I’ve something special for you today.

A few weeks back, I noted that silver was barely stirring when gold began roaring in June. Yesterday, Charlie Morris over at The Fleet Street Letter gave his insights on the precious metals market as a whole and drew some interesting conclusions regarding silver.

Now, my publisher charges a considerable premium for Charlie’s research – quite rightly in my opinion, as his vast experience as a billion-dollar fund manager is incredibly valuable. But with the precious metals market heating up, I’ve been permitted to include a short snippet of it today. Enjoy!

Silver: it’s a waiting game

Charlie Morris

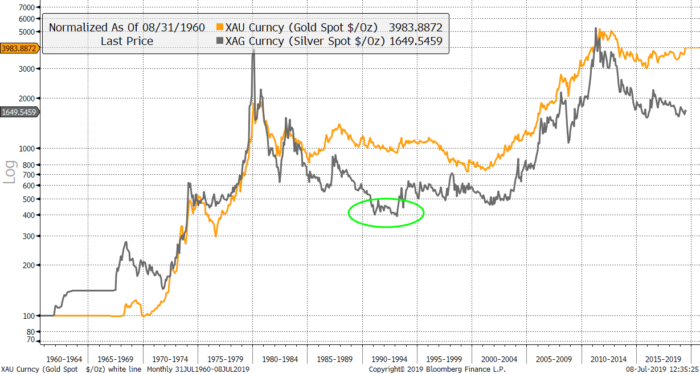

My view is that we are in a gold bull market. The bear ended in late 2015, and a bull started late last year. The driver has been a combination of things, but most important has been gold trading at fair value combined with a fall in real yields. Easy money drives gold. The other precious metals are linked to gold, but not as closely as many believe. We’ll start with silver, and touch on others in the subsequent questions that arrived this week.

The gold-to-silver ratio (GSR) stands at a whopping 93. That is one ounce of gold buys 93 ounces of silver. We have only been in deep cheap territory (such as now) for silver once before, in the early 1990s. I have plotted gold and silver since 1960. Gold was fixed under the gold standard until the 1970s and so silver became a proxy and shot to a premium. Gold caught up when it traded freely and the two stayed in sync until the peak in 1980.

Gold and silver are closely correlated over the long term

Source: Bloomberg –gGold (gold) and silver (grey) since 1960 in USD terms rebased

Source: Bloomberg –gGold (gold) and silver (grey) since 1960 in USD terms rebased

When the bull market ended, silver fell further and bottomed in 1993 at $3.56, having touched $50 at the peak. Thereafter the two prices began to converge, and silver enjoyed a fabulous bull market in the 2000s. In the post 2011 bear, the silver correction was much deeper. The pattern is clear: silver rallies harder during a bull, and falls further in the bear. The spread can be seen on the GSR in the next chart.

Gold-to-silver ratio

Source: Bloomberg – gold-to-silver ratio since 1970

Source: Bloomberg – gold-to-silver ratio since 1970

A high reading makes silver cheap versus gold and vice versa. You can see how wise it was to avoid silver between 1980 and 1993. But to then own it until 2011 was a much better bet than gold. That drop from GSR 99 in 1993 to 33 in 2011 means that silver did three times as well as gold over those two decades.

We need to ascertain what might be the catalyst for silver investors to return. There are a few things at play here. The central bankers have recently been active in the gold market, but they don’t touch silver. Hence gold rises but silver doesn’t. Alternatively, a sceptic might say that silver hasn’t confirmed the gold bull market. I would disagree, because silver’s not going down, it’s just not going up; which isn’t quite so bad.

Ultimately, and industrial usage arguments aside, it is investors that drive the silver price to a premium over gold. They have been largely absent which you can see in the final chart. I know silver coin demand is not included, but the state of the exchange-traded fund (ETF) market is telling, and certainly representative of a wider trend.

Silver investor demand

Source: Bloomberg – silver price (grey) and the number of ounces of silver sitting in ETFs around the world (purple) since 2006

Source: Bloomberg – silver price (grey) and the number of ounces of silver sitting in ETFs around the world (purple) since 2006

Notice how investors bought silver up until 2011, adding 500 million ounces of silver, but then they stopped. And that’s the problem for silver – no one is buying it. You can tell that there is a surplus, because the price fell on stable investor holdings. Had they sold, the price would have fallen even further.

My unscientific view is that to get silver going, investors need to view it as a cheap alternative to gold en masse. It would be better to switch when the trend gets going. In the meantime, the gold miners are on the move, so better to focus there than in silver…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates