If you saved $10,000 (£7,600) a day…

… every day…

… since the pyramids in Egypt were constructed…

… you would now have one fifth the average wealth…

… of the world’s five wealthiest people.

So says a report called “Time to care” by Oxfam, released just on time to attack the Davos crowd, revealing the extremes of global wealth disparity.

Just over the few years I have been watching Davos, the perception of the event has transformed hugely – from a cloister of intellectual technocracy to an annual celebration of virtue signalling and champagne socialism by billionaires.

Davos satire has become a niche of its own:

The CEO of Goldman Sachs, pictured centre, moonlights often as a DJ

The CEO of Goldman Sachs, pictured centre, moonlights often as a DJ

Source: @litquidity on Twitter

Source: @TheDavosMan on Twitter

Source: @TheDavosMan on Twitter

Each year it seems the mockery of Davos grows stronger. The masses become more aware of the farce.

But to go back to Oxfam’s report, if you were intent on stashing away cash for thousands of years like in the above sample, you wouldn’t use a paper currency. Good luck on preserving your purchasing power for 50 years with a stash of fiat pounds or dollars, let alone millennia.

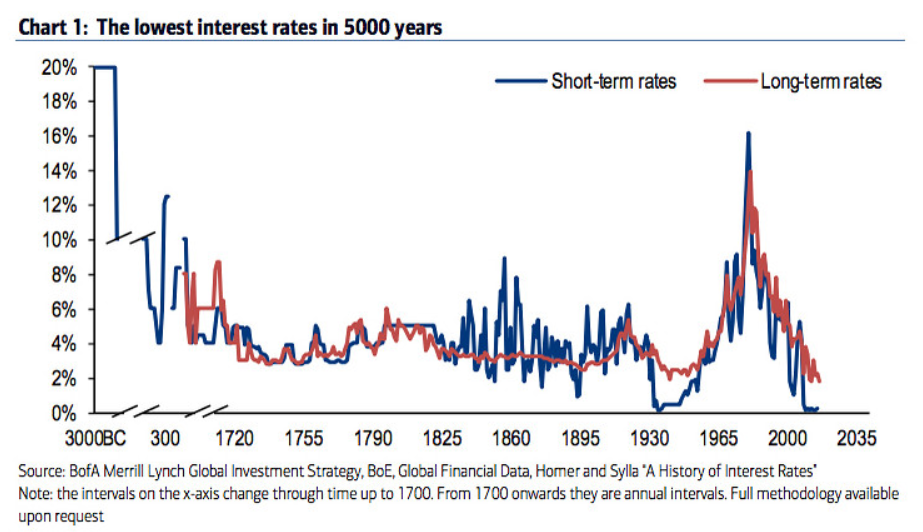

And of course, if you were going to survive for thousands of years… surely you would want some interest on you deposits?

Interest rates were much higher when the pyramids had just been built (around 2500 BC, though I know this is hotly contested):

This supernatural individual and his daily deposits, would have beaten all five of the wealthiest folks in the world today, hundreds of years faster, with a little interest rate on his side.

I’m being a little flippant, as the Oxfam report is simply highlighting how extreme the gap between rich and poor has become. As we wrote yesterday, the antics of Boeing is a case in point of corporations having “maladjusted” to an era where debt doesn’t matter any more, until it does.

But at the same time, I think it’s worth dwelling upon interest rates. The magic of compound interest, which Albert Einstein described as the eighth wonder of the world is seldom given the recognition it deserves these days. This is probably because so few people can marvel at its incredible power in their bank account now we’re in a world of low interest rates. But the very wealthy can still harness its incredible power – which I believe to be a key driver behind the wealth inequality that Oxfam is railing against.

Richard Russell illustrated this forgotten power over 40 years ago in his well-known piece “Rich Man, Poor Man”.

To be clear, it was written for Americans so exchange the term “IRA” for “pension fund” or “ISA” (emphasis added):

In this study we assume that investor (B) opens an IRA at age 19.

For seven consecutive periods he puts $2,000 in his IRA at an average growth rate of 10% (7% interest plus growth). After seven years this fellow makes NO MORE contributions — he’s finished.

A second investor (A) makes no contributions until age 26 (this is the age when investor B was finished with his contributions). Then A continues faithfully to contribute $2,000 every year until he’s 65 (at the same theoretical 10% rate).

Now study the incredible results. B, who made his contributions earlier and who made only seven contributions, ends up with MORE money than A, who made 40 contributions but at a LATER TIME. The difference in the two is that B had seven more early years of compounding than A. Those seven early years were worth more than all of A’s 33 additional contributions.

It says a lot about 1997 that 10% growth rates were normal, expected, and could be used for such an example. However, it does show the incredible power that interest can do when left alone, undisturbed by taxes.

While interest rates have been depressed all around the globe, the very wealthy have been able to avoid tax on the little interest that can be earned. They’re also much more likely to be invested in stocks, the interest (dividends) again not taxed, leading to an ever larger compounding portfolio.

This lack of access to the eighth wonder of the world, while the elite have continued to enjoy its fruits, is a story that is not often said. But contributes to figures like this, from Market Crumbs:

The world’s billionaires—2,153 of them, have more combined wealth than 4.6 billion people. Narrowing the concentration down to the world’s wealthiest 1% shows they hold more combined wealth than 6.9 billion people. For context, the global population is currently estimated to be close to 7.8 billion people, with nearly half of them living on $5.50 per day, according to the World Bank.

While the Davosians have managed to harness this power for themselves, it has come at a cost – wealth itself is becoming a badge of shame…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates