“America’s predicament is tantamount to that of the Soviet Union”, runs the front page headline of a Chinese newspaper. “The American Empire is abandoning the values that have been regarded as its standard, such as the family and religion. And some traditional architectures, such as the military, are in deep turmoil…”

We remarked on Monday how the existence of Cold War II is more obvious in Chinese media.

But if the Chinese Communist Party pulls a Tiananmen Square in Hong Kong, you’ll see a lot more recognition in the West that China hasn’t become liberal just because it got plugged into liberal market economies back in 2001. Unless China backs off entirely (not going to happen), the situation will reinforce ever further the growing contrast and conflict between East and West.

The Hong Kongers protesting the mainland’s creeping control over the city say they’re prepared to die for their movement. The People’s Liberation Army and the People’s Armed Police stand ready to take the Soviet approach to political dissent. The nights are already filled with violent clashes.

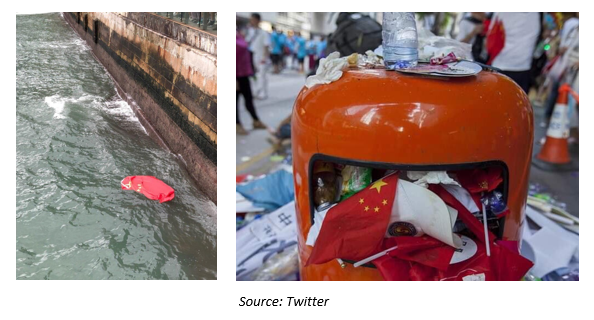

The protestors ripped the Chinese flag down and chucked it in the harbour a few days back, sparking outrage in the mainland. Curiously however, counter-protestors who held a pro-Beijing rally in Hong Kong were happy to dump their flags in the bin right after.

How much of this protesting and counter-protesting is being orchestrated by third parties is anyone’s guess. But the manner in which the Chinese government straddles Hong Kong is a good indicator of how it’ll try conquering Taiwan in the future.

How much of this protesting and counter-protesting is being orchestrated by third parties is anyone’s guess. But the manner in which the Chinese government straddles Hong Kong is a good indicator of how it’ll try conquering Taiwan in the future.

The stakes are much higher in Taiwan of course – the US state department just rubber-stamped a $2.2 billion arms sale to the country. Should China attempt a military invasion, Taiwan would be able to launch a massive strikes on the province of Guangdong, a massive economic hub and home to many of China’s elites. A subtler approach will likely be needed…

But enough wargaming – back to the markets.

If any currency is going the way of the Soviet ruble, the Chinese renminbi is getting there faster than the USD.

How many renminbi a dollar will buy you over the years

How many renminbi a dollar will buy you over the years

The US Treasury has now formally labelled China a currency manipulator. Having cracked seven against the greenback, the Chinese have allowed the redback to fall further, standing at 7.05 at the time of writing.

(There’s a rumour going around that the sudden and unexplained resignation of HSBC’s new CEO is tied to this. The story goes that he was fired after the Bank of England discovered HSBC was lending billions of dollars to the People’s Bank of China to keep its currency propped up.)

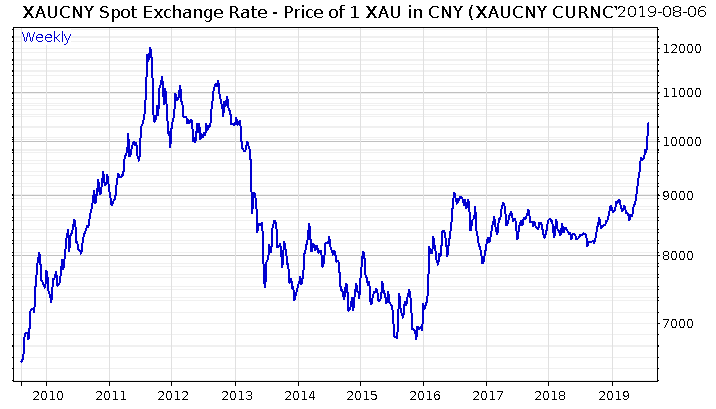

As you’d imagine, with the value of the redback falling, the price of gold in redbacks is running like it stole something:

In a short aside, gold has reached all-time highs in 73 currencies now, including our own here in Blighty. The Chinese haven’t made it there yet, but give it time.

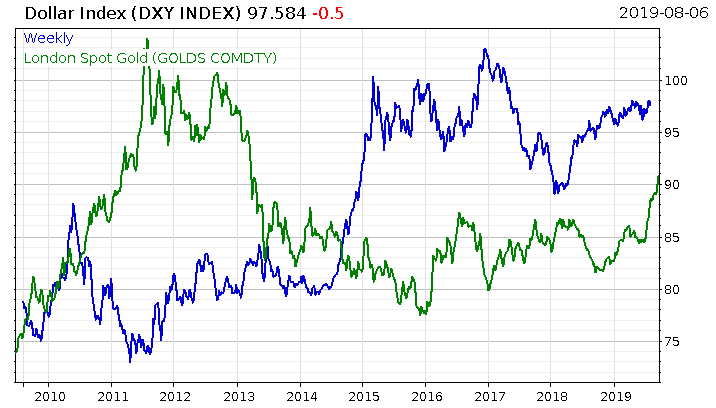

Demand for the yellow metal is such that its price is rising in dollars… while the dollar is rising against everything else!

As you can see below, with the dollar in blue, and the price of gold (in dollars) in green, it’s pretty rare to see the pair move in the same direction.

But the weaker the renminbi gets, the cheaper China’s exports will become, exporting deflation to the rest of the world. This will deepen the East/West China divide, as no government wants to import deflation, and make their debt burdens heavier. What the US wants is for the rest of the world to import their goods from elsewhere, further amplifying the divide.

Globalisation, as experienced in the 90s and 00s, is over. Countries will now need to pick sides, and eat the additional costs which that loyalty creates.

The US’s shift from China engagement to China containment has not gone unnoticed by the Chinese people, and is beginning to show up in their import data. From Russell Napier in The Solid Ground:

If a people who increasingly see themselves as under siege change their view of foreign products, this should be evident in import numbers and China’s imports are indeed contracting, despite reported real GDP growth of 6.2% in [the second quarter of this year]. Import growth of US products has seen a particularly rapid decline of 31.4% in 2Q 2019. This is not just about changing attitudes in China towards US products, but a shift to a siege mentality is important as it can persist even if direct action by the state to reduce imports comes to an end. While such a shift by the state is possible, it is not probable, as there is evidence that the state is preparing for a siege/containment and not a trade war.

This Cold War, like a siege, will not end quickly. Buckle down for the long haul.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates