It may be Monday… but that doesn’t mean it isn’t beer o’clock.

Don’t worry, I’m not downing pints of Guinness at my desk this fine morning (though that does sound delightful). No, it’s time I put a bottle of my favourite Belgian beer on the line for a fine reader of this newsletter. Solve the riddle below, and I’ll have a bottle delivered to your door.

We had a lot of fun last time around with the Ancient Horses’ Asses series back in November. But nobody guessed that the force I alluded to that keeps the cost of global trade down and allows massive supertankers and container ships to slide defenceless across the sea at a snail’s pace was the US Navy, by creating a benign maritime environment (mostly) free of pirates.

This time around, I’m determined to get this beer into the hands of a reader. I may even do runners-up. I’ll release extra clues gradually throughout the week, if nobody figures it out fast enough.

You’ll also be in competition with readers of Southbank Investment Daily, our premium daily e-letter. But as you’re my main readership, I’m going to give you a day’s head start.

So here it goes.

What historical event brought together a pair of commodity traders…

A journalist who was being censored by the Nazis…

An American business executive…

A colonel in the Luftwaffe…

An English travel agent…

An Italian lady set to inherit a fortune…

A New York fashion designer…

And a German acrobat?

And how did a trade war nearly kill them all?

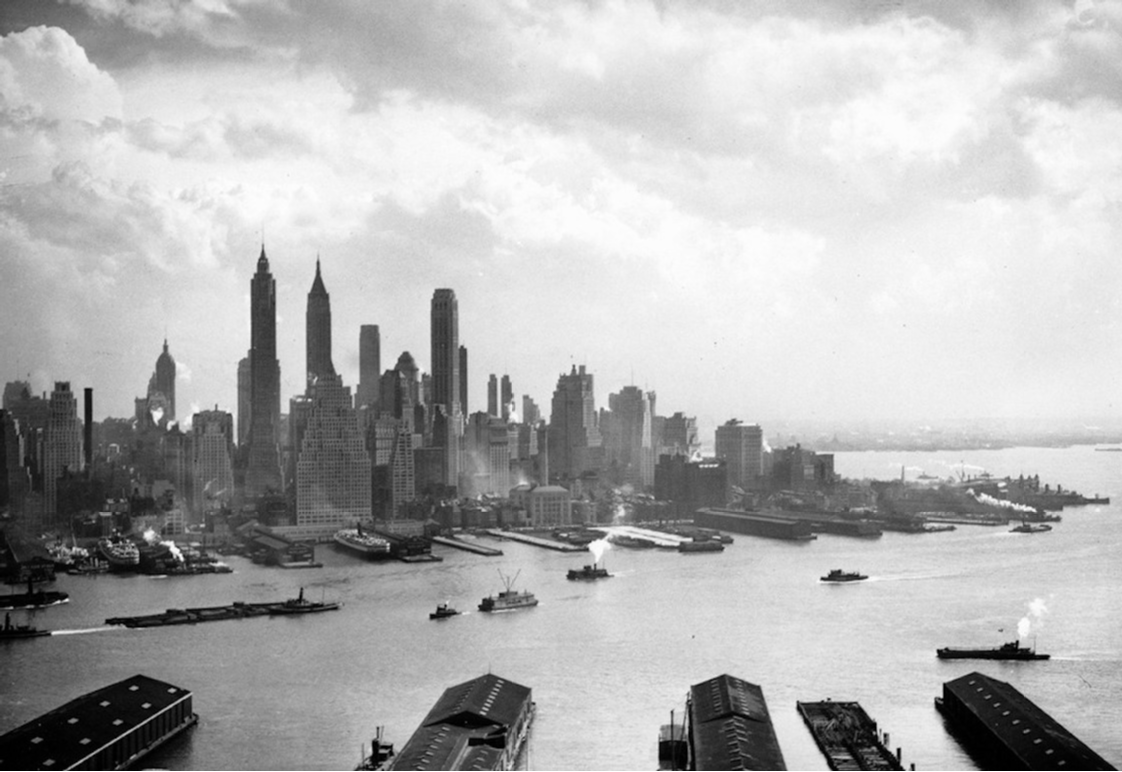

The key to both questions resides in the image below. What have I photoshopped out of this old print of New York City?

Answer me those three things – what historical event brought those people together, how a trade war nearly killed them all, and what’s missing from the photo – and the beer is yours…

… provided you send me your answers before everyone else, of course: [email protected].

Last time we did this, one reader requested that cider should be available to readers who prefer it – I will look to source some decent scrumpy for such a scenario.

The only other assistance I’ll give you today is that I will clarify that the German acrobat in question is not my colleague Nickolai Hubble, who is German and amongst other acrobatic abilities can balance a rifle on his chin, something he felt appropriate to display in the office last year while a job interview was taking place in the background.

Now, back to the markets…

Parabolic palladium

The price of palladium has got so wild, that it’s being blamed for damaging the reputation of London as a precious metals market.

From the Financial Times:

John Metcalf, chairman of the London Platinum and Palladium Market, whose members include banks such as HSBC and JPMorgan, said that “extremely turbulent trading conditions” threatened liquidity in the London market, according to a letter seen by the Financial Times. In the letter, Mr Metcalf, who works for the German chemical giant BASF, said there is likely to be a “prolonged” shortage of palladium metal in London, adding that the situation appeared worse than when Russian exports were restricted in the late 1990s, following the collapse of the Soviet Union.

Mr Metcalf urged members to bear this in mind when pricing physical metal “for the sake of the London market’s reputation and continued functioning.”…

The CME Group, which owns the Nymex metals exchange, said there was a total of 996 such trades in palladium on Tuesday. That is equivalent to more than three times the amount of physical metal stored in registered warehouses. Tai Wong, head of metals trading at BMO Capital Markets in New York, said he had “never seen a rupture” like current prices in his 15 years of trading. “It’s not a normal market and will not act like a normal market for some time,” he said.

Last week, some 18.7k oz of palladium were withdrawn from JP Morgan’s metal vault in Manhattan, reducing the total amount of physical palladium available for trading in the New York Commodity Exchange, COMEX, by over a third. Rumour has it this massive withdrawal of metal was shipped over to London to cover the palladium shortage here.

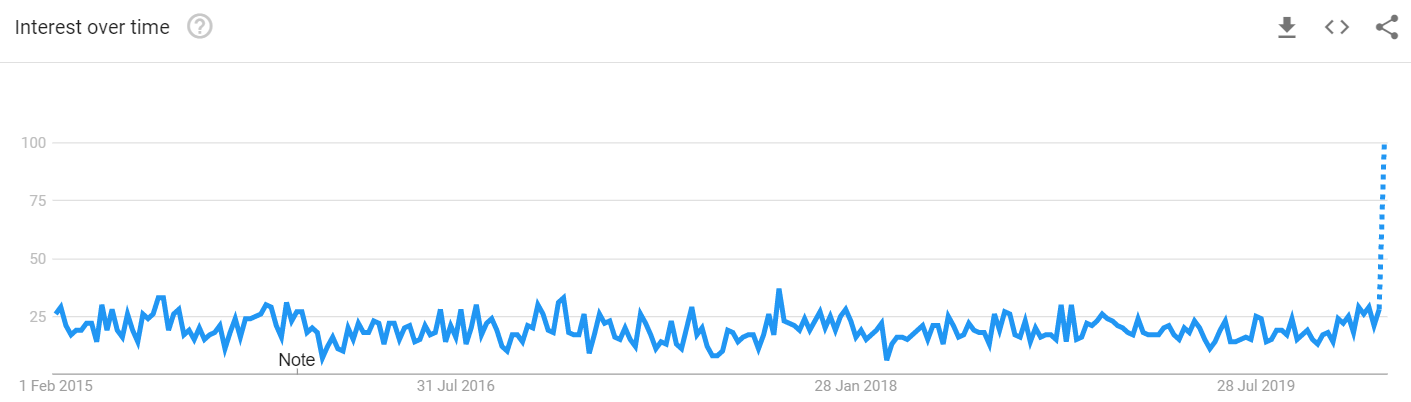

While palladium is down £50 since last week, the market is incredibly tight. And whenever any market begins acting “not normal”, it attracts speculators:

Global Google searches for “buy palladium” over the past five years

Global Google searches for “buy palladium” over the past five years

Source: Google Trends

What we’re watching is a forward indicator of what increasing environmental regulation aimed at reducing emissions will do to markets – create speculative squeezes, and raise prices in general. Though there’s only a few grams of palladium in your average petrol car, these costs add up big time if you’re in the business of making millions of them. Again, from the FT:

The bull market in palladium caused by a chronic shortage of supplies has cost the global automotive industry $18bn over the past year, according to a new report by US bank Citi.

The price of the silvery white metal has surged more than 80 per cent over the past year as industrial consumers have scrambled to meet demand for the critical ingredient in catalytic converters for petrol and hybrid cars. Analysts at Citi believe that barnstorming run — palladium hit a record high above $2,500 an ounce last week — squeezed cash flows, costing the car industry $18bn in 2019.

“Platinum group metals [which include palladium] now represent a whopping 15 per cent of global automakers’ cash flow, up from 7 per cent a year ago and 4 per cent three years ago,” said Citi analyst Max Layton in a report, noting that his calculations assumed that buyers had not hedged the cost of their purchases.

Bear in mind that this price rally has occurred while demand for cars was lacklustre in 2019. Regulation makes its own luck price rallies. Provided the coronavirus doesn’t cause a massive global trade slowdown, I see the supply squeeze continuing and prices going even further to the upside.

Remember what’s happening in palladium next time you hear of broad environmental regulation being proposed or implemented. The new catalytic converter regulations introduced in India and China that have driven the price parabolic were well known ahead of time, but markets didn’t price them in.

Just like the policymakers who created the regulations, market participants do not appear to have cared for or anticipated the consequences of the regulations. This dynamic creates speculative opportunities for us, and I expect this formula to repeat when more green regulations are rolled out.

More to come…

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates