Your usual author Boaz is still away, and so today I’ve got a special issue for you.

Earlier this week, a major milestone was reached in Brazil, where a solar power project was auctioned off at the lowest price ever for a power generation project.

That means that solar is now the cheapest form of energy from any technology, ever.

With that in mind, James Allen, our resident Energy Expert has kindly allowed me to pass on his latest research on the subject, usually reserved for his regular subscribers.

Without further ado…

Vanguard 1 is a small spacecraft launched by NASA 61 years ago. It is the oldest satellite still orbiting the earth.

However, its age is not the most remarkable thing about it – not by any stretch.

To my mind that is the following: Vanguard 1 was the first satellite to use solar cell power.

The satellite contained a set of mercury batteries, and a 108.03-MHz Minitrack beacon transmitter, for sending radio signals back to Earth.

The transmitter used six square (roughly 5 cm on a side) solar cells mounted on the body of the satellite for power. The cells were single crystal silicon and produced a total of about 1 watt with 10% efficiency.

I find the fact there were solar panels in space over six decades ago simply astonishing.

Since then, solar power has boomed into a huge industry worth hundreds of billions of dollars.

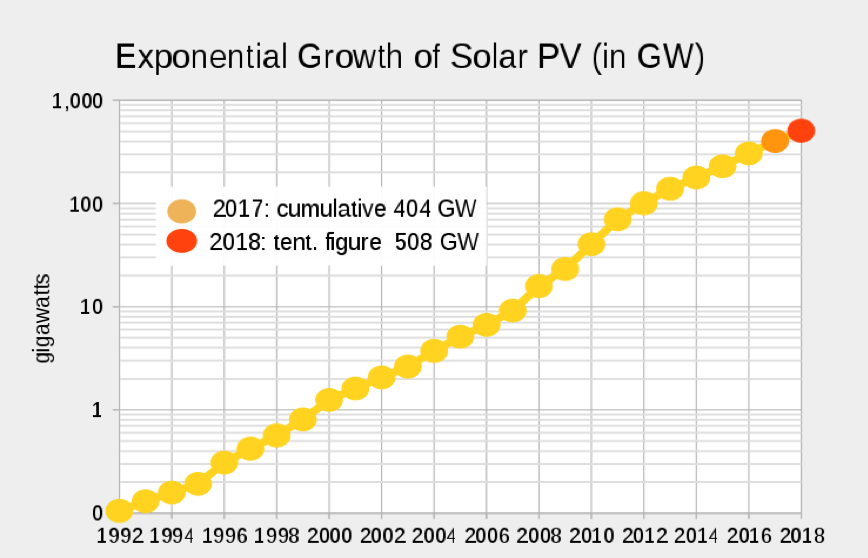

Between 1992 and 2018, global solar installed capacity increased by more than 20% every single year, reaching over 400 GW last year. In fact, 100 GW was added in 2018 alone, which was more than the total historical installed capacity up to 2012.

Exponential growth indeed.

But there’s something you need to know about this growth.

Historically speaking, wealthier, developed nations have led the world on solar energy, investing the most capital and building the most capacity.

That means solar’s exponential growth has been, so far, mainly driven by countries such as the US, Germany, Japan and most recently China.

You might think of this as Round 1 of the great solar boom.

But that is changing.

In fact, the next exponential growth stage will be driven from emerging markets that are only now starting to take advantage of the huge drops in solar panel prices seen over recent years.

Now, countries in emerging markets are ready for their own period of exponential growth. I call this “Round 2”.

Why emerging markets could make solar investors rich for decades

Take a look at the below chart, which shows the exponential growth in solar PV capacity since 1992, which I described above.

This chart is logarithmic, which means that the Y axis increases exponentially, rather than in a linear fashion.

Therefore, if the data shows up as a straight line on a logarithmic chart, it translates to exponential growth in reality.

But let me show you what that looks like on a linear scale, since 2000.

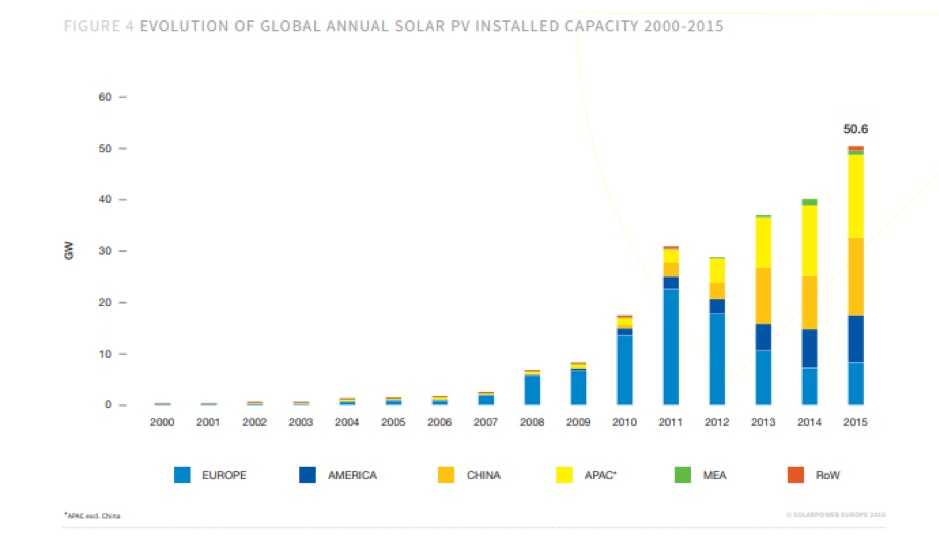

You can see that, apart from 2012, the record for newly installed annual PV capacity has been broken every year since the 1990s.

But you can also see how much of the growth so far has been taken up by developed nations – Europe, America, China and Asia-Pacific.

Bur the picture is changing.

In 2015, for the first time, countries outside the Organisation for Economic Cooperation and Development (OECD) invested more in renewable energy including solar and added more capacity than the 15 OECD countries combined.

This finding comes from the Climatescope report from Bloomberg New Energy Finance (BNEF). It’s an annual snapshot of the state of clean energy in non-OECD countries.

For the last couple of years the report has revealed that renewable-energy investment in non-OECD countries is heading up, whereas investment in developed nations seems to have plateaued.

And solar is leading the surge in non-OECD investment:

Investment in utility-scale solar in Climatescope nations spiked 43% from 2014 to $71.8bn in 2015. Total clean energy investment in Climatescope countries rose $24.8bn with solar accounting for nearly all of that. Photovoltaic (PV) costs are essentially on par with wind and, as recent tenders for power contracts have demonstrated, PV can now out-compete fossil-fuelled projects on price.

Last year, wind and solar generation accounted for just over half of the 186 GW of new power capacity in developing nations, according to BNEF.

Not only that, developing countries again added more clean energy generation than developed economies, increasing zero-carbon capacity by 114 GW compared with about 63 GW in richer countries.

Solar and wind now dominate renewable-energy investment in emerging markets. In fact, of the $11.5 trillion set to be invested in new power generation between 2018 and 2050, over 70%, or USD 250 billion per year, is forecasted to be invested in wind and solar, with the highest growth forecast to come from new markets in Latin America, the Middle East and Southeast Asia, according to BNEF.

This investment will see solar rise from just 2% of the world electricity generation today to 22% in 2050, BNEF predicts. No other electricity source will see such growth.

So why are emerging markets set to drive much of this growth in solar power?

Well that’s all to do with the price of solar PV cells and panels.

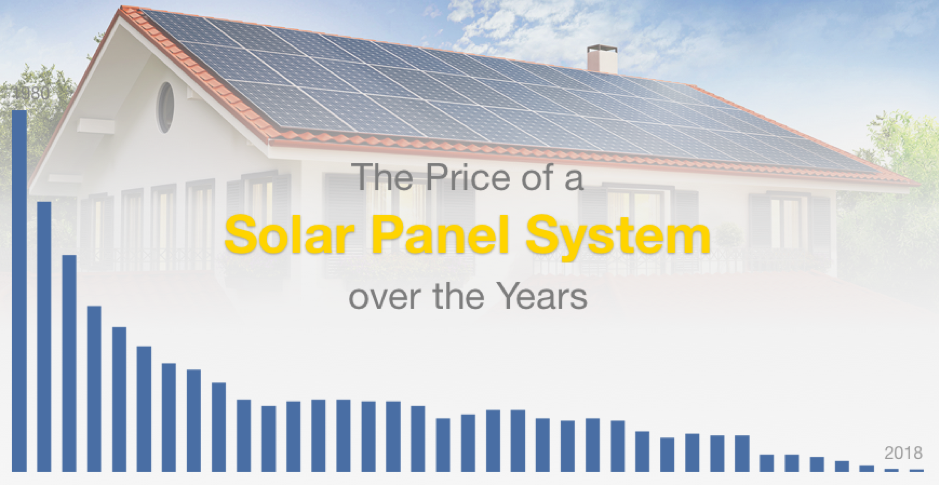

You see, until very recently, solar was relatively expensive, meaning any investor would have to wait a long time to be rewarded for their investment. This was something that advanced economies could justify, but in less developed economies there were more pressing and affordable concerns.

But with huge technological advances and resulting economies of scale, prices have now fallen far enough to bring solar into the financial reach of emerging markets. The cost per watt of solar PV has fallen from around $23.7 in 1980 to under $0.3 in 2018.

Of course, the rapid growth in expected solar capacity in emerging markets is not solely due to falling solar PV costs.

Many developing countries have an abundance of natural resources and lower equipment costs, allowing new renewable projects to become cheaper than fossil plants.

“Just a few years ago, some argued that less developed nations could not, or even should not, expand power generation with zero-carbon sources because these were too expensive,” said Dario Traum, project manager for BNEF Climatescope.

“Today, these countries are leading the charge when it comes to deployment, investment, policy innovation and cost reductions.”

Of course, there is also a major policy tailwind for renewables in emerging markets. According to the United Nations, 1.3 billion people are “energy poor”, lacking access to modern electricity services. The majority of those live in Africa and Asia.

UN Secretary General Ban Ki-moon has made eradicating this figure a priority, within the next 15 years.

“Affordable and reliable modern energy services are essential for alleviating poverty, improving health, and raising living standards,” Ban said in January 2016.

It’s clear, then, that meeting international objectives for reducing energy poverty and keeping pace with development and demographic realities will mean that the vast majority of growth in energy demand will occur in developing countries.

James Allen

Editor, Exponential Energy Fortunes

James does have a specific company that he thinks is perfectly placed to take advantage of round two of the great solar boom.

But that’s for subscribers only…

All the best,

Kit Winder,

Investment Research Analyst, Southbank Investment Research

Category: Market updates