The world’s stockmarkets lost eight trillion US dollars in value in October according to Bloomberg. By that measure, it’s the worst month since 2008.

Change in value of global stocks by month

October wiped out almost all of 2017’s gains in dollar terms based on a Wall Street Journal estimate. The loss is also worth about 10% of 2017’s global GDP according to the World Bank.

Ouch.

And that’s just the stockmarket. Plenty more was lost in the bond market, which also tumbled in October. Italy’s bond crisis began for real and the US Treasury yield spiked.

But what caused all this? The Remainers can’t blame everything on Brexit.

The market rout appears to be due to a cluster of errors. The US and Europe were the key markets to take a turn for the worse. Let’s look at them in turn.

In the US, investors seem to have realised the Powell Put’s strike price is lower than first thought. The Powell Put is the idea that, should the stockmarket fall far enough, the Federal Reserve’s new chairman will save the day. The question is, where is the line?

The belief that central bankers are responsible for keeping the stockmarket high is worth thinking about. It sounds absurd, or at least used to. How did we get here?

It crept up on us over time.

In the days of the Greenspan Put, people were still quite likely to believe in the stockmarket’s forecasting ability. Therefore, it made some sense for a central banker to pay attention to the stockmarket as an indicator.

When stocks tumbled, the Fed’s chairman Alan Greenspan would spring into action on interest rates, claiming falling stocks were a warning sign of recession.

Chairman Ben Bernanke’s attempts to deal with the financial crisis rewrote the book. By manipulating the stockmarket intentionally, he hoped to unleash the so-called wealth effect. Wealthier people spend more, so juicing stocks would encourage consumption.

Chair Janet Yellen was a little sceptical of the idea. She worried more about how it created inequality.

But the new Fed chairman appears to be different. Jerome Powell doesn’t see the stockmarket’s performance as a means or an end. At least, he claims not to. Which is a lie.

You can bet that a big enough stockmarket rout will change his mind. But it’s that “big enough” part which has investors worried. How low do stocks go before the central bankers jump back into the fray by letting it rain dollars?

Instead of promising a good weather forecast in case of rain, Powell has done the opposite. He’s pushing ahead with interest rate increases while stocks fall. The trouble with this is, interest rate upcycles tend to end in disaster. A crisis always marks the top of a series of rate hikes.

So where’s the next crisis coming from? And when?

Europe’s reckoning

Next to the US’ bond market, Italy’s was the other source of misery in October.

The budget battle with the EU triggered a spike in interest rates there too. The default risk of Italian bonds spiked. And the risk of a breakup of the eurozone rose too. Stocks in Europe tanked.

But here’s what you need to realise about both stories. Nothing has actually happened yet. The market has merely priced in the rising probability of what could happen next.

If you’ve secured a copy of my new book, you’ll already know what happens next in Europe. And three recent pieces of news fit perfectly into my predictions. Perhaps even better than Bloody October did.

Italy’s economic growth hit 0%. Europe’s tumbled to 0.2%. But inflation in the eurozone rose to a six-year high.

Combine the three and many of you will be thinking of stagflation. But that’s not the issue I’m talking about.

The divergence of economic conditions inside Europe is the real worry. My book explains how and why this is happening. And where it will leave Europe.

Given the book is called How the Euro Dies, you can probably guess.

But one mystery remains.

What are the Italian banks up to?

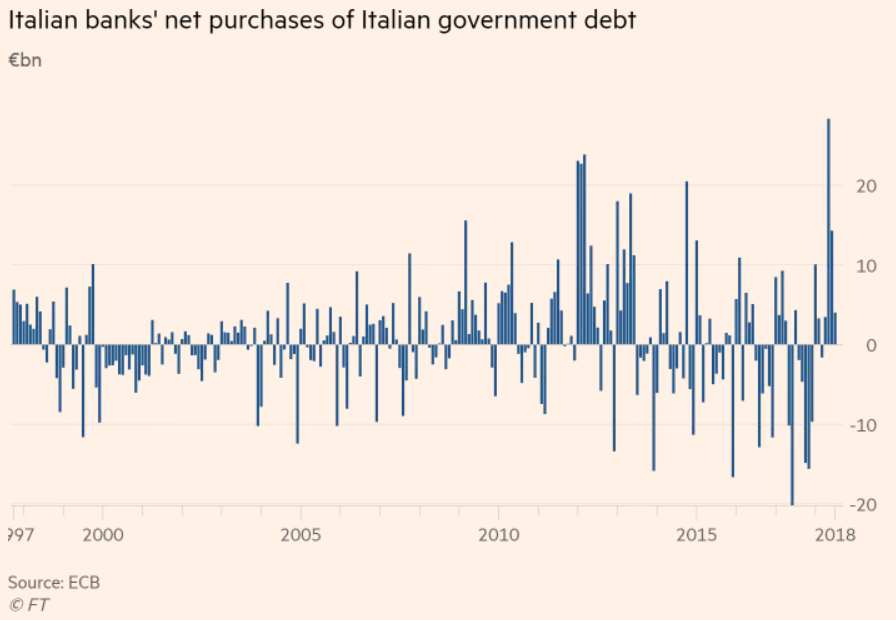

Before the Italian crisis sparked up in May and October, Italy’s banks had been selling huge amounts of Italian government bonds

When I updated my original Zero Hour Alert predictions for Bloody October in August, I discovered that this had reversed. Italian banks went from dumping Italian government bonds in 2017 to gorging them down like mad in 2018.

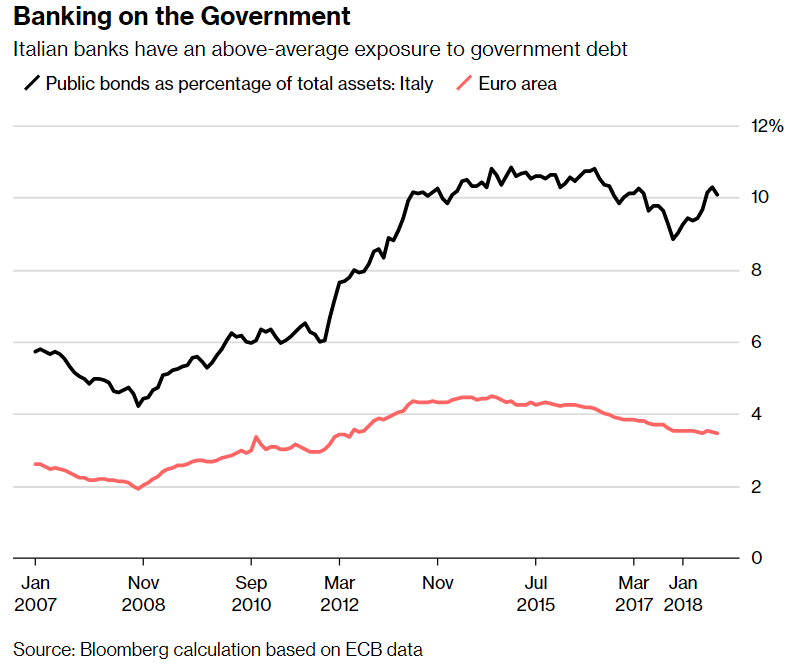

The following two charts show how powerful the change was. Keep in mind the Italian banks were supposed to be offloading Italian government debt to try and synchronise into the coming European banking union.

The first chart shows that Italian banks have a huge overexposure to their national government’s debt. About three times more than other banking systems in Europe do. And that amount surged in 2018 after tumbling in 2017.

The second chart shows the Italian banks went from record sales of Italian government bonds in 2017 to record purchases in 2018.

On 9 October, Marketwatch reported on the figures:

Italian government debt held by Italian banks was up 12% this year to 374.58 billion euros in August, The Wall Street Journal reported, citing European Central Bank data, leaving Italian sovereign debt to make up more than 10% of lenders’ total assets.

Why are Italian banks piling into their own government’s bonds? And just when they’re crashing?

A VOX research paper from Daniel Gros has one possible answer. It’s about the idea that “banks should be allowed to buy large amounts of their own sovereign because this way they can stabilise the market in a crisis.” They’re a “buyer of last resort”.

But don’t think the Italian banks are rescuing their national government out of the kindness of their banker hearts.

Traders call this doubling down. Italian banks already own a disastrously high amount of Italian government bonds. So they’re trying to support the price by buying more.

The collapse draws near. Find out how it plays out in my book.

Until next time,

Nick Hubble

Capital & Conflict

Category: Market updates, The End of Europe