alive and secondly to avoid further losses. Risks are high, so we need to be cautious and remain risk averse. Our whole attitude is a war time one. Stay safe and follow the ALPH4 model.

If you have any questions or comments during these turbulent times, please write in. We will do whatever we can to help.

As ever, we appreciate your feedback and support.

Good luck.

Best wishes,

Rashpal

“Bull Markets don’t die of old age. But they do die of Coronavirus” – Bloomberg Reporter

When the disease first started its initial appearance, it did not seem to be a super-serious situation. Most of the strongest equity markets were rising and were at a new all-time high. They had become overbought and due for a consolidation. The driving 200-day moving averages were typically around 12 percent beneath the index level.

Under those circumstances, a setback to test those trendlines was quite normal. The initial fall back was quite moderate and at the time of our last monthly document there had been no major changes in our model predictions. However, within days the disease morphed into a much more serious threat and accelerated rapidly in the remainder of the month. Along with it, equity markets got infected and began to break down…

We have had a crash in a short space of time and it is now clear that we are in the midst of a globally co-ordinated equity bear phase. It is also accompanied by real fear and death in many places. Governments going into war mode now, to help get through the situation, will find huge debts building up, high and rising unemployment and there will be many bankruptcies. These are not normal times…

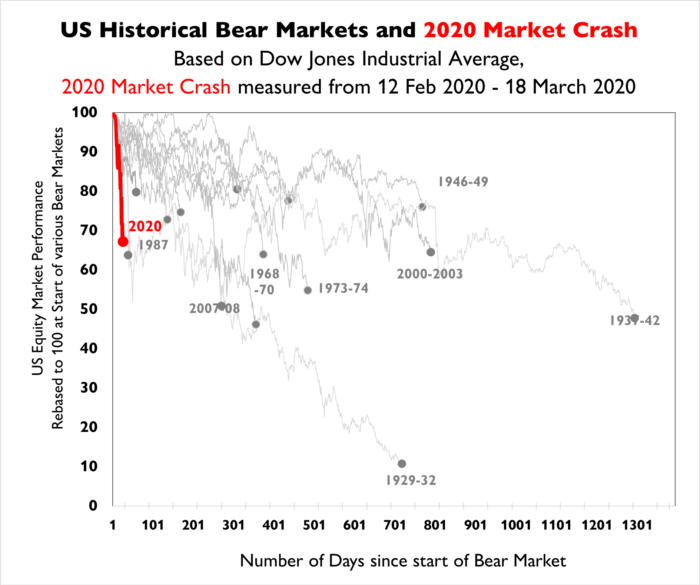

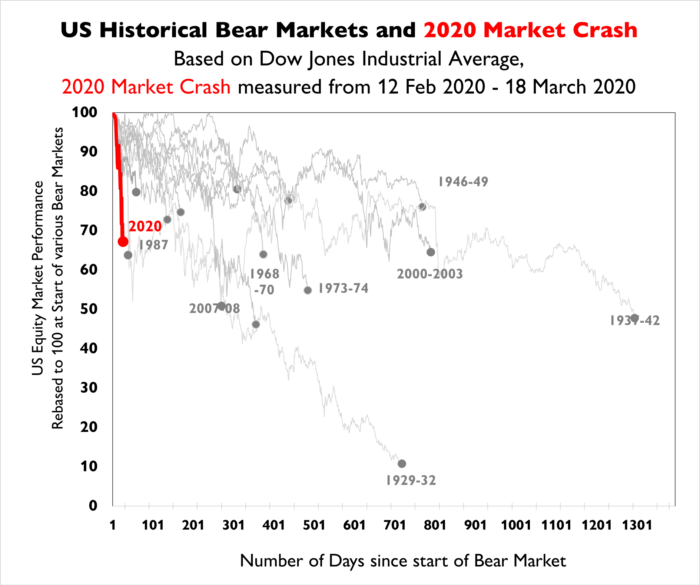

When we look at historical bear markets, we find that they typically last around 18 months, fall by a third (33%) and take just under two years to recover. As a rule of thumb, it is worth remembering that retracements typically occur in the order of magnitude of between a quarter (25%), a third (33%) or a half (50%).

However, we need to be careful talking about a “typical” bear market, as they are not all equal. Bear markets can either be structural, cyclical or event driven. Structural bear markets, caused by imbalances and financial bubbles, last the longest and cause the greatest destruction in wealth. They last around 3 years on average and fall by a half. Cyclical bear markets are a function of the economic cycle, last just over 1.5 years, fall by a quarter and recover in a year.

Event-driven bear markets, as their name suggests, are driven by specific events – such as an oil shock, a crisis, war, etc. These bear markets are the shortest – lasting around half a year – and fall by a quarter, before recovering in a year. However, we play these numbers to ourselves, we are not going to get bullish for a long time yet.

If we look into the future, to see how things could evolve in the coming months, and how low it could drive the stockmarket, we do not come away with much optimism. In earlier documents we had explained that a recession was due somewhere between the end of this year and next year. As we started the year, we had the US in full election mode. This is normally positive for markets.

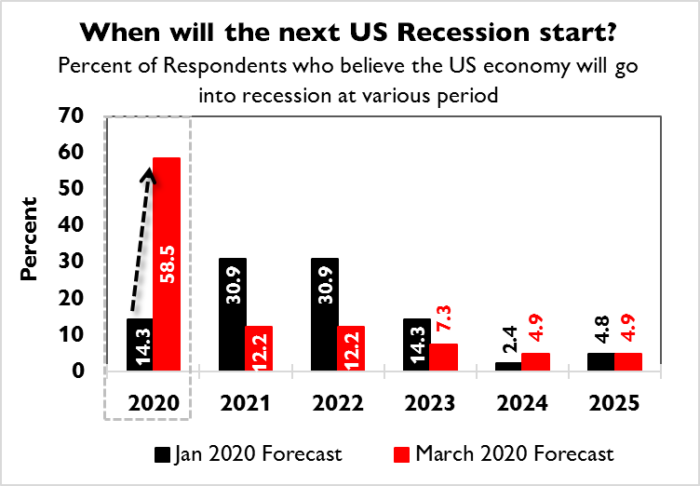

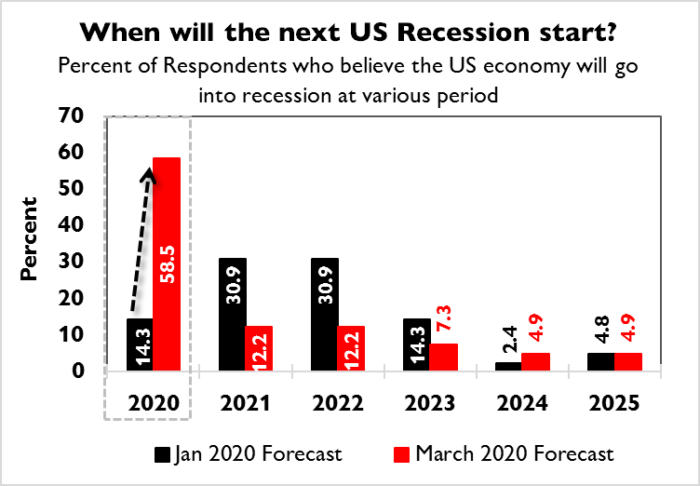

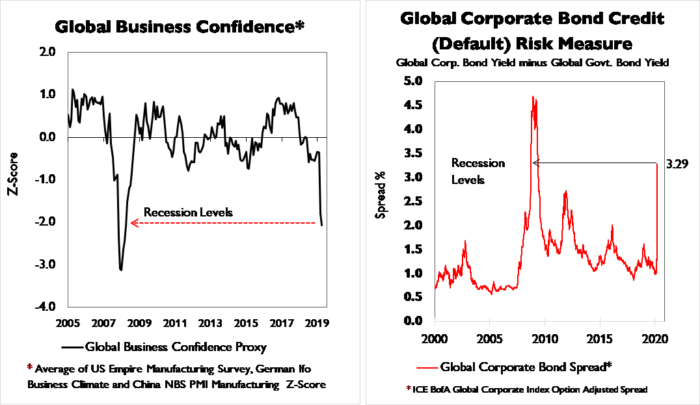

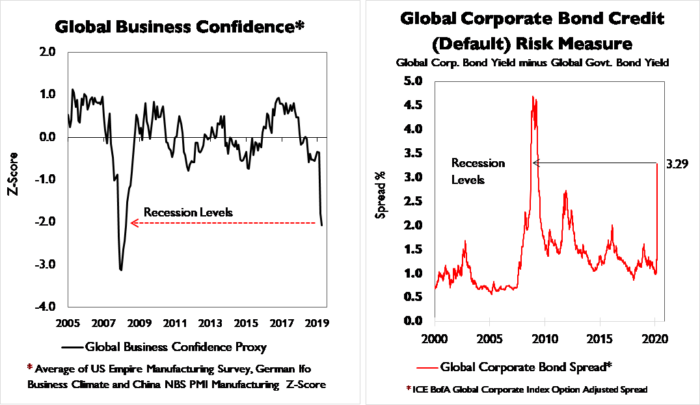

In the UK, we had a landslide election victory for Boris Johnson. He had very positive big spending plans. As a result, the stockmarket was expecting strong global economic growth to follow (Figure 8) and these two forces made it likely that the probability of a recession was delayed until next year.

Now, we have had an unexpected event. This has been a force majeure. It has caught us all by surprise and brought the recession forward to now (Figure 9). We are in it and it will be bad. There is still a chance that next year we will still be in it and a small probability it could drag on even longer.

Figure 8: The global equity market had been discounting an overly optimistic view of global economic growth up until last month. The sharp reversal since then is a recalibration in light of the growth shock expected owing to coronavirus.

Source: Southbank Investment Research, Refinitiv Datastream

Source: Southbank Investment Research, Refinitiv Datastream

Click to enlarge

Figure 9: Wall Street has revised its expectations for a recession in light of recent events. It now expects the recession to start this year.

Source: Southbank Investment Research, Wall Street Journal

Source: Southbank Investment Research, Wall Street Journal

Click to enlarge

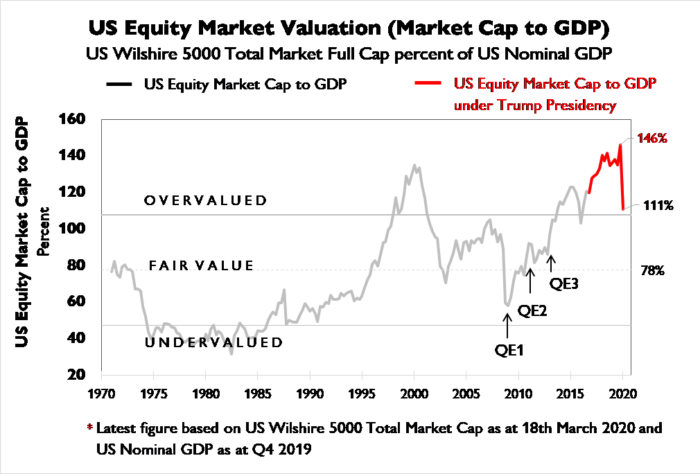

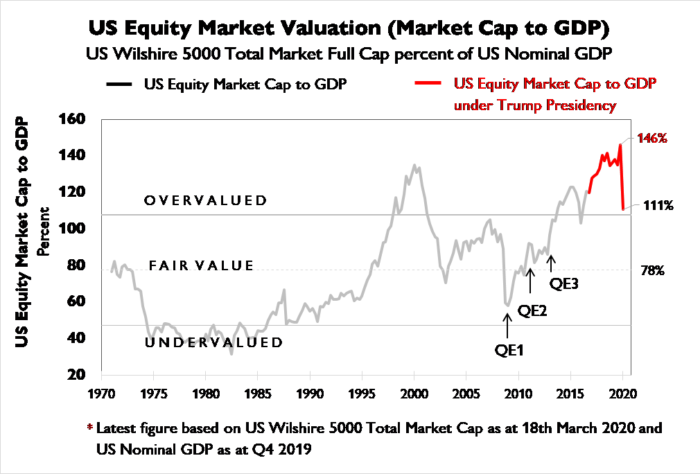

We know that the market has defied gravity for a long time in the era of zero interest rates, however nature has come up with its own way to burst the bubble. Mankind’s efforts to avoid a bear market have been thwarted by a virus. The US stockmarket has been massively overvalued by all sensible yardsticks and even after the crash last month, there is still significant scope for further downside.

One way we can illustrate this is using Warren Buffett’s favourite valuation measure (Figure 10) which compares the size (market cap) of the stockmarket with the size (GDP) of the economy.

Historically, under this metric, the US stockmarket has been considered cheap when it has averaged around 40% the size of the US economy and fair value around 80%. After the global financial crisis, it was never allowed to become “cheap” as policymakers intervened with unprecedented monetary and fiscal policy.

As a result, after subsequent interventions, the US equity market had become grotesquely overvalued and stood at around 140% the size of the US economy before the virus-induced sell off. Even now it is still larger than the US economy (Figure 10).

Figure 10: The US stockmarket remains grotesquely overvalued even after the crash last month. The potential for further downside remains significant.

Source: Southbank Investment Research, Refinitiv Datastream

Source: Southbank Investment Research, Refinitiv Datastream

Click to enlarge

Given where equity valuations stand, in terms of stockmarket moves it looks as though we will get a 50% setback. There will then be rallies. However, it is entirely possible that the subsequent move will break lower.

For many countries this could be a grand super cycle correction. We could also have a global depression. It is just possible that the coming warmer weather will kill off the virus and things will improve quickly. However, taking into account the big hit to business and consumer confidence that has ensued as well as the risk of corporate defaults (Figure 11) in the months ahead, this will still put a damper on markets after that. Looking for an easy and quick way out is a mistake.

The present and the near future are both grim. A recession is coming and we must treat this seriously. The stock markets have priced this in and central banks, led by the US Federal Reserve and the Bank of England, have already lowered rates to zero – but it has made little difference. Any future effect will be greatly reduced. They mean well and will have to print money to help the unemployed. The only other changes available now are tax cuts. This is now a global problem…

Figure 11: Global business confidence has been severely hit and the market is pricing in significant risk of corporate defaults as companies struggle to raise cash to reimburse lenders

Source: Southbank Investment Research, ICE Indices, Refinitiv Datastream

Source: Southbank Investment Research, ICE Indices, Refinitiv Datastream

Click to enlarge

We can compare the fall to date with what has happed on previous occasions, what we find is that we have had a modest bear in only a month (Figure 12). That means on a more normal time scale we are going to get a big bear market. The next 6-12 months will be tough...

Our top priority is to not lose money. Risks are high. We need to be cautious and risk averse. Our whole attitude is a wartime one.

Figure 12: The US stockmarket has incurred a modest bear market in only a month. On a more normal time scale we expect a larger bear market in the coming months.

Source: Southbank Investment Research, Refinitiv Datastream

Source: Southbank Investment Research, Refinitiv Datastream

Click to enlarge

Category: Market updates