Well here we are [%= :subscriberName(D,Reader) %], Friday again.

It doesn’t feel like a week has passed since I was writing to you last Friday. Though longer or shorter, I can’t tell – isolation has made my perception of time rather blurry.

But it’s been a momentous week. As we described yesterday, we’ve seen the arrival of negative interest rates in the gilt market (UK government debt). If that phenomenon spreads widely throughout the gilt market and stays there, we’re going to see the monetary corruption of negative interest rates come to our banks.

And spread it has since yesterday’s note – the interest rates on loans to Her Majesty’s government for 2yrs through to 6yrs are now negative. Good for gold, bad for everything else…

Something else occurred earlier this week that’s worthy of your attention: the Germans and the French teamed up to propose doling out half a trillion euro to eurozone members needing WuFlu assistance. While a mere half trillion may sound almost paltry relative to the other sizes of cheques politicians are bandying around these days, what’s important in this case is less the figure itself, but the manner in which it will be paid.

The proposal is that the EU itself will borrow the money to do it, and then distribute it to the nations that need it. Paying off that debt would come out of the EU’s budget, which of course Germany is the largest contributor, so this would be something of a wealth transfer from Germany to the southern European nations – an indicator that the Germans are more committed to using their cheque book to ensure survival of the euro system.

While the EU has borrowed money in the past, it hasn’t done so on anything like this scale before. If this plan is approved and implemented, we get much closer to the great centralisation of power that the European Project ultimately represents. Giving the EU Commission the autonomy to borrow vast sums of money and distribute it amongst member states is a step closer to the full fiscal integration of a Federalised Europe, where money is borrowed collectively and distributed from the top of the technocracy down.

We’re a way off the plan being implemented yet – the frugal nations are already objecting, and there is debate over whether the distributions to the southern states would be grants or loans. The plan is of course being framed as a temporary strategy to deal with the unprecedented nature of the WuFlu crisis – but as Milton Friedman so rightly said, there’s nothing so permanent as a temporary government programme.

It would be fitting and, indeed, rather funny if the European Central Bank ends up printing the money required for this project. It’s not like it’s running out of inkjet cartridges, as you’ll see in this next chart.

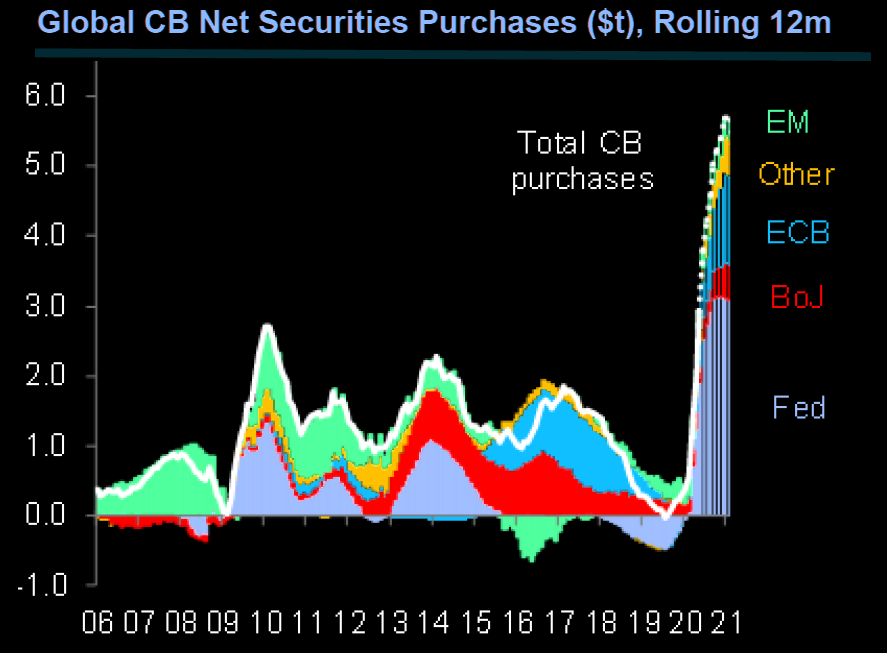

Have you seen Nessie yet? She’s wriggled out of her Loch and surfaced in the balance sheets of the world’s central banks:

That’s almost five trillion pounds’ worth of money that’s been injected into the global financial system. Another strong force for gold, but once the global economy starts recovering, it’ll go into other assets as well…

Gilded green cages

I’ve ventured outside to write this to break up my routine somewhat. I’m sitting in what’s called a “garden square” on my street, a type of private park I didn’t know existed until I came to London. The buildings were built with the square in mind, and so it is enclosed on all sides by buildings facing in.

Kensington is littered with dozens of them – residents pay a deposit to get a key, and the landscaping maintenance comes out of council tax. Strict social distancing rules apply of course, and parents and irritable loungers are constantly reminding the kids running around about it.

It’s a beautiful little rectangle of greenery in the middle of London, kept vaulted in a cage of tall railings and an electronic locking gate. It’s like a drop of amber enclosed in a steel pendant, hanging across the neck of the London property market.

As pleasant as it is, when I think of the rising wealth inequality in the developed world, I think of gilded enclosures like this one. You can only get in here if you can afford to buy or rent on the four surrounding streets. As central banks have worked tirelessly to increase the price of assets around the world, the price of access to this area has soared, not due to the splendour of its appearance, but from the price of money being artificially lowered. Those located closest to the printing press gain the most from its usage, and so it is here in London and in other capital cities around the world.

Ben Bernanke openly described his strategy as chairman of the Federal Reserve as pursuing “the wealth effect”, where deliberately giving asset owners the feeling of being wealthier through money printing would make them likelier to spend more money, thus stimulating the economy.

This strategy inherently favours the owners of assets over those who do not – the rich over the poor. And yet central bankers to this day refuse to accept any responsibility for increasing wealth inequality. Go figure.

With the policies that brought us here now being rolled out in the extreme (as you can see with Nessie), the trend of wealth inequality is set to continue. But there are political consequences for doing this which we have only witnessed the beginning of.

I expect we’ll see an awful lot more styles of gilded enclosure in the future, but with an awful lot more visibility attached to them – a steadily more obvious divide between those with assets and those without. You can imagine how outrage culture could feed on such visible divides like the railings and perimeters of these little rectangles of greenery in the metropolis.

I took a bike ride the other day to get out of my wee flat for a little while, and explore London some more. Every trip I become more in awe of just how utterly gigantic the property market here is – and just how expensive all that central bank money has made it.

Passing a number of other garden squares on my ride, I discovered one which has its own church in the middle of it. It wasn’t a rectangular garden but an oval, with a road of great white buildings encircling it.

As I peered through the railings as I cycled past, it was like a scene from A Room with a View: families lounging on the green grass all dressed in white, wearing fine hats. The sound of children laughing and playing lingered in the air as I breezed by. I almost felt a sense of déjà vu. This was what I had imagined English wealth looked like when I was a child.

I asked my girlfriend to take a peek at the properties on sale in the area when I returned home. None of those around the garden square were on the market, but some in the vicinity were. Two-bedroom flat? That’ll be 16 million quid, sir. Cash or card?

Wishing you a good weekend,

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Category: Market updates