There are always wars of opinion within the investment community – it’s a difference in views that makes a market after all.

The more long term the issue is, the more likely you will find a binary split where two distinct groups have formed to argue over it.

You get the inflationistas and the deflationistas, who argue over whether the global economy will die by the fire of currency debasement… or the ice of unserviceable debt burdens.

And then of course there are the “oil is great” folks, in strong opposition to the “oil is dying, and should be euthanised” folks…

You get those who believe that the US has fallen into deep decay from which it cannot recover, and that China is about to take its rightful place as the number one great global power (if what I sent you yesterday is any guide, let’s certainly hope not).

And then out come the American exceptionalists, who argue US assets are still safe havens, that the US consumer has a lifetime of buying still to do, and the US military still has the 11 carrier strike groups to counter any foreign threat.

On the fringes there are the gold bugs and the US dollar bulls who fight endlessly over which is the “real” money, and which will rise in the next crisis…

But in today’s note, I’d like to highlight a more short-term rift that has similarly bifurcated the investment community: those who believe the coronavirus is a buying opportunity, and those who believe it’s a black swan event about to nuke asset prices.

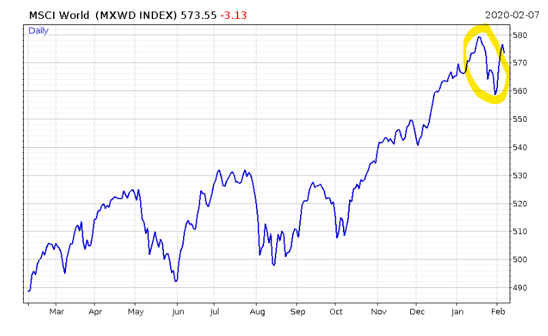

What’s going down in Chinatown? Not stocks…

That dent on the right there is all the coronavirus has done to the global stockmarket. As you can see, it’s bounced to the point where it’s almost recovered.

All quiet on the global front

All quiet on the global front

Source: FullerTreacyMoney

Wander into a stockmarket which you’d think would be particularly panicky about the pandemic like Hong Kong, and you’ll be disappointed by the drama.

Hell, that series of higher reaction lows on the index, that ascending series of bounces since August, is actually a bullish indicator…

More like a mounting crescendo than a climactic end song

More like a mounting crescendo than a climactic end song

Source: FullerTreacyMoney

And it’s not just stocks that have shrugged. Even the area of the market most susceptible to changes in perception – especially fear – is in a remarkably dozy, docile state.

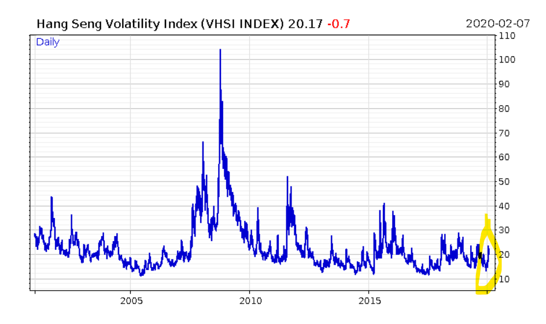

We’ll start with Hong Kong this time before zooming out.

Here is the Hang Seng Volatility Index. It measures the price of insuring against sudden moves up or down in the HK stockmarket using options (specifically, it measures the deviation in options prices).

As you can see, there have been numerous occasions just in the last five years where volatility in this market has been significantly higher than it is now:

Pandemic? The Hong Kong “fear index” doesn’t seem to be afraid of it.

But that’s not the half of it. Zoom out from Hong Kong and you find one of the strangest charts I’ve ever seen…

Extreme apathy

Were a pandemic to halt the world’s manufacturing in some places, and suddenly crush demand for it in others, you would imagine that the currency market would get pretty volatile, as markets sought to discount and offset differing slowdowns between different countries.

Throw in an ultra-high profile US drone assassination in the Middle East, bushfires ravaging the Aussies, the resignation of a Russian prime minister and his cabinet and Brexit finally happening, you’d think the FX market might be home to some serious goings-on.

But you’d be wrong. Because despite all of the above…

… there’s nothing going on in the currency market.

Indeed, for G7 currencies, there is less going on now than there has ever been since records begin for the index in 1992:

All quiet on the currency front. This index measures the cost of hedging against short-term volatility (up or down) in the FX market for G7 currencies.

All quiet on the currency front. This index measures the cost of hedging against short-term volatility (up or down) in the FX market for G7 currencies.

Source: FullerTreacyMoney

“Well Boaz,” you might counter matter-of-factly, “China isn’t a G7 country, so why would the coronavirus be creating volatility in the G7 FX market?”

Fair point – but even if you disregard how dependent countries like Germany are on Chinese economic growth… there’s nothing going on in emerging market (EM) currencies either:

Volatility in the EM space has been lower than it is today: in late 2014 by a whisker. But why is it that nobody seems to care about the virus, not those in stocks, or those in currencies?

I had predicted we would see an aggressive decline in volatility this year (Sunrise on the retail volatility salesman? – 4 December 2019) but that was before the coronavirus was on the scene. Now that it is, even I’m surprised at just how mute the market’s response has been – especially when you consider the amount of media attention it’s getting.

Hell, even Bloomberg, which ranks at the top for appeasing China, has begun laying in.

From the article:

Grocery runs in Asia’s financial powerhouse have begun to remind me of shopping in Russia in the chaotic summer of 1998. You grab what you can find, and if there is a queue, you consider joining it. Surgical masks and sanitizer gel are bartered for; detergent shelves are bare. A run on toilet paper last week, after an online rumor, was reminiscent of Venezuela…

No loo roll. But no fear in the market either. Hmmm…

My colleague Nickolai thinks the central banks have succeeded in “printing an antidote” – not for the actual virus, but for the market’s reaction to it.

I’m not so sure. As I noted earlier, there are some pretty loud voices in the investment community who are yelling out that the coronavirus will be at best a major headwind for asset prices this year and at worst, well an awful lot worse. I’ve an idea what might be driving this strange situation forward – but that’s enough for one day. I’ll explain my theory tomorrow.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates