Make way, dear reader, make way!

Make way…

For King Benjamin Franklin!

Behold, there he strides, in all his greenbacked glory…

The US attracts all manner of international condemnation these days – criticism of its culture, of its endless wars abroad, and of course, of the man in charge.

But for all the hot air you hear directed at the stars and stripes… the world adores Benjamin Franklin.

It’s an affair that is rarely acknowledged in public. Indeed, it’s probably considered politically incorrect by the aforementioned producers of hot air. But the fervour with which the world cherishes ol’ Ben’s portrait is on the increase. It’s a cult that sweeps the globe, and controls it too.

Tight lipped and stoic on the $100 bill (the most common US banknote in circulation), Benjamin Franklin stares out into more wallets, pockets, and bank accounts than ever before.

The world’s secret tryst with King Benjamin

Actions always speak louder than words. People can repeat slogans and trendy hashtags and talk about how the world needs to change because “it’s [insert current year] for goodness sake”, but the world doesn’t change on rhetoric – it changes on behaviour.

And while all manner of politicos around the globe have been bemoaning the decline of the US, what the world has been doing is much different. In fact, the US’s influence over the global financial system is only becoming stronger – with the help of the UK…

The degree to which Benjamin Franklin dominates the world was illustrated in a recent report from the Bank for International Settlements (BIS) called “US dollar funding: an international perspective”, which drew financial data from the world’s banks, central banks, and markets to sketch a picture of just how often the US dollar is used as the currency of choice outside of the US.

The US dollar has been the world’s global reserve currency for decades now (arguably even since the Second World War) so the fact that dollars are being used often in foreign countries shouldn’t be much of a surprise. But the sheer degree to which ol’ Benny Franklin still flows through the veins of the global economy – considering all of the anger directed at the US these days – is something to behold. And importantly, the number of global entities seeking funding in dollars is only increasing relative to other currencies.

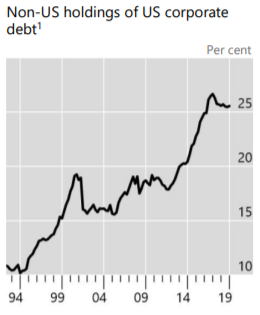

We’ll start with something relatively small, with foreign holdings of US corporate debt. This is a pretty straightforward chart – foreigners were cautious about the dollar and US corporate debt after the financial crisis but after the European debt crisis, they started hoovering it up:

Source: BIS

Source: BIS

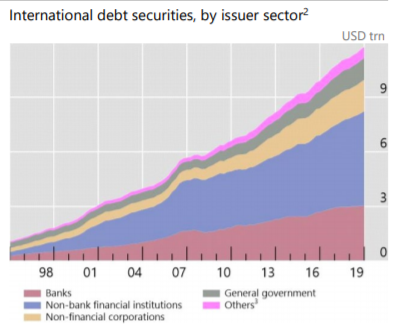

But it wasn’t just the profitability of the US corporations which they were after. It was the fact they were going to be paid back in dollars – they trusted the dollar more than other currencies. This is illustrated by this chart of “international debt securities” – that’s non-American corporations and governments – borrowing money in US dollars (trillions):

Source: BIS

Source: BIS

Note how the election of 2016 has changed next to nothing on that chart; in fact, the desire for US dollar debt appears to have accelerated since!

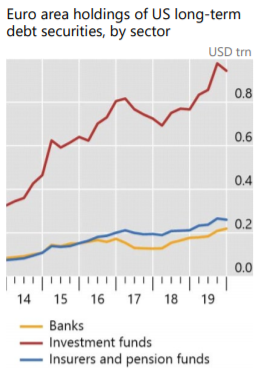

Of particular note is the appetite of European investors for US debt. Despite the calls from the eurocrats to internationalise the euro, and remarking on the dysfunction of the US administration, the hunger for dollars within its borders has only increased:

Source: BIS

Source: BIS

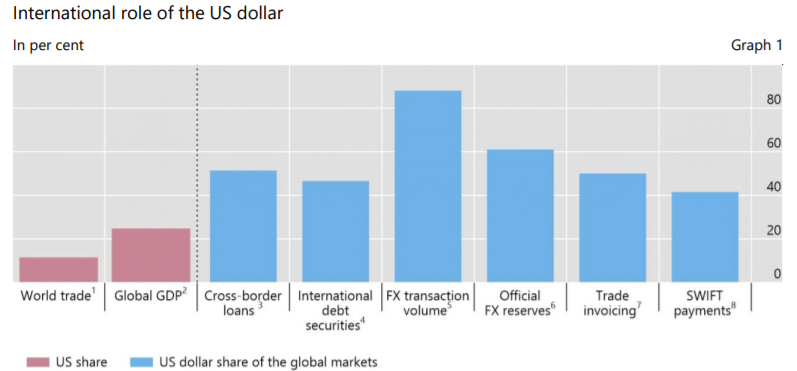

But then we get to this table, and it’s the real kicker. While the US economy makes up roughly a quarter of the global economy… the dollar is used in an incredible 85% of global FX transactions, half of all trade invoicing and cross-border lending, and 61% of all government currency reserves:

Though the US takes part in only a tenth of global trade (roughly), foreigners are using the dollar in over 40% of global bank payments (through SWIFT).

It just goes to show how little political rhetoric and self-righteous indignation from politicos impacts the real world. Some journalist with an international relations degree would probably be telling you the US’s influence in the global economy is in steep decline right now. But in fact, relative to the other fiat currencies – the US is beginning to look like the only game in town.

And the UK – or should I say, the City of London – is key to all this. While the dollar takes up 85% of the world’s FX transactions, the majority of those take place in the City, which dominates global currency trading: over 40% of global FX trades take place there, far exceeding any other financial centre. But it goes deeper than that, as much of the global financing of debt takes place in the City too.

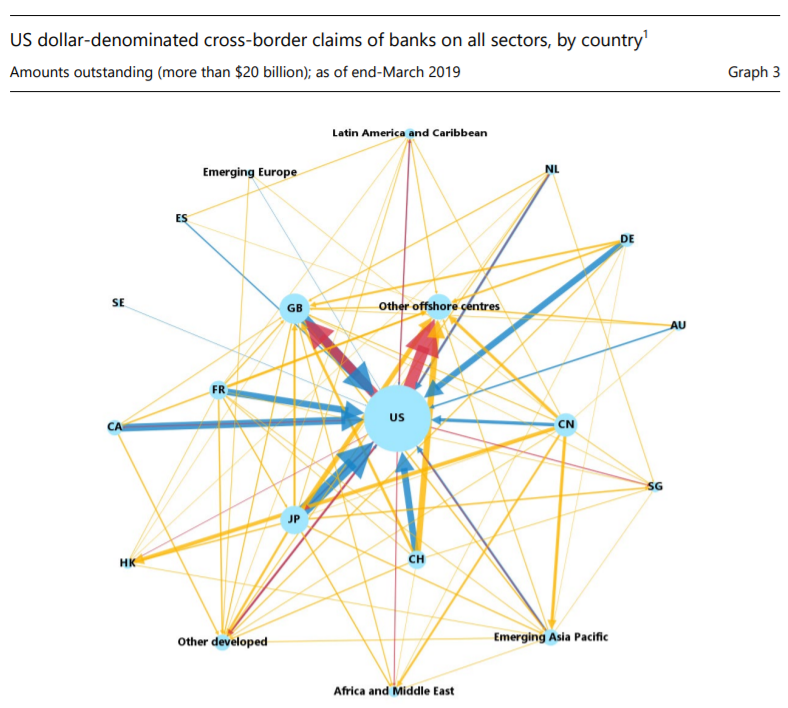

Here’s another chart from that BIS report, which shows who-owes-who in dollar terms. The direction and width of the arrow indicates the size of the dollar debt and who it is owed to:

Note how GB at 10 o’clock not only owes entities in the US a significant amount of dollars (blue)… but is owed a vast quantity back (red). This unique situation is a result of the “special relationship” London has with the US, where the City acts as a key distributor of dollars to the world (after recovering them from Wall Street and the US Treasury) while also being a key lender to US entities. It’s somewhat fitting, as Benjamin Franklin himself was known to like London more than any city in the States.

Many years ago, the video game developer Ubisoft ($UBI) released an alternate history title called The Tyranny of King Washington, in which George Washington went mad with power and declared himself king after the Revolutionary War. This scenario, where Benjamin Franklin has become the monarch of the world economy, feels like an ironic echo of it. But this reign of Benjamin Franklin is not really tyranny – investors, companies and financiers are choosing the dollar to conduct their business, a fact which is likely considered too politically incorrect for some to mention in this environment.

Indeed, when you see headlines like this that are brought on by the social unrest in the States…

… how long is it before people begin demanding that the dollar index change its ticker from “DXY”?

The fact that the world now refers to the US more than ever when it comes to money and is only becoming more addicted to US dollars is something probably considered politically correct by much of the press – an “inconvenient truth”. And yet it’s something hugely important to investors, or indeed any observer of global affairs. And that’s why now more than ever, we should be studying people’s actions, rather than listening to their words.

Wishing you a good weekend,

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Category: Market updates