Today’s edition of 20/20 Vision comes from our trend following experts Robin Griffiths and Rashpal Sohan.

They use a rules-based model to make investment decisions, taking the guesswork and human error out of the mix.

Instead of a Q&A format, Robin and Rashpal focused on answering the questions you, the readers, emailed in.

But before you dig in, don’t forget to check out

Can you guess how much it is?

Best wishes,

Nick Hubble

Editor, Southbank Investment Research

20/20 Vision

With Robin Griffiths and Rashpal Sohan

This is an attempt to answer some of the questions raised by our readers. There are a number that are beyond our scope of expertise. For this reason, we have stuck to those areas which fit with the work that we do and feel more confident in our response.

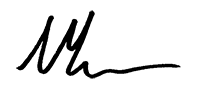

Looking into the future, we see far more economic growth arising from Asia than the Western world. Demographics will partly drive this trend. The post-WW2 baby boomers are now slowing down and dying off. They dominate Western economies. The next big generation has been born and will also drive a boom but they are too young at present

(Figure 1).

Meanwhile, China and India simply want to catch up with what the West takes for granted. They are on the way. These economies have populations at least five times larger than the biggest in the West. Prepare to live in a world influenced more by Asian culture and thinking.

Figure 1: Demographic trends are negative for the West (US) but will improve after 2023

Source: Southbank Investment Research, ECU Group, Dent Research

Source: Southbank Investment Research, ECU Group, Dent Research

Our investment process does not require us to forecast major economic changes. Our Dynamic Investment Trends Model (ALPH4) model adapts quickly enough to major changes and as a result we do not have to anticipate them. The algorithms are the secret sauce.

It is true that something called a “Grand Super Cycle correction” is probably going to occur at some point. When it does, surviving intact will be a significant outcome. However, this has been a plausible scenario for the past 20 years and many have been caught out trying to anticipate it for that long.

It has recently been looking as though it might come in early 2020, however, now seems unlikely to arrive before late 2021. Governments know about this and are trying all that they can to delay the inevitable outcome. They have been winning until now, and are determined to carry on.

When Mr. Bill Gross, the bond guru, used to write about what is labelled the “old normal”, a Great Crash was expected. However, governments and central bankers altered the scenario by printing money and lots of it. Thus, in the “new normal” governments must continue to expand their balance sheets and print even more money to keep growth going. Eventually, this will stop – but we see no sign of the top just yet.

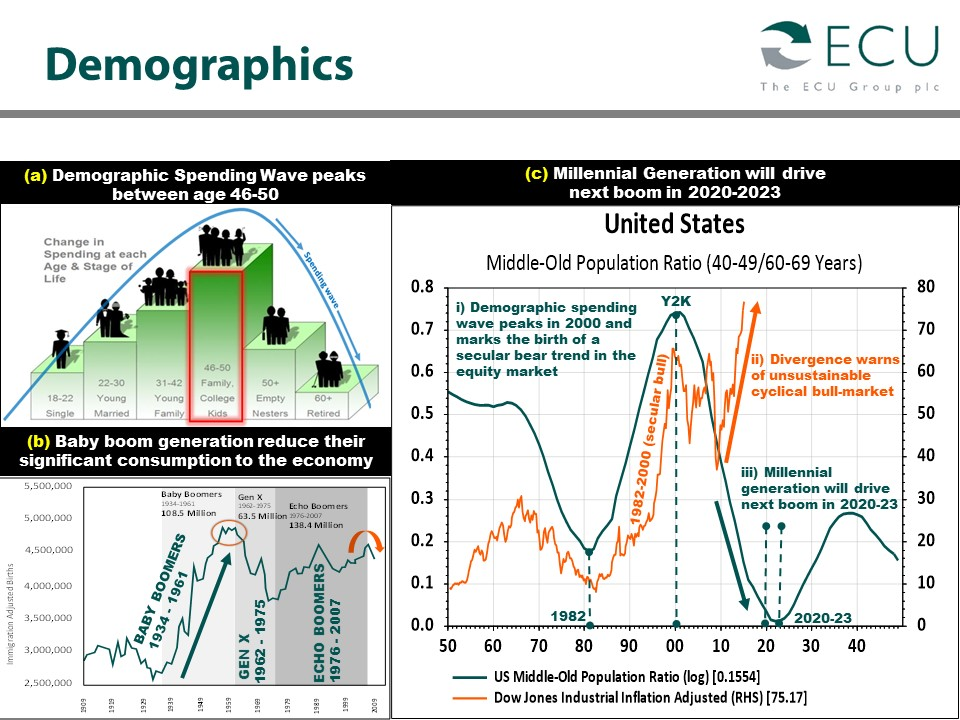

Our model is set to be dynamic and change reasonably quickly, however it cannot adapt to a market crash like 1987 (Figure 2). They are also a little vulnerable if trends just go sideways with no action. If we got a crash soon, then a hit would be felt.

If we were to go into conditions so bad that it was impossible to deal, then we would also get caught out. Such changes are very rare. Even during wars huge markets usually operate. To an investor who can’t predict such times accurately, wide diversification of risks into many asset classes is a survival strategy. It is an ill wind that blows nobody and good. If the change takes place at a more normal speed – as in 2008 – then our model has time to adjust and makes some money.

Figure 2: The ALPH4 model is adaptive and responds fairly quickly to changing trends but it cannot protect against an instantaneous market crash like 1987

Source: Southbank Investment Research, Refinitiv Datastream

Source: Southbank Investment Research, Refinitiv Datastream

Our model is currently out of commodities. Gold is the only real exception. It is behaving more like money than a metal. On balance, we would prefer to stay with a global portfolio of diversified equities and use geography as a risk spreader.

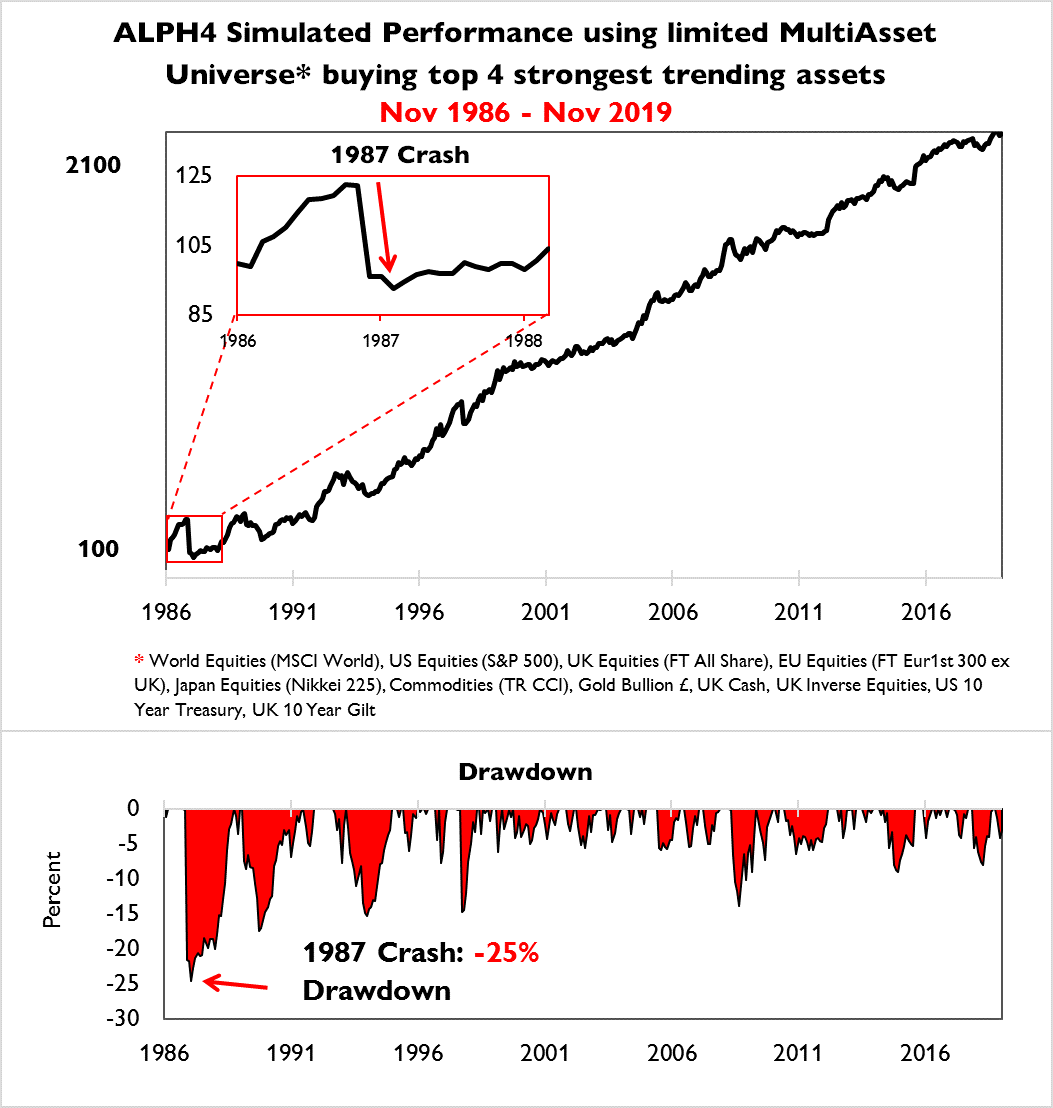

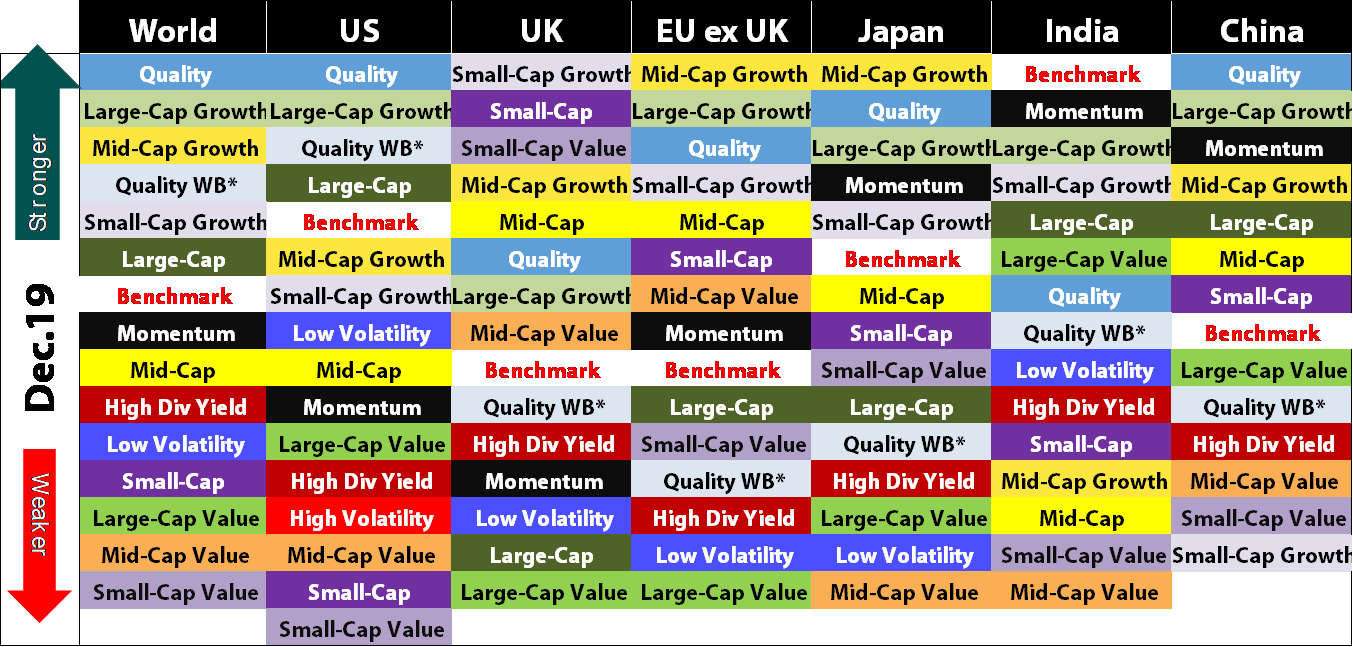

Some styles of investment are held out to be strong in absolute terms. Value investing is one. However, we can show that the value style of investing has no absolute merit. It is a style that comes and goes in fashion (Figure 3). In the past 50 years it has only ever worked three times. Mr Warren Buffett was told by his partner to pay up or he would not deal enough.

When we rank the many different styles in order, across all world markets, we can see value working better in some, but not all areas (Figure 4). We can also see that since the global financial crisis it has been a total failure (Figure 3). Its time will come again, but not just yet.

Figure 3: The Value style of investing is not an all-weather style of investing but rather comes and goes in fashion

Source: Southbank Investment Research, Refinitiv Datastream

Source: Southbank Investment Research, Refinitiv Datastream

Figure 4: The value style of investing is still ranked as weak globally compared to other styles of investing

Source: Southbank Investment Research, Refinitiv Datastream

Source: Southbank Investment Research, Refinitiv Datastream

Looking forward, we think the era of prudence has ended and now a magic money tree will be put in place by whoever wins the UK election. This may not cause inflation but growth will be in proportion to the money printed. This is part of the “new normal”.

We don’t think growth in Asia will stop. We also expect a lot of new technology to enter our lives. Robots are top of the list plus gadgets to keep us healthy and quantify our wellbeing. Cars go electric and bicycles, eventually airplanes will follow. The world must clean up its act as the alternative is too drastic.

Taxes will have to rise and most governments will become more socialist even if they are called Tory. In the US, a Donald Trump re-election is positive for the stockmarket. Attempts to get rid of him are negative.

Markets can handle change, even rapid change. However, they don’t like uncertainty or super-rapid moves. The bottom line is that most of the things people worry about hardly ever culminate, but they would be horrible if they did occur. Meanwhile, our model says keep investing and put more risk on now. Don’t go the other way.

We wish you all a Merry Christmas.

Robin and Rashpal.

Category: Market updates