One cold December night in 1989, a man drove a lorry into Wall Street.

He was there to commit a crime he’d spent two years preparing for – ever since the stockmarket crash of Black Monday in 1987.

As he turned down Broad Street and began his approach to the New York Stock Exchange, he kept a close eye on the time. He’d scoped the place out on a previous night with a chronometer, to see how often the police patrol would drive past the exchange. He had a four and half minute window to deliver his cargo and escape undetected.

But delivering that cargo wouldn’t be easy. Though he’d spent hundreds of thousands of dollars on the object in the back, none of that had gone towards making it manoeuvrable: it weighed over three tonnes, and was 18 feet long. He’d needed to bring a crew of compatriots with him to shift it out the back – there was no way he’d be able to do it himself.

But as he approached the stock exchange, he realised that fate had thrown him a curveball. The day before, the stock exchange had plonked a massive Christmas tree out front, preventing him from executing his original strategy.

Thinking fast, he made a change of plan.

“Drop the Bull under the tree,” he told his men. “It’s my gift.”

A bronze bull amid the bears

“Charging Bull”, by Arturo Di Modica in Manhattan

“Charging Bull”, by Arturo Di Modica in Manhattan

The man at the wheel that night was Arturo Di Modica, a sculptor who had moved to the US from Italy and become highly successful.

He was incredibly grateful to his adopted country for taking him in and allowing him to prosper. So grateful in fact that after the US stockmarket collapsed in 1987, leaving many Americans in the lurch, he wanted to sculpt something that would restore confidence, and project strength and a virile optimism.

What he came up with was the now iconic bronze bull, which he gifted to New York that night in 1989, in what has to be one of the most expensive acts of littering in modern history. Di Modica was happy to pony up the $350k and two years it cost to make, as he saw it as giving back for the lucrative life he’d been able to strive for and attain in the US. While the stockmarket had a terrible 1987, he’d had a very profitable year.

Whether the sculpture had any impact on the psychology of Wall Streeters at the time is debatable, but in any case the bearish sentiment following Black Monday soon dissipated and the US stockmarket had a “Charging Bull”-run worthy of the bronze idol raring outside.

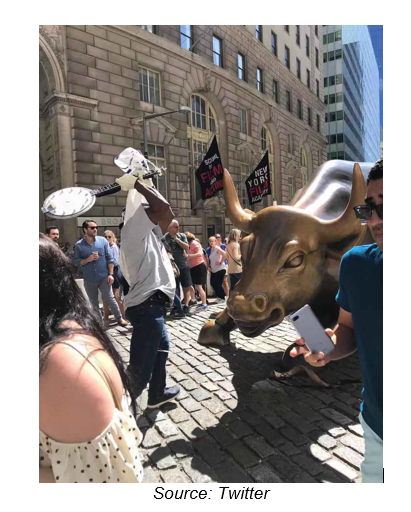

The story of the Bull’s birth in the aftermath of a stockmarket collapse is ironic, when you consider what happened on Saturday, where after a decade-long bull market, a man attempted to destroy it.

… and with a banjo, no less:

This man’s attempt to “drop the bull” may end up being an indicator that we’re nearing the end of this bull market. But as I argued yesterday, I reckon we’ll see a melt-up, a final thrust of the horns, before banjo man will see this “golden calf” destroyed.

This man’s attempt to “drop the bull” may end up being an indicator that we’re nearing the end of this bull market. But as I argued yesterday, I reckon we’ll see a melt-up, a final thrust of the horns, before banjo man will see this “golden calf” destroyed.

It’s also symbolic of how this may well be the most hated bull market in history; as many observers (myself very much included) have called it out as built upon sand, only for it to push higher.

It should be noted that the last time the Bull was vandalised was in 2008 and 2017. This is likely another indicator that what is labelled “capitalism” is being viewed increasingly negatively by the populous. As the wealthiest in society benefit from sustained central bank stimulus while everybody else is punished with low rates, it’s not hard to understand how this has happened.

Di Modica said of his Christmas gift to New York that “My point was to show people that if you want to do something in a moment things are very bad, you can do it. You can do it by yourself. My point was that you must be strong.”

Where there’s a will, there’s a way – the reason our business exists is to find those rarely trodden paths which lead to riches or safety when either is hard to find.

I wonder if we’ll need to wait for an artist to dump a massive bronze bear in Wall Street in the dead of night before the next “big drop” arrives…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates