“I love the smell of napalm in the morning. You know, one time we had a hill bombed for 12 hours. When it was all over, I walked up. We didn’t find one of ’em, not one stinkin’ dink body. The smell, you know that gasoline smell, the whole hill. Smelled like… victory. Someday this war’s gonna end.”

– Lt. Colonel Kilgore in Apocalypse Now (1979)

Though we noted yesterday that the protagonist of Apocalypse Now would be horrified at what dwells within the concrete jungles of finance today, Lt. Colonel Kilgore would be right at home.

Replace “napalm” with “QE”, and “bodies” for “positive yield” and his famous quote sums up the attitude of the central bankers as they prepare to unleash hell on savers, pension funds, insurance companies and more in their battle against deflation.

“Someday this war against deflation’s gonna end” they tell each other. They just need more napalm lower interest rates. “One time we bombed the bond market for 15 years,” the Japanese veterans say. “Now days pass when we don’t find one of ‘em, not one stinkin’ dink government bond being bought or sold in the market.”

As for the risks and instability brought about by his actions, Kilgore once again displays intuition befitting a present day central banker, encouraging his men to surf in a warzone.

Captain Willard: Are you crazy, Goddammit? Don’t you think it’s a little risky for some R&R?

Lt. Colonel Kilgore: If I say it’s safe to surf this beach, Captain, then it’s safe to surf this beach! I mean, I’m not afraid to surf this place, I’ll surf this whole f***ing place!

The flight of the Valkyries to safety

The upcoming strafing by the monetary brigade is a great boon for governments, debtors, and large businesses (who as we noted yesterday, are soon to sup on negative borrowing rates straight from the tap). But where is the shelter for the everyman in the coming bombardment?

Every day that passes, more information is revealed of the coming “extraordinary policy reactions” (to use the FT’s phrase) being cooked up to destroy the purchasing power of currency, and make debt burdens lighter. If what we’ve had since the financial crisis wasn’t extraordinary, one can only imagine what we’re due to witness.

With the sound of Wagner’s Flight of the Valkyries becoming ever more audible in the bond market, some gold in your portfolio is as good as a helmet.

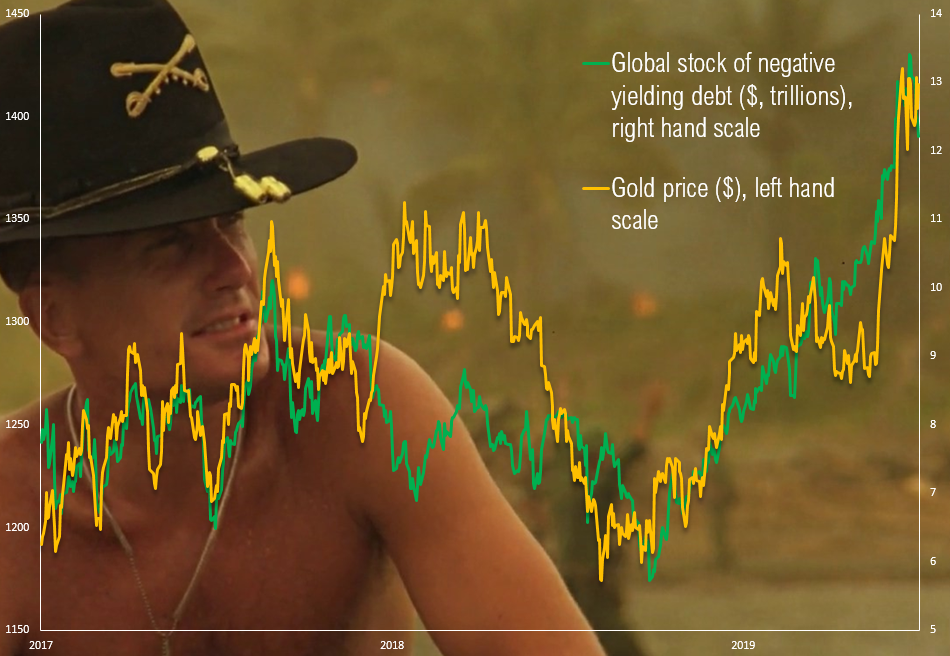

The decline of real interest rates (interest rates minus inflation) is my anchor for the price of gold. But the investment team at Ruffer has pointed out what seems to be another, newer driver of the gold price: the outstanding quantity of negative-yielding debt. I charted that metric yesterday by itself, but if you overlay it with the gold price, the correlation is compelling:

The smell of “victory”. Data courtesy of Bloomberg, click to enlarge.

The smell of “victory”. Data courtesy of Bloomberg, click to enlarge.

The negative-yielding debt pile is set to grow strongly for the time being, and the price of gold with it – for why would own an asset that pays a negative yield, when you could own one that pays zero? I know which I’d rather have. As fund manager Daniel Lacalle recently wrote:

The fact that the most conservative investors are being forced to purchase bonds of nearly bankrupt companies for virtually no yield is not a success of monetary policy nor a tool for growth. It is a monumental monstrosity that will ultimately generate a crisis of unprecedented consequences.

The negative-yielding “high-yield” bonds we wrote of yesterday are only one aspect of the grand distortions the central banks have, and will continue to, create. Pushing investors to take more risk by cutting interest rates has led investors down many other strange paths into assets, inflating their price. These include fine art, vintage cars, and particularly notable to today’s letter – vintage watches.

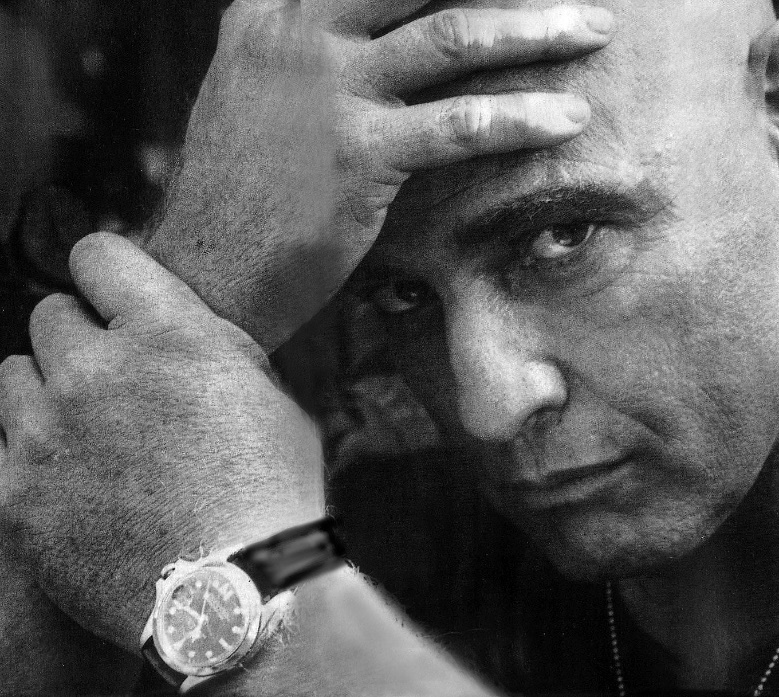

Brando with his Rolex on the set of Apocalypse Now

Brando with his Rolex on the set of Apocalypse Now

The rising prices of these luxury assets have illustrated not only the reach for yield caused by QE, but also the growing wealth divide brought about by these radical monetary policies. Paul Newman’s Rolex Daytona for example, became the world’s most expensive wristwatch to sell at auction in 2017 when it went under the hammer for a record $17.75 million.

The Rolex GMT-Master worn by Marlon Brando in Apocalypse Now is now up for auction too, creating similar levels of hype. Brando gave it to his adopted daughter who has since decided to cash in following the performance of Newman’s Daytona. Though Brando damaged the watch (flipped off its bezel with a knife) this has ended up adding to its value – a legacy its hard to imagine the Kilgore’s at the central banks will repeat.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates