Well thar she blows again!

A whale has surfaced once more in the bitcoin market – and this time, it’s caused even more of a stir.

Though it’s disturbed the water, I’m not so worried; over the long term the only bitcoin whale to be worried about is no whale at all, but a leviathan, currently sleeping soundly on the seabed…

But before we get to that, a quick recap.

We wrote a couple weeks back about the group of whales (or possibly just one individual) that had suddenly surfaced in the bitcoin market, making two billion-dollar bitcoin transactions within a week (Thar she ₿lows – 13 September).

I speculated that if this was somebody selling a fat sack of bitcoin for a billion dollars, then the deal must have been brokered off-exchange, as the BTC price didn’t appear to have been affected.

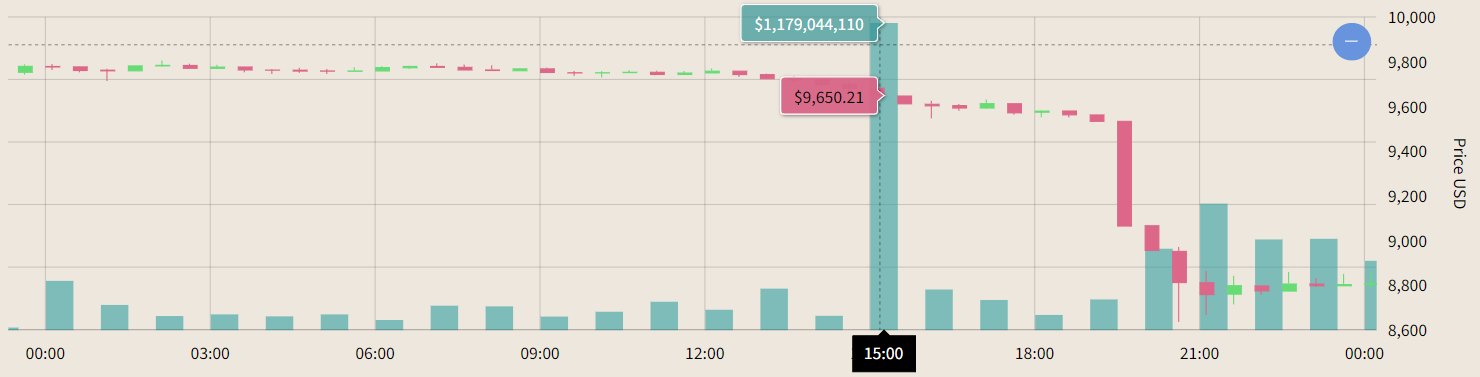

On Tuesday at 3pm however, such a behind the scenes deal between two parties was not arranged. One individual, or a group, sent almost $1.2 billion worth of BTC to multiple crypto exchanges. Then, beginning at 7.30pm, they began dumping the entire stack on the open market.

The whale spouts. Blue bars at the bottom represent the quantity of bitcoin being transferred across the network. The green and red candles indicate the price – note the large red bar which appears after 18:00, following the billion dollar transfer at 15:00. Source: ByteTree

The whale spouts. Blue bars at the bottom represent the quantity of bitcoin being transferred across the network. The green and red candles indicate the price – note the large red bar which appears after 18:00, following the billion dollar transfer at 15:00. Source: ByteTree

This hoovered up a lot of liquidity in the market, and the BTC price has since taken a beating, losing more than 10% of its value in short order.

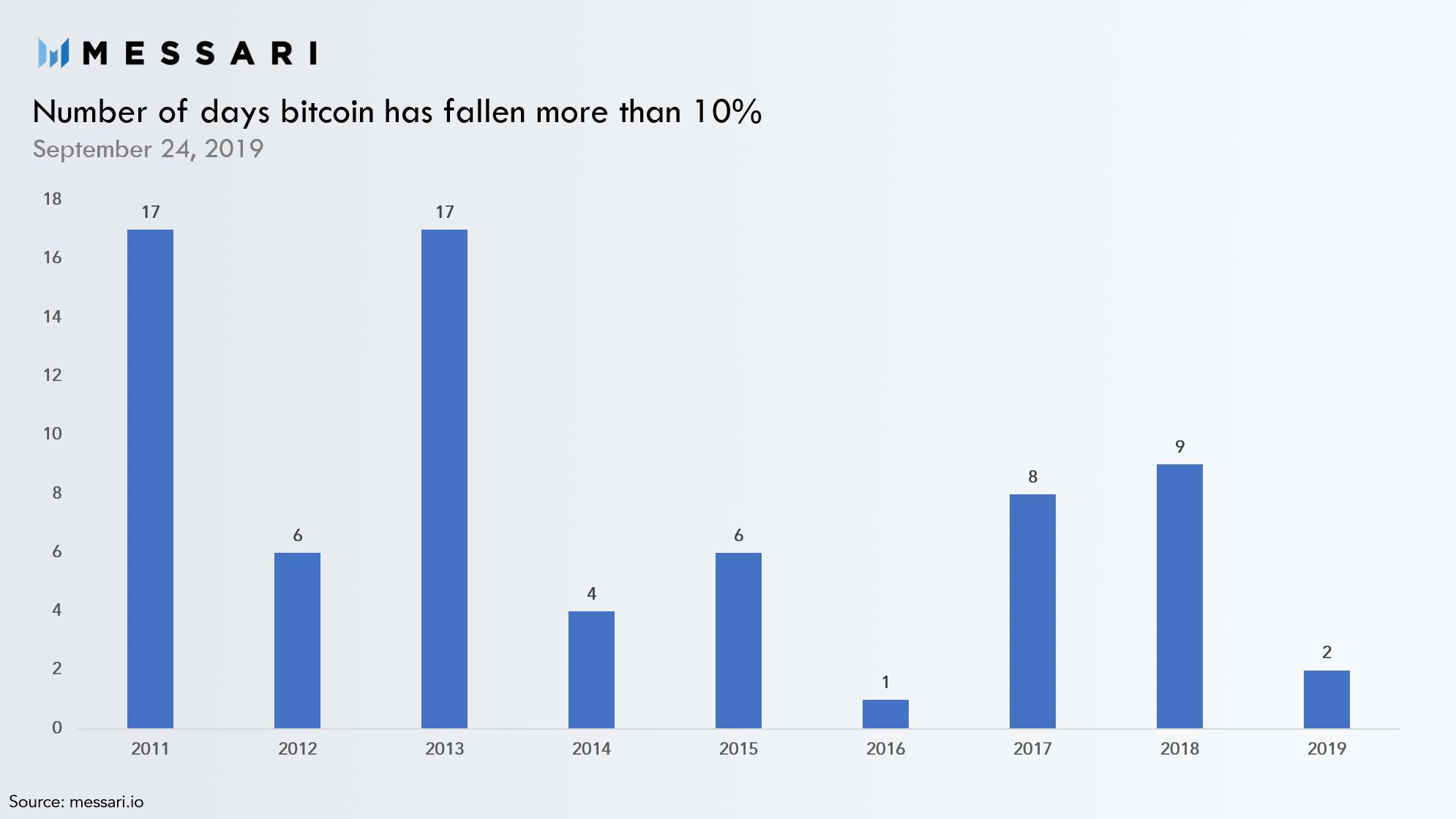

If you’re new to crypto, this may seem brutally volatile. But if you’ve been in the space for a while, Tuesday was just another of “those days”, the second we’ve had this year.

Believe it or not, 2019 has been remarkably stable for BTC, as this table for crypto analytics firm Messari shows:

In a fittingly strange twist for crypto, while 2016 was a year of great upheaval in many regards, for BTC it was positively serene. Chart courtesy of messari.io

In a fittingly strange twist for crypto, while 2016 was a year of great upheaval in many regards, for BTC it was positively serene. Chart courtesy of messari.io

Bitcoin whales, as far as I’m concerned, are much like real whales: benign most of the time, but with the potential to do damage as a result of their size.

If somebody out there has just made a billion bucks, after many years of “hodling” their BTC, I wish them well. It’s highly unlikely the impact they made with their exit will last, and the BTC community will take it on the chin as they always have, and carry on with it.

The only bitcoin “whale” I think merits inclusion in a long-term perspective on BTC is the mother of all crypto whales, more leviathan than anything else: Satoshi Nakamoto. The pseudonymous creator of BTC controls a monstrous ₿980,000 stack, earned when he was the only bitcoin miner for a year.

That’s about $8.5 billion dollars at current market prices. If he decided to dump that on the market, that would no doubt act hammer the BTC price purely from the selling pressure, but its effect would be much more damaging than that.

For Satoshi to sell their BTC would be like the founder of a company selling their shares, but much more destructive. It would give off all manner of negative signals – they think the price is too high, or that they’d found a fundamental error in the code, that the project after years of trying had failed to become a genuine “peer-to-peer electronic cash system” as outlined in the white paper.

Satoshi’s hoard, stored in thousands of bitcoin wallets, is watched closely by bitcoiners for any sign of life – as it’s on a public blockchain, anyone can monitor it. If BTC started leaving those wallets and heading to those of an exchange, this would immediately cause alarm – the market leviathan awakening. This alarm would then escalate, I reckon, into swift and severe selling (imagine the irony if Satoshi’s BTC was sold through the crypto exchange called Kraken…).

However, such apocalyptic days have not occurred, and if Satoshi wanted to sell, they missed their moment in late 2017 – arguably, making a profit from this thing is not on their near-term agenda.

I spoke to Sam Volkering about this over beer the other day – he reckons that Satoshi has actually died, and the keys to his hoard lost forever (I’ll get him to explain that theory to you sometime).

I’m open to the idea that Satoshi deliberately destroyed the private keys to his stash to ensure the above never happens, and mined BTC anonymously with a fresh slate when others joined in – but this is pure speculation on my part (something you kinda have to do in crypto, funnily enough).

Whatever the case, for now, the leviathan sleeps. And for the sake of the BTC community, long may it continue.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates