Has the storm passed? Are happy days here again?

The fella from Cuba with a machete at his waist says so. The Bond girl lounging nearby agrees. But the fella from Dixieland… he’s still got a menacing look in his eye. And he’s not a man to be trifled with.

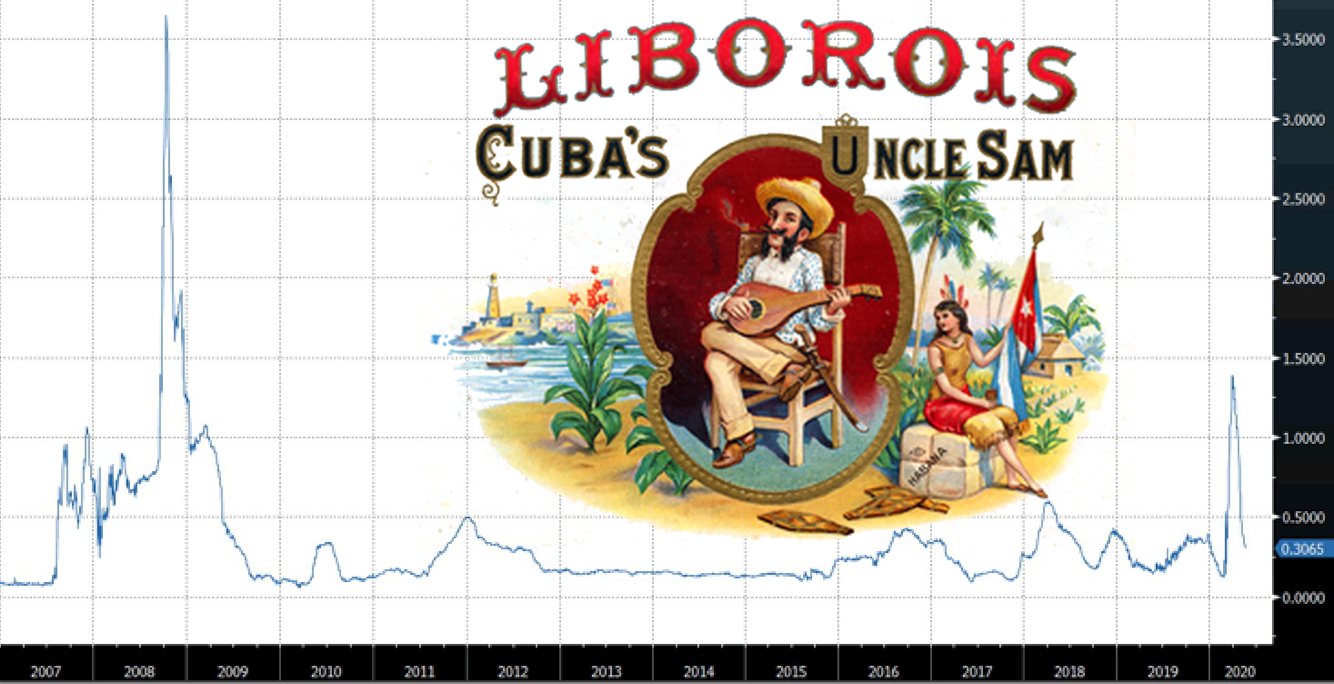

What feels like a decade ago at the beginning of April, we explored how an esoteric though deeply important metric of financial stability was blowing up – in ways that it hadn’t since 2008.

It happens to have a remarkably similar name to Don Liborio, a symbolic character of Cuba like Britannia is to us or Uncle Sam to the Americans.

It was the LIBOR-OIS spread – a measure of how much banks are trusting each other. I explained the technicalities in my original letter (Restaurant in Florida blowing up the financial system, 1 April) but in short, LIBOR-OIS shows you how much more banks are charging each other for three-month loans compared to overnight loans.

The overnight loans are heavily controlled by central banks like the Federal Reserve and the Bank of England, while three-month loans are not. When these begin to diverge and the LIBOR-OIS “spread” increases, it indicates that something is going wrong in bankerville: that longer term lending is becoming more expensive as banks are losing trust in each other.

I’ve updated that chart from almost two months ago. As you can see on the bottom right, the eruption which occurred has abruptly collapsed, taking a massive u-turn in the direction of “normal”:

Click to enlarge. Note how the spike this year reached a level which hasn’t been hit since 2008.

Click to enlarge. Note how the spike this year reached a level which hasn’t been hit since 2008.

This is good news. It suggests the fear affecting global banking system has passed; the dollar-based banking system at least, which forms the basis of the global financial system. The eurozone and emerging markets may be a different story, but that’s for another letter. For now, Don Liborio is beginning to play a somewhat peaceful tune and the machete remains sheathed.

Another happy song can be heard emanating nearby… sung by a Bond girl, no less. I say Bond girl – I’m really referring to the bond market, seen by many investors as an oracle which accurately predicts future events.

The prices of bonds have historically indicated rising economic problems ahead of time, generally much in advance of stocks. It’s for this reason that the bond market is perceived as “smarter” than the equity market, which often ploughs bravely ahead after the bond market has started signalling there are problems, only to get clobbered when those problems become abundantly clear.

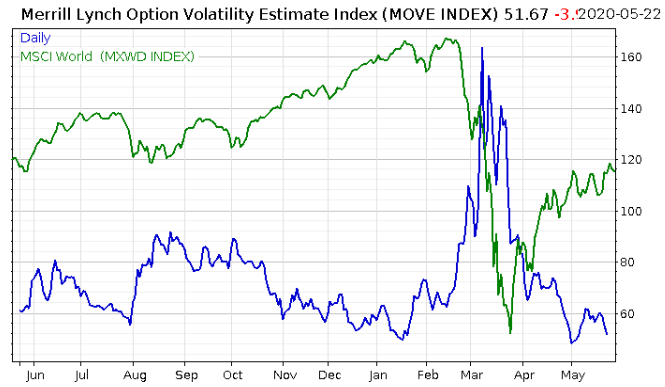

When it comes to realising the problem ahead of time, participants in the bond market certainly seem to be ahead of those in equities. This is the MOVE index in blue, a measure of how volatile market participants expect bonds will be in the future. This began rising before the global stockmarket realised something was wrong (in green), and peaked before the stockmarket bottomed:

To be clear, the MOVE index measures only US government bond volatility, but this is a proxy for global bond volatility as the US Treasury market is the world’s biggest bond market

To be clear, the MOVE index measures only US government bond volatility, but this is a proxy for global bond volatility as the US Treasury market is the world’s biggest bond market

In short, the bond girls (and guys) appear to be ahead of the stockmarket in panicking over WuFlu, and then getting over it. And as you can see, that blue line of bond volatility has since fallen lower than those bright and chirpy days of January this year (remember January? I can’t).

That is of course, unless it was the chaos in the bond market which actually led to the chaos in the stockmarket. There’s a giant elephant in the room here, as the bond market is much more directly affected by the Fed’s anti-crisis money printing measures than stocks are – so the movements of the MOVE may well be simply a testament to how effective the Fed is at crushing dissent in the market closest to it. It could be that the problem began in bonds, then spread to stocks before the Fed began papering over the problem in bonds. Whatever the case, the MOVE index is telling us that everything is now fine and dandy in arguably the most important market in the world.

But perhaps that should be the second most important market in the world. For while stocks, bonds, and interest rates can bounce all over the place, they still need to be priced in a currency. And in the foreign exchange market a man from “Dixieland” is still issuing a warning.

This is the dollar index, or DXY. It’s the value of the US dollar when measured against the other major currencies. We’ve written extensively over just how important the value of the dollar is in recent letters (even for us here in the UK) as the dollar is used so extensively within the global financial system. When the dollar goes up, that’s the value of the world’s reserve currency going up, effectively a tax on global economic growth.

As you can see when the WuFlu shock really hit, it spiked very sharply, before retracing a little over half its gain:

Since then, things are not all as rosy in Dixie as they have been with Liborio and the Bond girls. The DXY is now in a range that is being compressed: as you can see, since March it is bouncing from each low at a higher level, whilst selling off from each high at a lower level. This is what my colleague Eoin Treacy likes to call “an explosion waiting to happen”. When the range compresses finely enough, the move to either high or low should be decisive – if it breaks higher, there’s gonna be trouble. If it’s lower, the world will breathe a sigh of relief, and maybe even get round to thinking this WuFlu crisis really is in its last stage.

Since then, things are not all as rosy in Dixie as they have been with Liborio and the Bond girls. The DXY is now in a range that is being compressed: as you can see, since March it is bouncing from each low at a higher level, whilst selling off from each high at a lower level. This is what my colleague Eoin Treacy likes to call “an explosion waiting to happen”. When the range compresses finely enough, the move to either high or low should be decisive – if it breaks higher, there’s gonna be trouble. If it’s lower, the world will breathe a sigh of relief, and maybe even get round to thinking this WuFlu crisis really is in its last stage.

But companies and governments outside of the US borrowed more dollars than ever before in 2019, and the economic lockdown has already starved the world of dollar payments. If the dollar gets stronger now, there’ll be hell to pay…

More to come,

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Category: Market updates