If the US stock and bond markets were to close for the year today, it would be the first time in over 40 years that both assets ended the year in the red.

There’s a few weeks in December yet, but time is ticking on a belief that has driven trillions of pounds of investor capital: that when stocks go down, bonds go up, and vice versa.

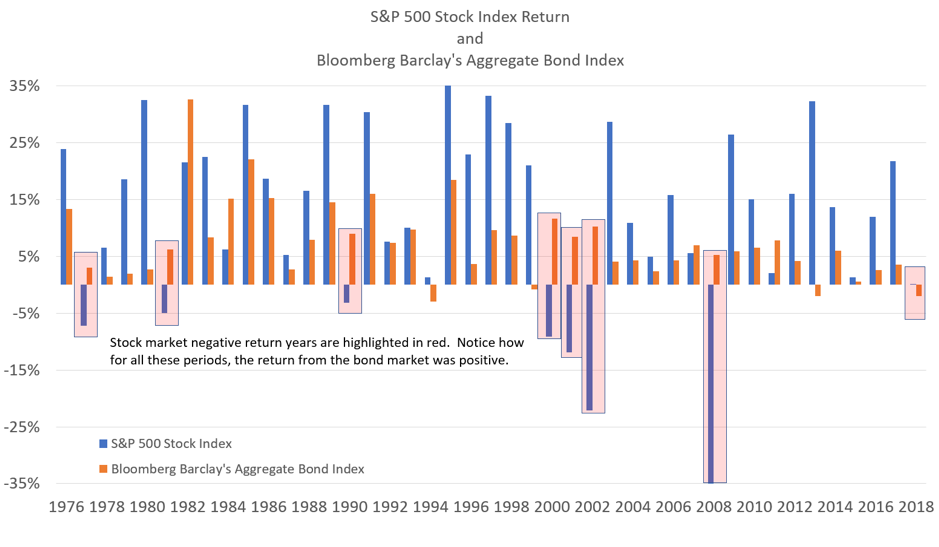

As this chart courtesy of East West Investment Management illustrates, all of the really bad years for stocks in recent history have been good years for bonds. And there hasn’t been a year in recent history when both stocks and bonds ended the year in the red… until now.

Source: East West Investment Management (click to enlarge)

In yesterday’s letter we focused on how February’s flash crash revealed that when push comes to shove and stocks plummet, bonds cannot be relied upon as a safe haven – “the safety is off”. A similar dynamic played out at the beginning of Bloody October, and if the year closes with both stocks and bonds in the red, then that’s further confirmation that deep change is underway in financial market behaviour.

Many years ago I watched a TV series called Lovejoy, about a roguish antiques dealer played by Ian McShane who ends up in all kinds of different scrapes in pursuit of rare artefacts. In one episode, called “The Judas Pair”, the plot revolves around a pair of duelling pistols made by a famous renaissance gunsmith for a nobleman. At the climax of the episode, Lovejoy discovers that the pistols are designed to kill whoever fires them, where the bullet fires backwards through a hidden socket into the eye of the person aiming it. The nobleman could win every duel without firing a shot if his opponent used one of his “Judas Pair”.

I’ve a hunch that passive investors owning bonds to hedge their stocks, and stocks to hedge their bonds are holding a similar “Judas Pair”, which will similarly betray them in the next crisis.

But if bonds still yield next to nothing, and cannot be relied upon as a safe haven… why own them?

The number of traders and asset managers who were working in financial markets when both assets fell in unison is miniscule. If neither stocks nor bonds manage to rally into the New Year, we will have entered a new environment that nobody in the financial services industry has experience in – a “Brave New World”, which will require brave new ways of thinking and even braver calls.

A speculator’s paradise now

Speaking of brave, my colleague Eoin Treacy has recently begun hunting down stocks to short… while at the same time expecting a “melt-up” in the stockmarket as a whole. It’s a seemingly contradictory position, but I can explain how it works.

Parts of the US yield curve have just inverted, due to bond traders selling short-dated bonds and buying long-dated bonds. In some cases it’s now cheaper to borrow over the long term than the short term. The inversion of the yield curve has traditionally implied a US recession is on the way, as bond traders supposedly have a better grasp of the US economy’s pulse than anyone else:

As a trader who cut his eye-teeth in the equity market, I can tell you unequivocally, bond traders are smarter. They just are. Denying it is like trying to argue that people in Malibu are no better looking than any other big U.S. suburb. So when the yield curve starts inverting, you better believe I am paying attention.

– Kevin Muir, trader and portfolio manager

I’ve not been to Malibu, so I can’t comment on that. But as I discussed with Brent Johnson a while ago on The Gold Podcast, even if there is a recession on the way for the US economy, that doesn’t mean that financial asset prices can’t go crazy in the meantime. For if it becomes cheaper to borrow over the long term than over the short term… speculators can “borrow long and invest short”, or take out a loan with a repayment date ages away at low interest, and invest it in the short term at higher interest. With this “speculator’s paradise” in mind, a melt-up in asset prices becomes more plausible.

But stocks are gonna need a serious amount of gas if they’re to recover. The vanguard of the bull market, the FANG stocks – Facebook, Apple, Netflix and Google – seems to be splintering:

The NYFANG index contains the FANG stocks, as well as other big technology companies like Nvidia and Alibaba

Strategies that were “short vol” – like the XIV we mentioned yesterday, which bet on market volatility staying low – were eviscerated in February, and have yet to recover:

And around the same time, it seems the “smart money” left the market:

The smart money index is based on the idea that emotional traders will buy or sell in the morning as soon as they enter the market, while the more experienced, rational and steady hands at the wheel will place their trades later on, after evaluating market sentiment for the day. To figure out what these “smarter” traders are up to, it measures the evening price trend while ignoring the morning price trend.

As you can see above, the “smart money” has been taking its chips off the table with both hands since the beginning of the year; Eoin should be able to find many companies to short in this environment.

Something tells me we’re in the “gloaming” of this great bull market: the period immediately after sunset.

Have a great weekend,

Boaz Shoshan

Editor, Southbank Investment Research

Category: Market updates