We had long feared they would come.

Watching the monetary corruption spread across foreign lands for so many years now, I guess we all knew, deep down, that they would arrive on British shores eventually.

I had hoped we would persevere for longer before our defences were broken…

But negative interest rates have arrived in our green and pleasant land.

Yesterday, for the first time in our nation’s history, Her Majesty’s Treasury was paid to borrow money by the market.

Now to be clear, the battle sure ain’t over – as we’ll explore, it was only in one particular type of loan that the negative rate was paid. But the barricades have been breached. If negative rates spread through the gilt (government debt) market, it’s only a matter of time before those rates bleed into our banking system, as banks use gilts as a base from which to lend. Once gilts yield nothing or less, it becomes much harder for banks to earn any risk-free interest, and thus the likelihood of depositors being charged a negative rate to make up for it increases.

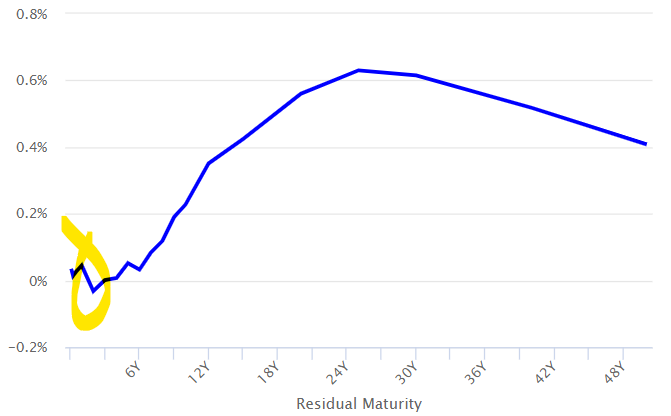

Here’s where it all happened. This is the yield curve for the UK Treasury – it shows you what interest rate the world is charging our government to borrow money (displayed on the left), over the very short term and all the way out to 50 years (number of years displayed on the bottom):

Source: World Government Bonds

Source: World Government Bonds

While you might expect that the market would always demand a higher interest rate for a longer duration loan, this isn’t the case and you can see that the market is demanding a higher interest rate from the Treasury for a 30-year loan than a 50-year loan.

This is because the market is trying to price future inflation expectations, the health of the government’s finances, and the value of future income payments themselves all at once into the market, and for whatever reason, three decades’ time feels riskier than five decades’ time (a topic for another letter perhaps).

But look to where I’ve highlighted on the chart. This is where it happened, where the government borrowed at a negative interest rate. It wasn’t deeply negative, sure – as you can see, the chart only went slightly below zero. But the act of one market participant bidding more than the government’s debt will be repaid for, doesn’t bode well. Just take a look at what’s now going on in Germany.

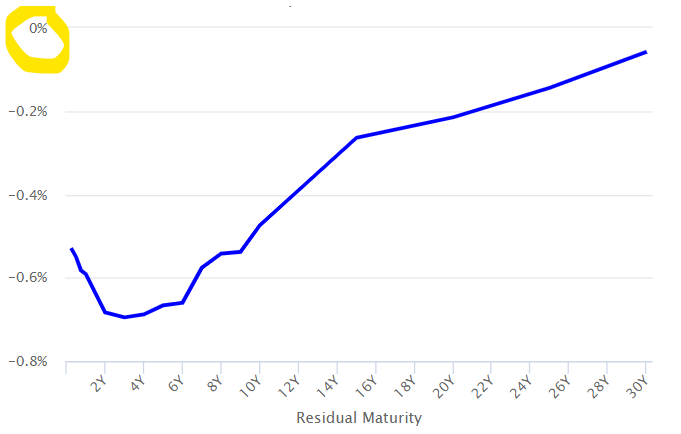

As I say, the battle over negative rates here in the UK has only just begun. In countries like Germany, the war is lost: take a look at its yield curve, the entire thing is underwater!

Source: World Government Bonds

Source: World Government Bonds

That’s right – the German government can borrow money for 30 years, and not only pay nothing, but be paid for the privilege. You might wonder why when the market is offering it such terms, it is not rinsing the market for everything that it’s worth, but Germans have some rather strong feelings about borrowing money, even if they’re being paid to do it.

But forget the German government’s attitude towards debt for a moment, and imagine what happens to the German banking system when the base interest rate that it can earn on lending is below zero. There’s only two German banks that are still publicly listed – Commerzbank ($CBK) and Deutsche Bank ($DB) – the rest have all been nationalised or gone broke. And the stocks of those two are trading at or near all-time lows.

The bar by which negative interest rates are passed on to consumers just keeps on getting lower in Germany. Deutsche will charge negative interest on deposits over €100,000 now, and good luck earning any interest below that. I expect that minimum level to be reduced in due course, as I don’t see how the situation is going to get any better for Germany’s banks.

What’s interesting however is how the banks, dying to make a loan of any kind, have begun passing the negative rates on to borrowers as well. While the German government may not want to borrow at negative rates, the banks reckon the average German does. German lenders are willing to bleed on the lending side giving negative rate loans… provided somebody else is lending to them at an even more negative rate. It’s absurd – but that’s the eurozone for you.

From Reuters:

Germans are being shown the bright side of negative interest rates as some online lending platforms pay customers to borrow despite the steepest recession since World War Two.

The European Central Bank’s sub-zero rates on bank deposits have long been a source of complaint for German households, who have seen dwindling returns from their savings despite being among the most thrifty and debt-shy in Europe.

But there could be a silver lining for those in need of cash after the coronavirus pandemic shuttered many shops, businesses and factories – or those who want to avoid bank branches as they observe social distancing rules.

Price-comparison websites Smava and Check 24 are marketing two-year loans at an annual interest of -0.4% – meaning borrowers would pay back less than they took out.

With each loan capped at 1,000 euros ($1,100), this is partly a gimmick by the two portals, which compensate the banks that originate the negative-rate credits.

But it also shows one way in which the ECB’s ultra-easy policy is trickling down from financial markets down to consumers – albeit only to those with strong credit scores.

As I say, negative rates have only just landed ashore in this country – we’ve not been defeated like Germany has. The negative rate beachhead remains just a beachhead – but the longer negative interest rates stay on our shores, the risk that they spread throughout our banking system grows. Now this initial advance has been made, I fear we won’t see a retreat any time soon…

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates