The global stockmarket (MSCI World index, three-year chart) gets a front-row seat to a viewing of Leonardo DiCaprio’s The Revenant

The global stockmarket (MSCI World index, three-year chart) gets a front-row seat to a viewing of Leonardo DiCaprio’s The Revenant

“Honestly I think every national politician is going to get CV-19. Their lives are a series of meetings like this, and they’re all narcissistic enough to believe it can’t possibly happen to them.”

That’s investor and market commentator Ben Hunt. The meeting he’s referring to is one Ivanka Trump and the Australian minister for home affairs Peter Dutton attended seven days ago. Dutton has since been diagnosed with Covid-19.

Presidents and prime ministers, chairpersons and crown princes alike are all having meetings with their respective Treasury secretaries and central bankers to discuss the impact of the virus on their economies and government-spending remedies.

If the politicos at the top have the virus, and have given it to the monetary elites… then last week’s market crash was but a mischievous kid with a cap gun, while a howitzer is loaded and aimed in the background.

Do any of the risk models and stress tests conducted by financial institutions simulate a pandemic scenario, where the individuals with their hands on the market and currency switches are suddenly incapacitated?

I’m guessing “no”, but then again, I doubt there’d be all that much in price action to simulate. A steep sharp drop, followed by… nothing, when what’s left of the monetary elite shut the exchanges, and declare a bank/market holiday. No getting money in or out, or the execution of any trades. “Do not adjust your brokerage account – order will be restored shortly…”

There are other measures which may well be on the way first of course – even if the money masters haven’t been corona’d. Banning shortselling is an easy one to get out of the gate in a crisis – few will leap to the defence of shortsellers when “Mom and Pop”’s pension schemes are getting “The Revenant treatment”…

The simple bear necessities

It’s a telling move when CNBC, one of the largest financial media companies in existence out there, is asking questions like this:

But investors have got used to so much “bull”, that they’ve forgotten what the growls of the bear even sounds like.

Credit for this conditioning goes in part to Super Mario, of “whatever it takes” fame. The technocrats in Europe should consider bringing the guy out of retirement – when he was in charge, he managed to goose the otherwise abysmal Euro Stoxx 50, pretty high. Here’s the index, with the beginning and end of his stint as European Central Bank president indicated in red:

You may notice that rather long line going straight down on the far right-hand side. Draghi appears to have thrown Christine Lagarde what is known in rugby as a ”hospital pass”.

But the long-awaited fiscal stimulus, the eurozone’s Big Bailout, is coming. The greatest stakeholders in the project, the Germans, are finally loosening their tight fists. On Friday they boldly claimed that no German business will be allowed to fail as a result of the pandemic – ie, If you want some of that sweet bailout money, just say coronavirus is damaging your business.

Perhaps this will be when Deutsche Bank finally gets bailed out. Not overtly, like in 2008 – but through the back door. “It needed the money not through any fault of its own management or inherent dysfunction – t’was the WuFlu wot did it!”

And if the Germans are doing it, all the other members of the euro project must be allowed to as well. As I’ve argued in previous letters, I believe the pandemic will push nations into fiscal stimulus, whether they like it or not. In the eurozone, this may well mean ever-greater fiscal union, whether they like it or not: Lagarde may well push for the creation of the eurobond to finance the reaction. The eurobond, first proposed in 2011 but never implemented, would involve all eurozone countries borrowing together at once rather than individually to meet their own needs.

While the economic shock of the shutdown is inherently deflationary, and threatens to detonate all the unexploded debt ordnance littering the financial system, make no mistake about it: the response being prepared to fight it is deeply inflationary.

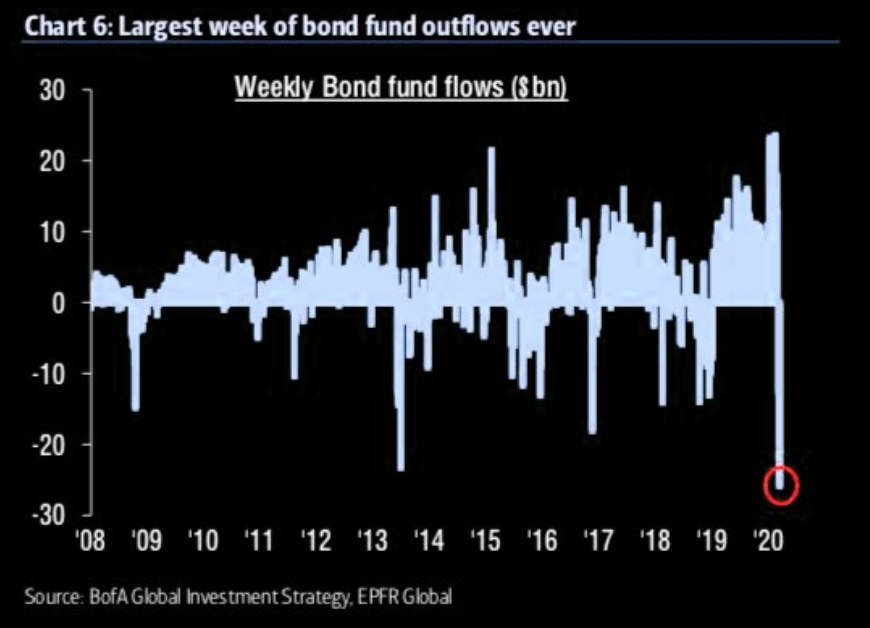

This may be one of the reasons why despite the stockmarket being mauled like DiCaprio in the The Revenant, the assets meant to be a safe haven during such events – bonds – were dumped at a scale last week that has never been seen before:

I say “maybe”. Right now there is a strong lack of liquidity within the financial system which I alluded to on Friday.

What used to be considered a “bear necessity” during a crisis is being ditched just like everything else. The market doesn’t want assets at all right now: it wants currency. Stocks, bonds, gold… it all has to go, because right now there’s a bear at the door demanding greenbacks. The market is not nearly as interested in assets, as it is in currency – specifically, dollars.

I expect a much stronger dollar before this is all over – let’s watch.

But finally, some good news!

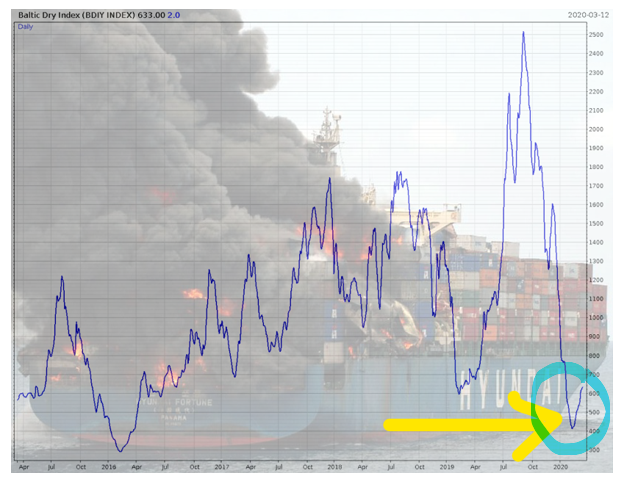

Remember the Baltic Dry Index? It’s a measure of how much freight is being carried across the ocean, and is used as a measure of globalised economic activity.

We wrote about it in early February, commenting on how despite it indicating a massive economic shock, the stockmarket wasn’t paying attention. Well, just as the stockmarket began paying attention, the index has bottomed:

And is slightly higher than its last low at the beginning of 2016. It’s not exactly Christmas for investors, but if this keeps up, it means the global economy isn’t completely out for the count. Just like DiCaprio’s character Glass, it is emerging bloodied but unbroken…

Just a month or so ago, investors were all about green technologies and socially responsible businesses that didn’t create pollution. Every executive and their dog were dying to get their firm rubber-stamped as meeting ESG (environmental, social and corporate governance) standards to please the increasingly politically motivated eyes of investors.

Now, investors hope for increased traffic figures, and cheer for the resumption of emissions from China! How swiftly times change.

Nothing puts things into perspective like a near-death experience, eh?

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates