The CNN Fear & Greed index, which gauges the mood in the US stockmarket from utterly terrified at 0, and scandalously greedy at 100, is currently displaying a reading of… four.

Fear is in fashion.

But so far, the American stockmarket has only fallen to levels we last saw in May last year:

Just imagine if the Americans were like us, and their stockmarket had fallen to 2016 levels:

As macro trader Raoul Pal put it recently:

Just so we are clear: a recession usually leads to a 30% to 40% fall in equities, a big recession usually has a 40% to 60% fall and a depression is 60% to 80%. We haven’t even priced in a recession yet. There is a long way to go.

If things keep getting worse, I think CNN is going to need a new gauge.

Thankfully, there are more insightful indicators you can use to inform your investment decisions – gauges which will tell you in short order if the mighty bear market has come to shred your portfolio to pieces. And at 2pm today, you can get access to them yourself

CNN could of course just let its gauge run into negative territory. We let plenty of things go negative in financial markets these days in ways which don’t make much sense, so I guess “negative fear” wouldn’t be much of a stretch…

Negative thinking

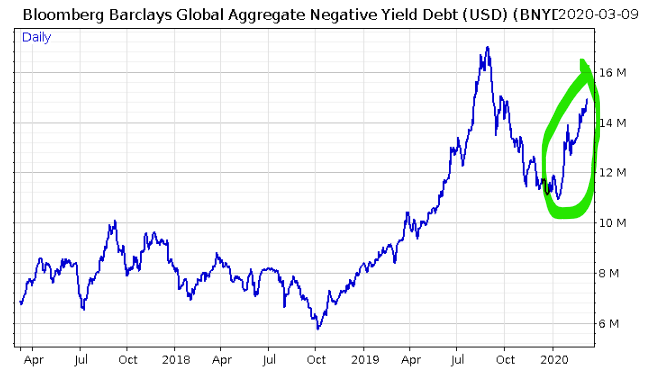

Debt that pays negative interest is all the rage right now. In fact, coronavirus has only made it more popular:

That scale on the right there is in millions, so I’m afraid there’s not just $14 million of loans which don’t make sense out there, but $14 trillion.

Sadly, it’s not just anybody that’s getting paid to borrow money though. Nobody’s getting negative interest rates on their credit cards – anytime soon, anyhow.

Instead, it’s governments and large companies that are being paid to borrow. Loans to a government can be safer than a loan to a bank in some circumstances, and a loan to a bank is all a bank deposit really is.

But even loans to governments are being defaulted on now. Lebanon decided the other day that it was suspending payments on its debt until further notice. It’s the rarely occurring, but highly dangerous case of a sovereign default. As banks use sovereign debt as a safe asset they can lend against, destroying that asset by defaulting on it can subsequently destroy a nation’s banking system.

This is particularly risky in the eurozone, as member nations cannot print their own money to pay off their debts and so must either issue more debt (and there’s only so much they can do of that), raise taxes, or rely on the European Central Bank (ECB) to bail them out. Lebanon defaulted on its debt as it had borrowed in US dollars, which of course it cannot print.

Similarly, Italy can’t print euros – only Christine Lagarde can at the ECB. Something to bear in mind considering the lack of taxes that Italy will be able to raise now that it has locked its entire country down…

The Millennium Bug, but for humans

About a month ago, I was thinking coronavirus was having a similar impact on markets as the Millennium Bug, or Y2K, did. The Millennium Bug was similarly high profile, caused central banks to flood the financial system with cash “just in case”, and triggered significant expenditure from governments and companies hoping to avoid it. Importantly, that flood of cash helped cause the melt-up in the US stockmarket, and the dramatic boom and bust.

More recently however, Eoin Treacy made a similar comparison to the late 90s, which may be a better fit to the current scenario. Coronavirus and its effects remind him of the Asian financial crisis, which in turn led to the Russian government defaulting on its debt in 1998 and then the bailout of Long-Term Capital Management, the $126 billion hedge fund.

The slowdown in China, and now the Lebanese default, made me think this comparison may have merit – albeit this time, events are occurring at a much accelerated rate. All we need now is a massive hedge fund to blow up, and considering the massive volatility spike we’ve seen across multiple asset classes, that sounds quite probable – certainly within the realms of possibility.

When stockmarket volatility blew up in early 2018, LJM Preservation and Growth was destroyed virtually overnight. Later that year, a fund called OptionSellers was ruined when volatility in the energy market exploded.

Volatility in stocks, bonds, oil, gold, and currencies has exploded over the last few weeks, in many cases more strongly than what was called “Volmageddon” in 2018. Chances are, somebody, or more likely multiple somebodies, have got absolutely destroyed…

Volatility in itself is not a negative thing of course. It’s just used mistakenly by many market participants as a byword for “risk”, which is incorrect. The volatility of individual stocks and other assets can be used very effectively to gauge how much exposure you should have to them – and if, in an environment like now, they’ve become dangerously unstable. You can find out how to harness “vol” to your benefit

Saudi Arabia’s scorched sand policy

“This is the financial crisis for oil,” said Ian Nieboer, head of macro research at RS Energy Group, part of shale data provider Enverus. “Except the producers aren’t too big to fail.”

– Financial Times

I used to play my father at chess all the time when I was a kid. I still do occasionally when I’m back in Aberdeen for old times’ sake.

As you would imagine, he would always beat me when I was growing up. It was only when I hit my teenage years and began playing much more aggressively that I had any success. I realised if I was constantly willing to sacrifice any of my own pieces for his, it threw him off guard, and made him rein in his attacks and play much more cautiously. It was then, faced with an opponent forced on the defensive, that I could gouge any victories.

The thing with chess is that it teaches you the principle of making sacrifices for greater strategic gain. If you can’t bring yourself to sacrifice pieces or at least take calculated risks, you’re not going to get very good at chess. Or at least, that was my experience and what I take from the game.

There’s a strategy in chess called the “desperado”, whereby you sacrifice one of your pieces, or at least risk losing it, in order to take out an opposing piece or keep your opponents king in check.

While chess analogies are pretty cliché, I believe that the US and Saudi Arabia have just employed their own “desperado” play in the oil market.

While Washington has not taken any credit for Saudi Arabia’s decision to drown the world in oil, I believe the US was been a significant driver of the move behind the scenes, even if it seems counterintuitive.

Crushing the oil price hurts both countries hard. Saudi Arabia losing vast quantities of government revenue, while the US faces the bankruptcy of its cherished newborn energy industry. It’s something of a “scorched earth sand” policy.

The move comes at a time when the coronavirus was already ravaging Iran’s elderly government and population, on top of the low oil prices caused by the outbreak of the virus in China. By ramming the oil price lower, Iran’s government will be even further starved of funding, and it may push the regime over the brink into outright social unrest and chaos. Opportunities like that don’t come often, and both countries have been trying to crush Iran for decades or longer.

On top of this, the US gains the benefit of further tightening the screws on the Venezuelan government, which has managed to resist the US’s “Operation Venezuelan Freedom” attempts over the last few years.

Considering the awful hardship that has been endured by the population so far, one dreads to think how bad it will get when the oil price starts translating into drastically lower revenues – they’ve already been reduced to eating their pets and zoo animals.

Margaret Thatcher described the problem with socialism being that eventually you run out of everybody else’s money, but the Nicolás Maduro regime run out of that a long time ago. All that remains is Venezuela’s meagre oil output, which itself has been crippled by corruption, bureaucracy, and graft: PDVSA, the state run oil company, produces a third as much oil as it did pre-socialism, while its employment has more than quintupled. I expect this price collapse will take away the last leg the state has to stand on, and the US will become much more assertive in the region.

The US will do what it can to subsidise or bail out its shale sector for the strategic advantages it brings. But Venezuela, with the world’s largest proven petroleum reserves, is a prize in a class of its own which Washington will try to secure for itself. Expect the US to intervene in Venezuela this year when the chaos reaches a fever pitch.

On top of this, I expect we’re going to see another major move by Iran to up the oil price. This may be a repeat of last year with a drone strike attacking Saudi oil production, shutting down the Strait of Hormuz through which vast quantities of global oil flows, or funding a terrorist organisation elsewhere to cause more disruption or damage against US or Saudi personnel.

I argued yesterday that the low oil prices would be a boon to the global economy, but not to the oil producers. While it is savers who have been getting wrecked to keep the show on the road following the financial crisis, now the producers of oil are being ploughed to keep the dance in motion.

But as Ian Nieboer said in the FT, the oil producers aren’t too big to fail. Whether or not they do – in Texas, in Iran, or in Venezuela – is the next big question, and what I’ll leave you with for today.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates