You ever watch an American TV show or film and think they overdo it with the music? Just smothering scenes in slow piano when they’re trying to spur emotion in the viewer?

I felt that when I was watching an American bureaucrat urging the citizenry not to take cash out of the banks – just lay off the piano, guys.

“The last thing you should be doing is pulling your money out of the banks now thinking it’s going to be safer someplace else. You don’t want to be walking around with large wads of cash, and you certainly don’t want to be hoarding cash under your mattress. It didn’t pan out well for SO many people.”

That’s the head of the Federal Deposit Insurance Corporation (the American equivalent of the Financial Services Compensation Scheme), one Jelena McWilliams. Her rather strange remarks are accompanied by the kind of soundtrack you hear when the hero of a film is reunited with his squeeze after proving himself in some great trial… or perhaps in an advert for some megacorp attempting to persuade you that it’s just like, totally down to earth, politically correct, and cares deeply about its customers.

Fittingly, McWilliams doesn’t say when or where hoarding cash under the mattress didn’t pan out well, for so many people. Presumably, nobody asked anybody in Cyprus, where hoarding cash anywhere was better than having it in a bank when the crisis rolled around and depositors took haircuts. Safety deposit boxes in Cyprus are hugely popular to this day, as those in the country have learned a long time before we tried all of this “social distancing” stuff.

I’m not sure slow piano music is what it takes to maintain somebody’s confidence in the banking system, but hey – it’s worth a try, right? And it’s not like you can afford to get this wrong – why not pull out all the stops with the soundtrack? Perhaps they should have gone all-in with a live orchestra behind her in shot.

Flippancy aside, you have to wonder what’s really going on behind the scenes when somebody in power suddenly feels the need to tell everybody that everything is fine and not to panic. Is there a bank run already in motion behind the curtain?

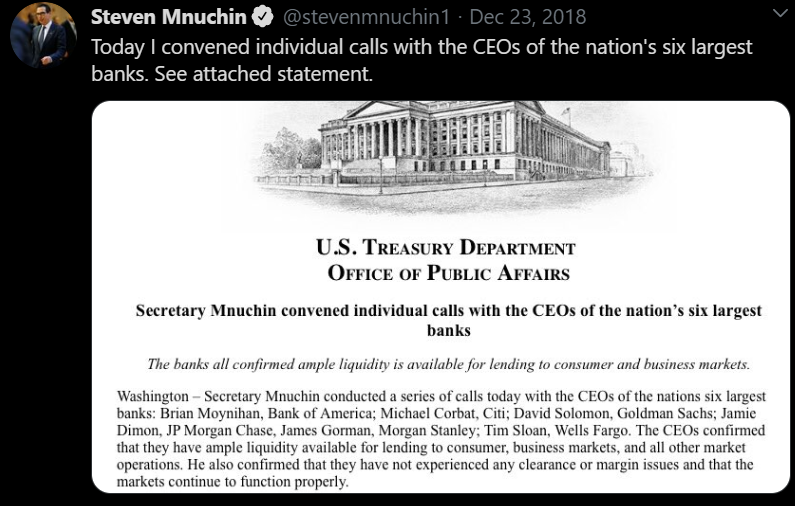

Something similar occurred in December 2018 when markets were going through a very rough patch (though not nearly as rough as today) when the US Treasury secretary, Steve “The Minooch” Mnuchin, announced completely out of the blue that American banks were completely fine everyone, please don’t worry about it.

Source: The Minooch’s Twitter

Source: The Minooch’s Twitter

The statement raised many an eyebrow, and not just from his interesting use of the word “convene” (am I convening this email to you today..? I dunno). For there hadn’t been much noise about problems rising in the US banking system prior to his announcement – there didn’t appear to be more chaos in the banks than anywhere else during the stockmarket tumult.

What had The Minooch been told? What information was he privy to that we weren’t, which would drive him to make such an arbitrary reassurance?

Whatever it was, ultimately it did not arrive. Or it hasn’t arrived yet.

But you know something’s up when you’re being told to keep your cash in the bank. As one subscriber writes in:

Thank you and your team for your daily insights from Southbank.

I noticed the bullion dealers being out of stock some time ago.

Have you tried to withdraw large sums (by which I mean £50-100k) of cash out of the high street banks recently? Too much flannel is making it next to impossible. The excuse I like most is that ‘….it might be dangerous to walk around with so much cash in your pocket’, or ‘withdrawing cash is a non-essential transaction so is not available at this time’.

Whilst the streets are currently empty and before they fill with rioters, I would be happy to take my chances. HSBC are also interrupting substantial (by retail standards anyway) currency transactions, blocking them for a week before contacting me…

The powers that be want you to keep your cash within the system. While they’re all about “social distancing” these days, they want to keep your financial affairs

Thanks to all who wrote in with their thoughts on the coronavirus market panic by the way. I read all your emails and try to respond to as many as I can: [email protected].

Let’s take a look at what you had to say…

The spoils of war pandemics

For pity’s sake, Boaz, why does everybody want inflation?

Don’t worry, I know. It’s not the many, it’s the few. Governments who want to keep popular by giving the undeserving benefits they didn’t earn. Big companies (or rather the employees/boards – not the owners – who run them) who want to keep up their share prices (i.e. bonuses) with cheap loans to fund buybacks.

The citizen in the street waits for the news item that reports a FALL in prices – in the Napoleonic war it was for bread, while the law kept wheat prices artificially high, to protect the incomes of the landowners who sat in Parliament.

Now it’s prices in the financial markets that HAVE to be shored up, while younger people can’t afford a house and the adverts to the older people who have a house, to turn it into income (after their working life buying it) proliferate.

…do I want to live the rest of my life periodically in house arrest (you aren’t telling me this is the last nasty to come out of China), on basic supplies, with Big Brother reminding me of just how unfree the Free World has become? I remember hiding behind my parents’ chair in fear when Big Brother’s face filled the screen (an early televised version of 1984). The sombre Boris was a bit too reminiscent.

Never let a crisis go to waste. It’s been interesting to see how the various governments have gone about using the virus to their advantage. While here in the UK we’ve seen the greatest restriction of liberty in British history take place… in China, Chairman Xi Jinping has used the virus as cover to bump off his enemies within the commie party… in Canada, Justin Trudeau’s administration tried to use it to gain the power to tax and spend without parliamentary approval… while in the States all manner of cronies, including the congressmen and women themselves, are getting a fat pay-off with this trillion-dollar “stimulus” plan.

The power granted to governments in this moment will not be surrendered easily, and likely not at all…

I always find your writing interesting and thought provoking although I may not agree with your views. I sensed a short term bottom on Thursday so started nibbling on a few shares with juicy yields. This is not a time to be fearful but also not a time to go overboard or all in. The fed is determined to ignite inflation, hence all the new money from thin air that is being shovelled into markets. I am positioned 1/3rd cash/ 1/3rd commodities and 1/3rd Gold (shares and physical). In this crash, I have remained very calm, unlike other big downturns, and this has surprised me as I have lost a lot of money in this 30% odd slump. However my gains came out of thin air and that’s where they have temporarily returned. Just like Arnold Schwarzenegger, they will be back. “Only he is lost who sees himself as lost.”

I commend and admire your calm in the face of losses. It’s a state of mind that’ll reward you richly if you maintain it, and remain steady while everyone else is going nuts. Lord knows there’s a lot more of that coming: it’ll be hurricane season in 60-odd days – and then there’s the US elections…

And on the topic of chaotic scenarios, one reader has a particularly florid one in mind:

The crisis deepens and the bond market goes into crisis mode – the Chinese refuse to pay up…

Banks take massive hits and stock and bond markets again go into free fall. Then China announces its new Gold Renminbi and moves in to take over the role of Global Reserve Currency – and Mr Nice to bail everyone out – at their price … control.

US$ crashes in forex markets – well all western fiat currencies do as well – gold rises to US$10k/oz (well in fact US$% fall in value – gold remains – well just gold).

China emerges as the Good Guys to rescue the Middle East, Africa and South America – all resource rich. Massive migrant crisis erupts egged from the sidelines by China – EU descends into hellhole.

This would make Covid-19 look like a mere minor picnic…

Indeed it would. In my opinion, the question of whether the Chinese Communist Party can unseat the dollar is the great macroeconomic question of our time. If it’s between the yuan and the dollar, I’m all for the dollar – as is most of the world, as yuan isn’t traded much at all outside of China, less so even than the Canadian dollar. But bring gold into the mix, and things start to change…

Can you please point me in the direction of the best bitcoin exchange to start out with. I am a complete novice, but I think it makes sense.

Any recommended reading – or anything else you think may be helpful – would be greatly appreciated.

I’ll start on the reading side – knowing your environment is paramount when you’re operating in fhe wild west that is bitcoin. I found The Bitcoin Standard by Saifedean Ammous to be a very good read, with a weighty overview of how money has evolved over the centuries, and arguing why bitcoin is a superior form of money to anything that has come before it. Ammous is pretty hardcore in his views, but it makes for stimulating reading, and gives you a glimpse into how the “true believers” see the future for bitcoin.

My colleague Sam Volkering has also written a book on the crypto space in general called Crypto Revolution, which is all about how the advent of digital money will disrupt many of the industries we’ve all grown to rely on.

The bitcoin space, in harmony with the currency itself, is often open source – ie, it’s free for anyone to access. You’ll often find that a lot of data on the topic has been distributed online for free. Mastering Bitcoin by Andreas Antonopoulos is one example, which can be found free online (and I don’t mean illegally). It’s very in depth though, and focusing more on the ways bitcoin can be used as a form of software. I recommend watching some of the lectures and podcasts Antonopoulos has done – he’s probably the closest you can get to a figurehead in the bitcoin world.

As for exchanges, I’ve found Coinbase.com to work well as an entry point, if you just want some bitcoin in exchange for cash and Bittrex.com to be a very good exchange for bitcoin plus other digital assets. They’re both pretty intuitive – but be careful. If you’re unsure if what you’re doing is incorrect, take the time to be sure. There are no bailouts in the bitcoin space – that’s why it’s so popular.

Firstly, I would like to commend you and the Southbank team on the excellent articles over the last few days. I generally find your content far better than the larger mainstream media sources as you let us make our own minds up rather than feed us sensationalist attention grabbing content.

In the last couple of days I have gone from being a self employed builder to teacher as like many others I wrestle with the new reality we are living in. The children’s primary school has provided a quantity of work to be going on with but it occurred to me this is an opportunity to widen their education to some degree. A few months ago I recall Sam was keen to encourage financial education within the school curriculum. Does anyone at Southbank have a suggestion of online content I can use to start educating my 7 and 9 year old about investing and making their future capital work for them? If you don’t have any suggestions may I ask whether it would be possible for you to put together an introduction to investing targeted at children?

A very interesting request indeed.

I’ve asked our editors what they would give to a 7 and 9-year-old to get them started with investing – and the answers I’ve received back have been as varied as their investing style…

If you let your kids play videogames, Eoin Treacy of Gold Stock Fortunes recommends the Market Crashers minigame on the Nintendo 3DS, found in the Mii Plaza, saying it taught his daughter everything she needs to know about “buy low, sell high”.

Tim Price at The Price Report recommends a book for kids called Save your Acorns by Robert Gardner, which is all about teaching children the basics of saving. He hosted Gardner on a podcast recently as well, which you can listen to here.

Charlie Morris over at The Fleet Street Letter Wealth Builder recommended you get them to find and research a chocolate company stock. And Rashpal Sohan over at Dynamic Investment Trends Alert referred me to a booklet a fund manager at Rathbones had released on the topic of introducing the principles of finance and the benefits of saving to the millennial generation. It is aimed at children a little older than than the 7-9 range, but there’s plenty of good stuff in it which you can find for free here.

As an aside, I hosted Rashpal with his investment partner Robin Griffiths on our daily broadcast this morning – they brought their trend-following expertise to the market rout, and shared some very interesting insights on what assets can be relied upon at the moment – what investments have held their strength throughout the turmoil. .

I don’t have any children (not yet, anyway), so I don’t think I’m the best judge of this. I first got interested in investing when I was about 8, when my dad told me I could earn money for free just by owning a “share” of a company that made jet aircraft, which I was nuts about at the time. If you can find stocks related to their interests, that’s a good way in.

I would err on the side of making it as practical as possible, as lessons learned from actually doing something rather than reading about it sink in better. Many trading platforms like IG offer “demo” accounts, which allow you to trade the markets in real time, but with fake money so you never actually make any losses. It’s great practice if you have the time to show them it, and gives the full nuts and bolts experience of using a brokerage account.

If you opened one for them each, you could let them scour the markets themselves for what they’d want to invest in, and then they can watch in real time what it’s like to grow their capital – or watch it go down the swanny. With markets as volatile as they are now, I think it’s a great time to show them how risky investing can be, a real learning experience where they can watch in real time how fortunes can be lost in a day.

You could even make a game out of who can make the most fake money in a week/month/quarter, with some kind of prize for the one with the best investing record. That’s just my £0.02, anyhow.

I’ll leave it there for this week – back again on Monday.

I wish you a good weekend. Stay safe, folks.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

PS If you’re a patron of the arts, who can appreciate the nuances of “The Excessive American Soundtrack” and the subtleties within “The Bureaucrat’s Fear of a Bank Run” you can enjoy the display of both I referred to at the beginning of this email here.

Category: Market updates