You could almost draw this chart with a setsquare.

Investors in Deutsche Bank have been reminded once again that just because something is cheap doesn’t mean it’s valuable.

Trust is a damn rare commodity these days, and $DB, one of the world’s most systemically important banks, is running out of it.

But so, it seems, is everyone else. Trust in politicians, the media, economists, and the institutions that have underpinned the world order since World War II is in a firmly established downtrend – they just don’t have stock tickers you can look up and chart.

The new kids on the block, the barons of Silicon Valley, are no exception – but importantly, their ascension has been the engine behind one of the grandest stockmarket rallies of history. And though they spend more money on lobbyists in Washington DC than Wall Street, money can’t buy trust.

From the The New York Times:

The federal government is stepping up its scrutiny of the world’s biggest tech companies, leaving them vulnerable to new rules and federal lawsuits. Regulators are divvying up antitrust oversight of the Silicon Valley giants and lawmakers are investigating whether they have stifled competition and hurt consumers.

After a spate of unusual negotiations, the Justice Department has agreed to handle potential antitrust investigations related to Apple and Google, while the Federal Trade Commission will take on Facebook and Amazon.

Lawmakers in the House said on Monday that they were looking into the tech giants’ possible anti-competitive behavior. That could lead to the first overhaul of antitrust rules in many decades, an effort to keep up with an industry that didn’t exist when antitrust laws were written.

The question of whether tech companies violate antitrust laws has long been the subject of academic debates and industry griping. But now the industry is in the sights of President Trump, Democrats running for president, Congress and consumers. Silicon Valley has faced fierce criticism over disinformation, privacy breaches and political bias.

The White House has launched a web portal to collect stories from people who have been banned or suspended from social media platforms – the thin end of a very large wedge that is set to become painfully wider for these companies, especially as Cold War II amps up.

Just yesterday, I was speaking to a colleague about the inclusion of China into large bond and stockmarket indices. The gradual inclusion of China into these broad indices will pour trillions of pounds worth of passive investment (from pension funds, sovereign wealth funds, passive retail investor savings, etc) into Chinese markets.

This effectively means funnelling that capital straight into the hands of the Chinese Communist Party (CCP) as it can control capital flows in and out of the country. If I were Donald Trump, I’d be severing this artery of Western investment into China as soon as I can.

I had read a great thread on this topic recently on Twitter, and told my colleague I’d send it over for his perusal. It was written by an equity and global macro analyst, a lady by the name of Emma Muhleman. However, when I went to find the thread, I found that her account had been suspended.

|

Now, I’m used to seeing Twitter users get banned – hell, I’ve been banned by Twitter. The ban hammer is generally used against those being crude or having political opinions contrary to that of the Silicon Valley crowd (guilty as charged, your honour). However, Muhleman’s analysis fell into neither of these camps.

Turns out, her account was one of many to be culled in a recent crackdown that appears to have targeted Chinese dissidents or anybody critical of the CCP. Twitter claims this suppression was a mistake, but the timing makes this hard to believe to my eyes.

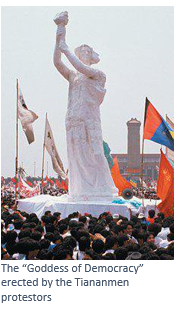

Today of course marks the 30th anniversary of the CCP massacring its own citizens (in some cases using brutal dum-dum rounds on students) in Tiananmen Square, and bulldozing the “Goddess of Democracy” they had erected there. Of course, the CCP’s PR department doesn’t want anybody drawing attention to it.

I was used to Twitter’s political bias, but never expected it would begin censoring financial analysis for the CCP. Muhleman has since had her account reinstated after going straight to Twitter’s corporate counsel, but actions like this paint an ever larger target on the back of big tech.

The days of governments trusting Silicon Valley to be responsible with their newly found power is over. As Thomas Watson once said, “The toughest thing about the power of trust is that it’s very difficult to build and very easy to destroy.” The tech darlings will struggle to maintain their altitude when their waxed wings melt under the heat of government scrutiny and intervention. And there’s plenty of room below:

I’ve a video on this topic to share with you tomorrow, but I’d like to leave you today with a quote I recently discovered on what asset really wins when there’s a global shortage of trust, be that in government, banks or big tech:

“Gold is ‘clotted’ trust or, if you like, clotted mistrust against all other promises of value. That leads us to the trail of its strange price movements: Its price rises wherever mistrust arises (mistrust of the future, politics, rulers), and it falls or stagnates where trust prevails.”

– Roland Baader, quoted from the annual “In Gold We Trust” report

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates