It looks like a bit of a correction has begun in the markets.

Yesterday the FTSE 100 got clobbered again, plunging 109 points to 5,867. This followed a 1.3% drop on Tuesday. It seems investors have suddenly got the jitters that Chinese ‘overheating’ may be a bigger problem than expected, as John Stepek noted yesterday.

Yet just three days ago, everything felt so bullish. Britain’s blue chip index hit its highest point since June 2008 in a welter of upbeat sentiment.

It all goes to show just how tough it can be to make money in the markets. And with the backdrop so uncertain, 2011 isn’t going to get any easier for investors. But there are some golden rules to follow that will keep your portfolio in good shape – regardless of what happens next.

Don’t listen to professional forecasters

We all want to know what will happen next to the economy. And we all have our own views on the subject. Whether these will end up being proved right or not, of course we can’t know for sure.

But there’s one thing that I’m very clear about. The last people we should be consulting are the experts – the economists whose day job it is to make forecasts.

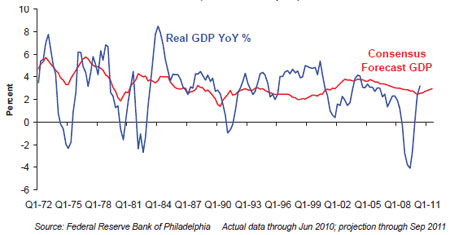

Why? Take a look at the chart below from the US Federal Bank of Philadelphia. It’s one of my favourites.

The blue line is the real – ie inflation adjusted – annual change in US GDP, going back around 40 years. As you can see, this has swung around all over the place. Just look at the early 1980s recession and the follow-on big bounce back in activity. And the chart gives a pretty sobering reminder of how bad the 2008 Great Recession was.

The red line, meanwhile, shows economists’ consensus GDP forecasts. Two things are immediately very obvious. First for much of the time, those predictions don’t even move in line with what actually happened. And second, the experts managed to miss completely all the big booms and busts of the last four decades.

James Montier of fund manager GMO sums up far better than I can. “Economists are simply useless when it comes to forecasting – probably the one group who make astrologers look like professionals when it comes to telling the future. And it isn’t just growth that they can’t forecast: it’s also inflation, bond yields, and pretty much everything else. Attempting to invest on the back of economic forecasts is an exercise in extreme folly.”

The trouble is, as investors, we’re still faced with those share prices jagging around. As well the biggest overdose of financial information ever available in the world’s history. So what should we do if we can’t trust economists to help us navigate financial markets?

Six rules for investing, whatever the markets are doing

Happily, Montier has the answer – some golden rules to follow that should keep us out of trouble, whatever the level of the markets.

First, always insist on a margin of safety. In other words, don’t just buy shares because they’re slightly cheap, but because they look really good value. That way you’ve some protection if your initial forecasts prove too optimistic. And as the old stock exchange adage goes, once you’ve looked after the downside, the upside will look after itself.

Second, be patient. If you buy a cheap stock and the price refuses to rise, don’t panic. You can’t know when the market will recognise the share’s true worth. It may take much longer than you expected. But value will out in the end.

And just as important, if you can’t find an investment that gives you a comfortable margin of safety, then don’t invest. As a private investor, you don’t have to be chasing short-term performance targets – you can afford to wait for better opportunities.

Third, be contrarian. That may be a bit of a sound bite, but if you can buy when everyone else is panicking and selling out, and then unload your stock when the world is piling back in, you’ll do far better than running with the herd.

Fourth, be fully aware about risk. The experts may dress this up using flash terms like volatility and standard deviation. Don’t be fooled. Risk, says Montier, is the “permanent loss of capital, never a number”. That’s another way of saying that if you invest in a stock whose market cap is higher than the underlying company’s real worth, you risk never getting all your money back.

Sometimes you can get caught out – a firm’s real worth can drop (and no doubt someone will remind me about HMV). But if you’ve spread your investments across a diversified portfolio, the damage shouldn’t be too bad.

Fifth, be wary about leverage, ie investments bought on borrowed money. And that applies to the companies whose shares you’re holding. If their debts are high, how relaxed do you feel? Sure, some business – such as utilities with their predictable cash flows – can cope with high leverage. But when times get tougher, many firms can start to struggle with their interest bills.

And finally – and this needs little explanation – never invest in something you don’t understand. Pure common sense, you’d think. But it’s amazing how many investors get sucked into stocks before they’ve worked out what the firms actually do.

These are all basic principles of ‘value’ investing. It’s an approach we like at MoneyWeek.

Our recommended article for today

UK’s recovery depends on companies like this

Britain’s small but resilient manufacturing sector is officially booming, says Tom Bulford. Here, he looks at one small-cap tech company

that’s leading the way to economic recovery.

Category: Market updates