Even assuming future annual increases are only one-third that of what they were in 2018, [American oil production] will add a new Saudi Arabia of output within a decade.

… It is indeed time to start noodling over what it means when the world’s largest supplier of internationally-available crude comes from a country that no longer has much interest in global stability.

– Peter Zeihan, Geopolitical Strategist

The relentless ambition of “the boys down in Texas” to pump shale oil has changed the world. Thanks to their efforts, the US government is no longer beholden to oil-producing countries like Saudi Arabia. The US has flipped from being Saudi’s biggest customer, to its biggest competitor in the oil market, and no longer needs to tread softly around them with their foreign policy decisions.

Or so the story goes. Our energy specialist James Allen holds a different view. If he’s right, it’ll have consequences you’ll see in the markets, on the geopolitical arena – and at the pump.

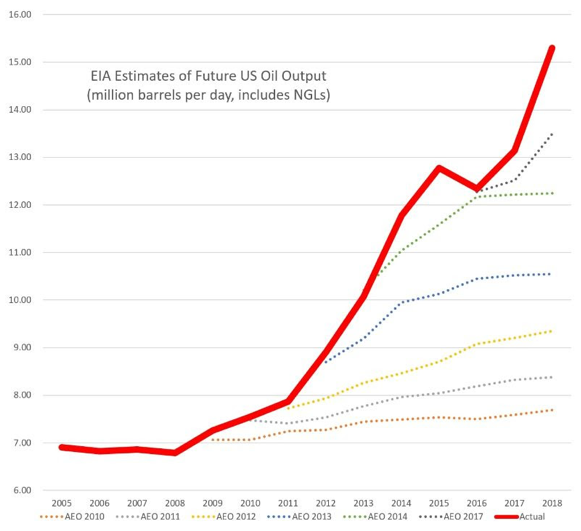

But we’ll get back to that in a second. First, take a look at this chart. It summarises the astonishing rise (and rise) of US oil production.

Those dotted lines are the annual projections for future US oil production, made by the US Energy Information Administration (EIA). That red line is how much oil the US actually produced.

It should be noted that the EIA is generally very bullish on US production – but every year, it hasn’t been bullish enough.

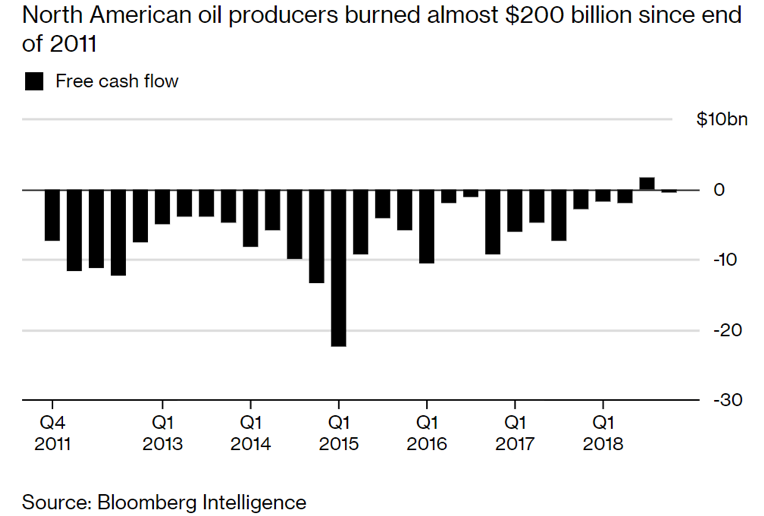

Yes, the boys in Texas with their fracking rigs have been very busy. But here’s the twist. Despite this grand boom in production… they, uh, haven’t made any money.

On aggregate in fact, they’ve been burning an awful lot of it:

My hometown of Aberdeen, a hub for North Sea oil production, was hit very hard by the crash in oil in 2014. The frackers and Opec’s attempts to drive them out of business which led to the “oil supply glut” were often blamed.

But the real culprit for the mayhem, as my colleague James Allen argues in his latest issue of Power & Profits, was the Federal Reserve. As the chart above illustrates, for all the oil supply the US has brought online, the business has not been profitable. The cost of production has been too high.

It’s only been possible to build and maintain this massive fracking operation thanks to low interest rates. Low interest rates, courtesy of the Fed. Low interest rates… which are no longer available since Jerome Powell took charge at the Fed and started hiking them.

The “boys down in Texas”, in their ambition to create a “New Arabia” of oil production, have saddled themselves with huge quantities of debt, often by issuing junk bonds. From James’s issue:

US shale oil exploration and production companies have raised about $300 billon from bond issuance over the past ten years. Many shale oil firms have simply rolled over their debt with the help of Wall Street investment banks that have provided finance despite production being unprofitable. Up to now Wall Street has managed to flog off assets of unprofitable fracking companies to investors such as pension funds, who know little of the risks in shale production. But investors are now signalling they’ve had enough. Wall Street, in short, is backing away, depriving the shale firms the finance that has funded the last decade of shale growth.

Now with interest rates rising, and having already drained the “sweet spots” (the easiest areas to suck oil from) in their territory, they face a reckoning. James is calling it the forthcoming “Crude Credit Crunch”. And he’s found just the company to profit from the chaos…

I thought it’d be good if you heard from James himself on this topic. Now that our studio is firing on all cylinders, we can record content pretty quickly, so tomorrow you’ll be able watch a conversation I’ve just had with him on his thesis. Don’t miss it!

Until then,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates