I’m getting increasingly worried about silver.

Just three years ago it launched itself majestically towards the $50 mark like a rocket-powered astronaut.

Ever since it’s been lurching about like a directionless drunk.

Now – and not for the first time – it’s staring over the precipice at $18.

The question is – it is going to topple over?

Silver – a great investment story, but never quite delivers

Silver investors are a funny bunch. Just as silver is ‘gold on steroids’, so silver investors are ‘gold bugs on steroids’.

Unlike namby-pamby gold buyers, who’ve sold off their gold exchange traded fund (ETF) hoardings – NYSE:GLD – by 40%, silver investors hold on and tough it out. The equivalent silver ETF has seen outflows of little more than 10%. They’re more committed.

Many are patriotic Americans who remember the old silver dollar with affection. Money was honest then. An ounce of silver for a day’s work. They believe in their metal. It’s just a matter of patience. Time will out.

They point to the fact that silver, historically, is money. That it means money in some 90 or more languages – shekel in Hebrew, argent in French, plata in Spanish. They point to the fragility of the current financial system and say the answer lies in hard currency.

Then they play their other trump card. Silver is finding more and more uses: as the world computerises itself, it will need endless silver. New discoveries are being made all the time about its ability to combat infection, odour, fungi, bacteria – the undead, even – so it’s finding more and more applications in medicine, biotech and clothing. The world needs more silver.

Then they play a third trump card. There’s a massive short position in silver on the futures exchanges – it amounts to more than annual global production. That silver cannot be delivered. Sooner or later, we’ll get the mother of all short squeezes and silver is going to go to the moon.

There’s a fourth trump card. Large silver discoveries are a thing of the past. Most silver occurs with lead and zinc, but investment in lead and zinc mining has gone the same way as Nick Clegg’s popularity. All sorts of shortfalls in both base metals are projected in the not-too-distant future. The same should also apply to silver.

And there’s even a fifth trump card. There is about 16 times more silver in the earth’s crust than there is gold, but gold is currently around 70 times more expensive than silver. If their prices moved to reflect their relative scarcity (as has been the case in the rather distant past), and the gold price remained unchanged, then silver would be nearly $80 an ounce.

There’s even more to it than that. Pretty much all the gold that has ever been mined still exists, but the silver has been consumed. So silver – say its most extreme believers – could actually go to parity!

Like the irresistible salesman with the shiny white teeth, like the adverts for EuroMillions, silver promises riches beyond the dreams of avarice – but it rarely delivers. And the silver investor walks away shaking his head wearily, incredulously, like the England player who’s just missed a penalty.

Silver is at risk of plunging another 20%

As I’m fond of saying, the more times a price tests a level, the more likely it is to go through it.

Over the last 12 months, silver has tested the $18-19 area time after time. It can only take so many tests. If it breaks down below, we’ll fall another 20% to $14 or $15 before you know it.

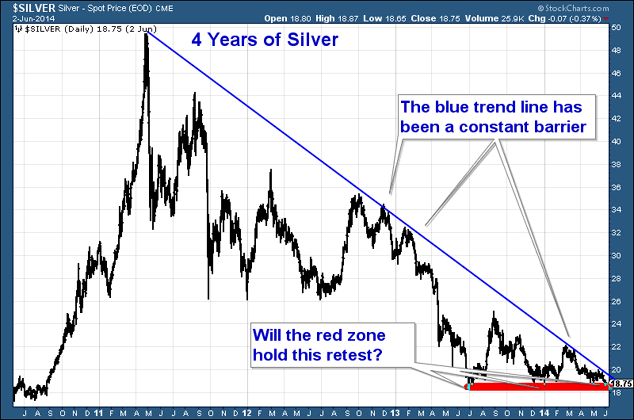

The key area is the red zone in the chart below, which shows silver since 2010.

That would be painful for silver investors.

On the other hand, if silver can manage to meander sideways over the summer months, then it will actually get through that large blue trend line I have drawn off the April 2011 high. That will be some small solace to silver investors.

So what looks most likely?

You would expect to see a bigger washout before the market makes its final low. ETF holdings show that the diehard bunch that are silver investors are holding on still. Perhaps a fall to $14 would see that wash-out.

For now though, it’s all about the $18 level. The big positive is that June is the weakest month in the year for silver. Professional traders look for a June low to buy that silver. Perhaps the low for the year is what we’re seeing at the moment.

I know the chief executive of one large silver mining company stops selling his silver in June for this very reason. If he can, he’ll do his selling earlier in the year and later.

Silver’s time will come again – of that I’m sure. The story is too good for it not to. But we may have to wait quite a while. If there’s one thing silver likes to do, it’s frustrate. And short-term traders in particular should keep an eye on that $18 mark.

Our recommended articles for today

What the rise of the ‘smart home’ means for penny share investors

The big tech giants are busy building the ‘smart home’ of the future, says David Thornton. That’ll open up plenty of ways for investors to profit.

Whatever Neil Woodford’s record, there’s no guarantee his new fund will perform

Fund manager Neil Woodford has been proved his worth in the past. But that’s no guarantee he’ll get it right this time, says Merryn Somerset Webb.

Category: Market updates