Pub quiz (I know it’s a Monday, but humour me).

As the pound gets wrecked… as German manufacturing is beaten with a shovel… and as the wheels fall off the Chinese economy (HengFeng marks the third Chinese bank in as many months to receive a government rescue)…

One niche, esoteric asset has been booming in parabolic fashion.

What could it be?

A cryptocurrency? Bitcoin’s been off to the races this year, and made a lot of people rich in the process. But no – the asset charted above is considered significantly more legitimate by mainstream investors.

A pot stock then? Investors sure have gone nuts for cannabis in recent years… but no. Again, this asset is considered more legit. In fact, the buyers who’ve pushed this asset to such a roaring high this year are likely all institutional players.

A gold miner maybe? Good effort, but again, no. Major institutional money has yet to flood into the miners, (presenting a considerable opportunity to those who get in first). In fact, the entire market cap of the gold mining sector – the current price of all gold mining shares combined – is still less than that of Home Depot ($HD), the US equivalent of Homebase here in Blighty.

So what is it then? What is this exotic asset that the big players are aggressively outbidding each other for?

Well, turns out there’s been a mad scramble… to lend money to the Austrian government for 100 years.

Yep, that charts displays the price of an Austrian century bond. If you’d bought one of those at the beginning of this year, you’d be sitting pretty on a capital gain of over 60%.

And it’s only capital gain you’re gonna get out of Austrian century bonds – you can forget about a decent yield. When the Austrian government began taking advantage of the bond market’s insatiable demand for its debt and began issuing these century bonds in 2017, the yield on these was 2.1%, which was absurd enough then.

Now, if you buy and hold these to maturity, collecting interest payments until the year 2117 (no matter how many times I see that date, it still looks like a typo), and you’ll received a whopping great return of… just over 0.70%. And that’s if the Austrians don’t default and the euro doesn’t collapse in the coming century.

The very existence of such bonds and the strong demand for them can be partly answered by the next question in our quiz: what did Norway, Moldova, Honduras, Pakistan, and Zambia all do this year that no other countries have?

Any ideas?

Grab a drink and have a guess.

Lumberjack season

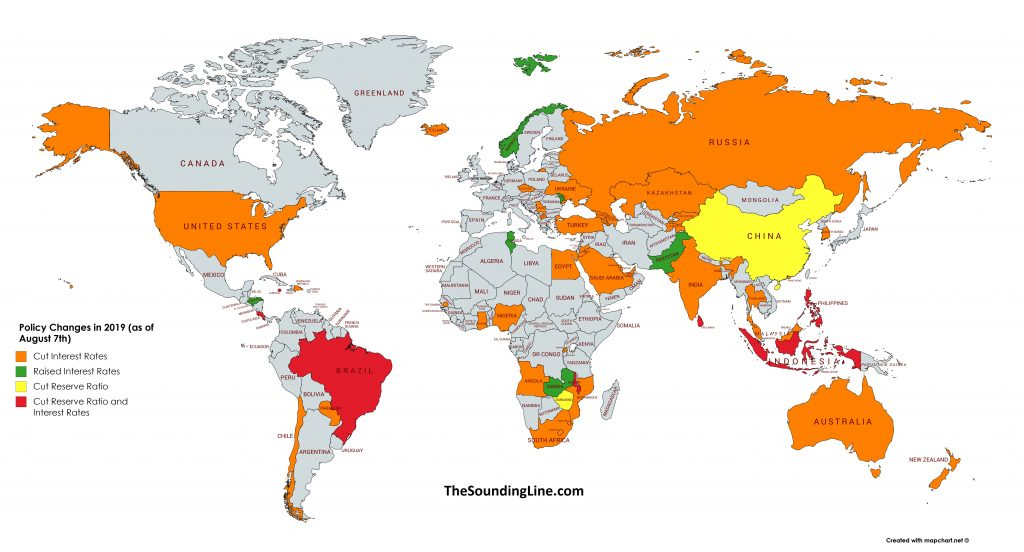

Those five countries are the only ones in the world that have hiked interest rates this year. Everywhere else, the axes are being polished and primed for cutting season.

42 countries have either cut rates, reduced bank lending ratios (to promote more debt issuance), or both this year. A website called The Sounding Line has made a great map of it all:

With interest rates around the world heading down, any yield is golden. But there’s another reason why bonds in the eurozone specifically could be rallying so hard, due to the unique “bail-in” set of rules that were introduced in 2014 (the Bank Resolution and Recovery Directive).

Large investors may be buying government bonds instead of keeping euros in the bank, because if that bank collapses, their deposits will be used to bail it in. Effectively, investors may be choosing to store their wealth in government treasury departments instead of European banks, because those banks are on the edge of insolvency. But by pulling their money out of said banks, they make the risk of insolvency a whole lot worse.

This vicious cycle was highlighted recently by Russell Napier in The Solid Ground fortnightly:

… large-scale Euro deposits bear risks that government bonds do not. While holders of government bonds do face the risk of a nominal decline in value, they do not face the risk of being bailed in and confronted with a scale of loss that is unquantifiable until well after the bail-in event. This structural shift, assuming that the Bank Resolution and Recovery Directive is enforced, is a key reason why government bond yields in Europe can reach lows never seen before in the history of interest rates.

… Down the rabbit-hole we go with the fear of a bail-in of deposits forcing ever-lower bond yields and ultimately raising solvency issues for banks, a further monetary contraction and the risk of the very bail-in that investors are fleeing.

In effect, this bull run in the European bond market may actually be a continental bank run in disguise. This stress may be being hinted at in the stockmarket, as nobody wants to own European bank shares. European bank shares are getting pounded to levels not far from the depths of the sovereign debt crisis.

That’s the European Bank index – just google “sx7e” to bring it up. Keep an eye on it – if it continues to crack lower there’ll be all manner of hell to pay.

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates