It’s Kit again.

This week I’ve written to you a lot about volatility.

There is one thing from Tuesday’s article that I want to tease out a bit further.

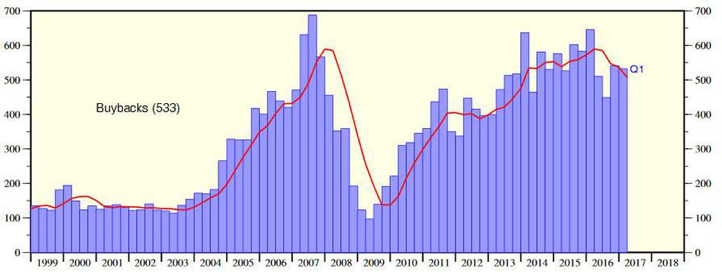

Corporate share buybacks, and debt.

Last year, corporate share buybacks rose an incredible 48%.

Why do they do this? Supposedly to return value to shareholders. If you own 100 out of 1000 shares, you own 10% of the company. If the company buys back shares for a few years, that could become 100 out of 700, which is over 14%. When you didn’t even buy any more. This entitles you to a greater share of the profits of the company.

That’s how earnings per share rises as companies buy back shares. The amount of the company earns is split between fewer shares.

Supposedly that’s why companies do this.

Why don’t they just pay dividends?

Management incentives.

Imagine you are a CEO. Your salary is big, but the shares your firm has given you offer even bigger rewards. If the share price does well.

What’s an easy way to boost the share price? Buy some back! Rising earnings per share, and a large buyer in the market (the company itself) will push the share price higher.

Then a few years on, you sell your shares for an excellent price, and take all the praise for a job well done.

But where does the money come to buy so many shares back? From company earnings?

Not recently. It’s come from debt.

Interest rates have been so low for so long that borrowing money has been seriously cheap.

There are two ways to increase earnings per share. Increase earnings, or decrease the number of shares.

Why bother going to all that effort to increase earnings? Much easier to just borrow money, and buy shares, improving your earnings per share that way.

America has seen record levels of this short-term thinking. US corporate debt has doubled since the financial crash. Global debt is now three times the size of the world economy.

There’s no sign of a slowdown either. In the second quarter of 2018, US companies announced $430 billion of buybacks. This nearly doubled the record, which the market had set in the first quarter.

Artemis, a fund manager, has looked into the effect of this. They say 40% of EPS growth and 30% of stock market gains are the result of this financial trickery.

Stock market valuations are at levels only seen in 1928, 1999, and 2007. In other words: pre-crash levels.

In 2015 and 2016, companies spent more than their entire annual earnings on share buybacks and dividends.

America has a stock market obsession. Companies are focused on share price and shareholder value above all else. Above even the actual performance of the company.

Interest rates have been low. Borrowing money has been cheap. So companies have loaded up on debt to buy back shares.

Debt is a sacrifice of future earnings. Companies will have to pay it back at some point.

What happens when interest rates rise?

That debt becomes expensive. To pay it back, they have to re-issue shares. Diluting shareholder value. Pushing the share price down.

This bull market is artificial. The accounting tricks can’t hold it up forever.

The story in Japan is very different.

The last stock market crash in Japan burned investors there badly. The market has still not fully recovered.

Japanese people have little interest in the stock market. So Japanese companies have little interest in their shareholders. Their loyalty is to their employees instead. That’s why Japan has a widely held system of ‘jobs for life’.

This is changing.

The current reform program in Japan aims to change boardroom culture. The aim is to encourage Japanese people to start investing in their own stock market again. Dividends and buybacks are a part of this.

My idea here is that the focus on shareholder value has boosted the American stock market hugely. Japan is just starting to do this. Maybe the effect on the Japanese stock market will be the same too.

Corporate America is near the peak of its share price craze. Japan is just at the beginning.

Japan’s companies are posting solid earnings. They have low debt. Their price to earnings multiples are low too.

In other words, investors aren’t so keen on Japanese stocks. Yet.

One the one hand, we see a market that’s overvalued, overcrowded, and has lots of debt. One that has used every trick in the book to keep the party going.

On the other, an undervalued market, where companies have focused on their products and services. Where valuations are low.

Anyone from the Benjamin Graham and Warren Buffett school of value investing knows where I am going with this.

It’s 3am in America. The party is almost over.

But in Japan, the sake is still on ice.

Why I love Mondays

All I can offer here is analogies.

But there’s a man who can be much more convincing. And specific.

On Monday, I’m going to see him speak, and I can’t wait.

Tim Price is a fan of Ben Graham, value investing, and Japan. The holy trinity of investing, some people would say (I would say that).

He’s coming in to give his speech to the Southbank Exhibition.

I’ve read his work, and it’s top class. It’s one of the great things about working here. I get access to the full range of opinions and research that Southbank has to offer. The ideas portfolio.

His research comes with recommendations, and you can get access to it for a fraction of the value.

Kit Winder

Capital & Conflict

Category: Market updates