If you’ve been trading sterling over the last few days, I tip my hat to you. If you’ve turned a profit, I tip it again.

With another vote of no confidence on the table, the distinct lack of a dull moment in British politics continues. Let’s wait and see if we have a general election on our hands. As my colleague Charlie Morris observed in the last issue of The Fleet Street Letter, the last time we had a socialist government the FTSE plummeted 70%.

I’ll need to ask Charlie what his strategy will be should Jeremy Corbyn get into No.10. Markets (generally) have a long memory, and so the announcement of such a possibility through a general election should inflict yet more pain on the FTSE.

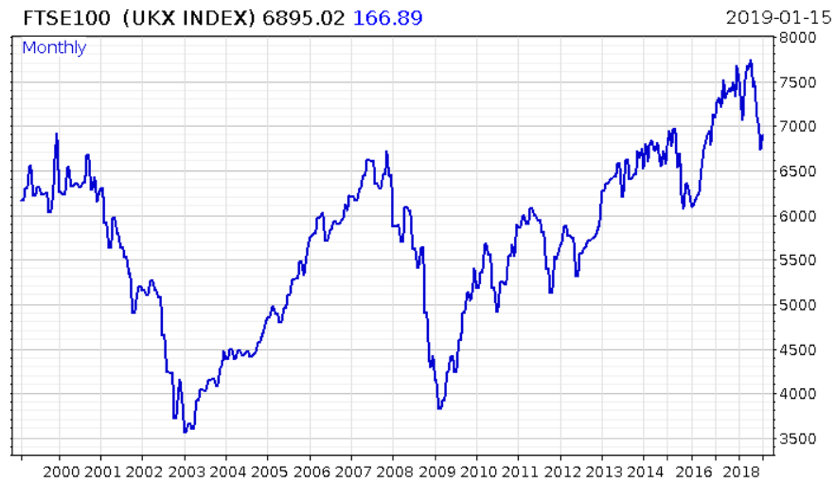

You may notice from the chart above that the FTSE 100 is currently lower than it was in 1999. The next time you hear somebody recommend passive investment funds, remember that folks who followed that strategy and bought the FTSE before the millennium only made a capital gain a couple of years ago, and are currently underwater yet again.

If you did buy the FTSE in 1999, at least you’ve made some decent dividends over the years. And hey, at least you’re not French.

… by which I mean, at least you didn’t buy the French stockmarket at its millenium peak. The poor bastards who did that have been submerged ever since and didn’t even see the sunshine during the boom before the financial crisis. The yellow vest protestors have no doubt added to the grief of the passive French stock investor. But interestingly, not to the French bond investor…

Where are the bond vigilantes?

I used to think if there was reincarnation, I wanted to come back as the president or the pope or a .400 baseball hitter. But now I want to come back as the bond market. You can intimidate everybody.

-James Carville

The Israelis, ever the innovators in military technology, modify small commercial drones from China to fire tear gas grenades at protestors.

The French however, are well behind the curve and their riot police are firing tear gas “manually” down at the yellow vest protestors from helicopters.

Not that the people who fund the French government seem to mind. French bond investors have effectively turned a blind eye to the widespread unrest, charging the Emmanuel Macron administration a mere 0.6% in interest for long-term borrowing.

With French riot police now facing down the Gilet Jaunes with semi-automatic rifles (German made, of course), I’m left wondering whether the French bond market would notice if Macron ordered his men to “aim for the yellow vest” and shoot his own citizens.

Bond traders are supposed to be smarter than equity traders, with a keener sense of what lies around the corner – what do they see that I don’t? My colleague Nick Hubble (who in recent times has been only too right about the problems facing the eurozone) rightly questioned what the yellow vests can actually do to change things except vote, for if they can’t change anything, then why should they affect markets?

Well so far, they’ve managed to destroy 60% of the speed cameras in France, got Macron to blow out his budget deficit, and now they’re trying to force a bank run, by withdrawing all their cash from French banks. The European Central Bank, being a liquidity machine, should confound that goal, but just an attempt at this reveals the level of discontentment with the status quo in France, which I expect must bleed into the French bond market sooner or later.

I maintain that this year we’ll see much higher French bond yields when investors appreciate the gravity of the widespread domestic unrest in France. Let’s watch.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

PS Despite all the Brexit drama, and anger at the current administration from all sides, we’ve not experienced anything like the levels of domestic unrest going on in France – not yet, anyway. Why do you think that is? I’d love to know your thoughts: [email protected].

Category: Market updates