The capital of Cuba likely isn’t the city that springs to mind when you think of a bustling stock exchange.

But on the dusty streets of Old Havana, there’s still one standing there.

The Lonja del Comercio building in Old Havana. Photo taken by Maxim Nedashkovskiy

The Lonja del Comercio building in Old Havana. Photo taken by Maxim Nedashkovskiy

During its heyday a hundred years ago, The Havana Stock Exchange had hundreds of companies listed on it, with traders yelling out prices across the floor in open outcry and scrying the tape for hints of future prices – just like in the market pits of London or New York.

Those days have been and gone of course. The brokers and investors wiped out, not peacefully by computers as they have at the LSE and the NYSE, but fatally by men like Fidel and Che back in the 50s. The decaying Havana Exchange is not home to vast arrays of hyper-fast electronics like its long-lost siblings in the capitals of capital; it’s now a dry and decrepit husk with only offices within.

But technology is as disruptive as the Cuban regime is detached. And there are few trends it can’t disrupt – especially when voluntary exchange, or ‘free trade’ is enabled by it.

Buying Cuban shares became a no-go for investors when the communists began nationalising everything in the early 60s. There wasn’t much in the way of investable Cuban assets after the revolution, unless you’re like me and like investing in cigars. But if you lived across the pond, even cigars were off limits, courtesy of JFK’s embargo (though the man himself made sure he had an ample supply of habanos before cutting all trade ties).

But then the internet came along.

Echoes of wealth in the digital age

The internet has either disrupted, disturbed, or destroyed almost every industry or aspect of life it’s been applied to. Nobel prize-winning Economist Paul Krugman’s claim in the late 90s that by 2005 the impact of the internet would be no greater than that of the fax machine has proved to be utterly incorrect, and Cuba has not been immune to its gravity.

A glance at the popular Revolico.com, a Cuban website for classified ads, reveals the level of ‘professional diversification’ required by many in Cuba to earn a living in a state-run economy:

From the first page of the jobs page on Revolico.com, a Cuban classified ads website.

From the first page of the jobs page on Revolico.com, a Cuban classified ads website.

In its early days the internet brought back a splinter of pre-revolutionary capitalism: the embers of the Havana Stock Exchange. A man by the name of Byron Barksdale, an American who visited Cuba, created the ‘CyberCuba Securities Exchange’ website in 1994.

It was a plain appearing website facilitating the buying and selling of pre-revolution share certificates and bonds, like the kind at the top of this letter issued by the Cuba Railroad Company back in 1937.

They are just certificates of course, with no accompanying ownership rights. For most buyers, they’re just pretty vignettes of a bygone era, but some optimistic investors believe they will be redeemed at face value, plus years of accrued dividends, if a capitalist political regime ever takes over (there are guys buying up pre-communist Chinese bonds for the same reason, but that’s a story for another time).

That bond at the top will cost you €50 by the way. There’s something incredibly ironic about banknotes, bonds, or share certificates that have been printed into extinction, or defaulted upon, becoming collector’s items after their demise – objects gaining value as a result of becoming valueless.

But I digress. While the internet brought about a spiritual revival of the Cuban stockmarket in the mid 90s, it has since done something much more important

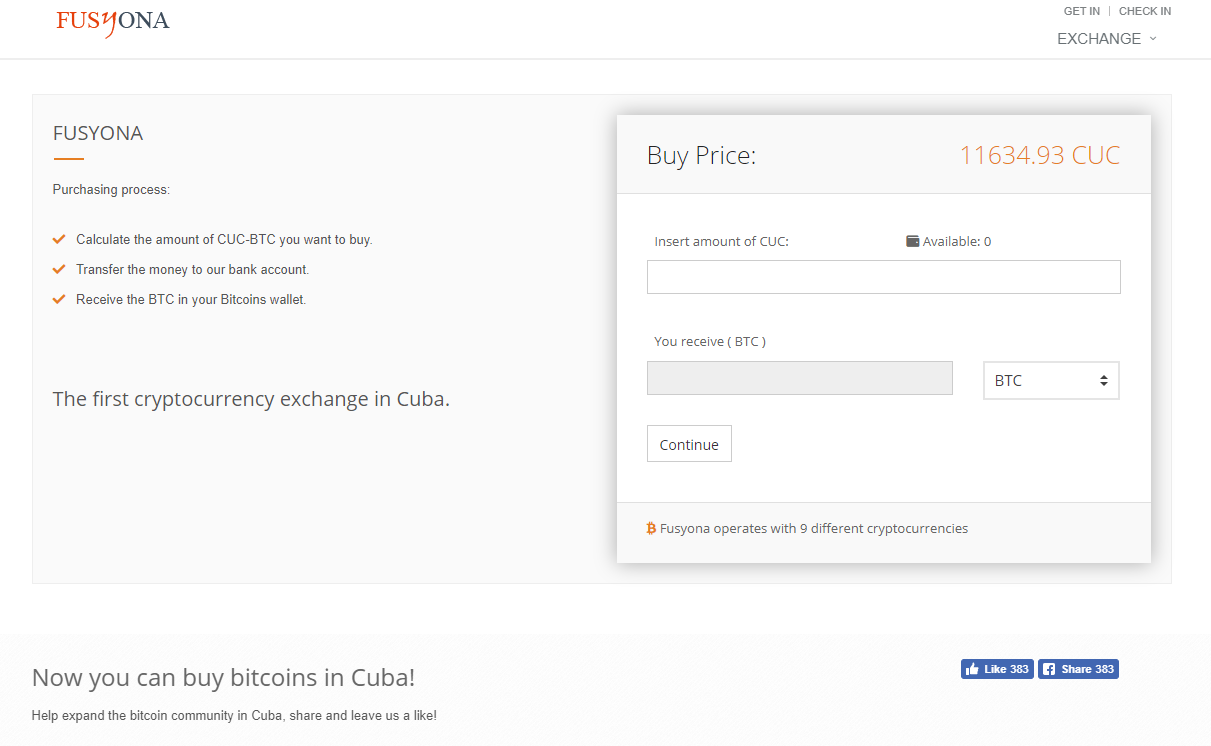

But the internet has brought something much more important to Cuba recently: a new currency, facilitating greater international trade. Enter Fusyona, Cuba’s first crypto exchange…

From Reuters:

The decades-old U.S. trade embargo cuts Cubans off from conventional international payment systems and financial markets. Cubans cannot obtain credit or debit cards for international use on the island and struggle to do so abroad.

So Cubans like Sanchez are buying digital currencies, which are mostly unregulated, decentralized and anonymous, to make purchases online as well as to invest and trade.

“This is really opening new doors for us,” said Sanchez, who uses Bitcoin, the most well known cryptocurrency, to purchase parts not available new in Cuba from an online Chinese store.

Alex Sobrino, founder of the Telegram channel CubaCripto where Cubans debate and trade digital currencies, said he estimated some 10,000 Cubans were using them.

“We are using cryptocurrencies to top up our cellphones, to make purchases online, and there are even people reserving hotel rooms with (it),” said the 33-year-old, who trades crypto as a side gig to his family’s baking business…

In the meantime, the craze is reaching even Cuba’s eastern regions, far from the cosmopolitan capital.

“I hope in the future cryptocurrency will be par for the course for all Cubans,” said Ruslan Concepcion, 27, who lives in the quiet eastern city of Las Tunas and invests in crypto to earn extra income.

Fusyona.com homepage (translated). Note: CUC is the Cuban currency pegged to the dollar on a 1:1 basis, often used by tourists. Cuba’s domestic currency is the CUP and is unpegged. This other, much cheaper currency often goes unnoticed by those visiting, much to their expense.

Fusyona.com homepage (translated). Note: CUC is the Cuban currency pegged to the dollar on a 1:1 basis, often used by tourists. Cuba’s domestic currency is the CUP and is unpegged. This other, much cheaper currency often goes unnoticed by those visiting, much to their expense.

The question of bitcoin’s survival and long term sustainability is often framed as a binary competition between BTC against the dollar and BTC against gold, where only one wins and the other evaporates.

But in reality, for BTC to survive it only needs to be superior to 1 of the 180 fiat currencies currently in existence, starting with the weakest and most prone to abuse and working its way up. Those with grim expectations for Bitcoin are maybe a little too optimistic on the outlook for the Venezuelan Bolivar Soberano, the Sudanese Pound, and the Cuban domestic Peso.

As Andreas Antonopoulos, one of the brightest minds in crypto observed recently:

You think Bitcoin is volatile? Not even close. Most of Sub Saharan Africa would love to have the stability of Bitcoin. If you’re American and you ask ‘Is Bitcoin better than the dollar?’ 99% of people are going to say ‘no’. If you ask a Zimbabwean ‘Is Bitcoin better than the Zimbabwean dollar?’ — goat poo is better than the Zimbabwean dollar.

I know which I’d rather have in my wallet…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates