I had this one stock waiting in the wings, which I was dying to recommend when the conditions were just right.

But as luck would have it, just as those conditions are arriving… I can no longer recommend it.

The post-crisis monetary stimulus by central banks were supposedly “temporary measures” to be withdrawn once the emergency of the crisis had passed. But here we are, over a decade later, with more rate cuts and asset purchases around the corner. As Milton Friedman so rightly put, “Nothing is so permanent as a temporary government program.”

Just this morning, Mario Draghi has said that the European Central Bank has “considerable headroom” to buy even more bonds (on top of its current pile of €2.4 trillion), and to reduce interest rates even further (they are already negative).

This further stimulus (temporary, no doubt) will be rendered for the same reason the last stimulus was: to spur spending, which would generate inflation and reduce the burden of debt. What it really did was inflate the value of assets, the majority of which are owned by a small, already rich cohort of the population. And while the stimulus may have grown their wealth, their spending does not, on aggregate, drive inflation higher.

Eurozone inflation expectations hit all-time lows last week, which is a likely driver of Draghi’s latest simulative plan. The beatings will continue, until morale improves.

But for those on the receiving end of these asset purchases, this relentless roll-out of absurd monetary stimulus is no beating at all – quite the opposite. And though the spending of the ultra-rich doesn’t drive consumer inflation figures, that doesn’t mean they don’t buy things.

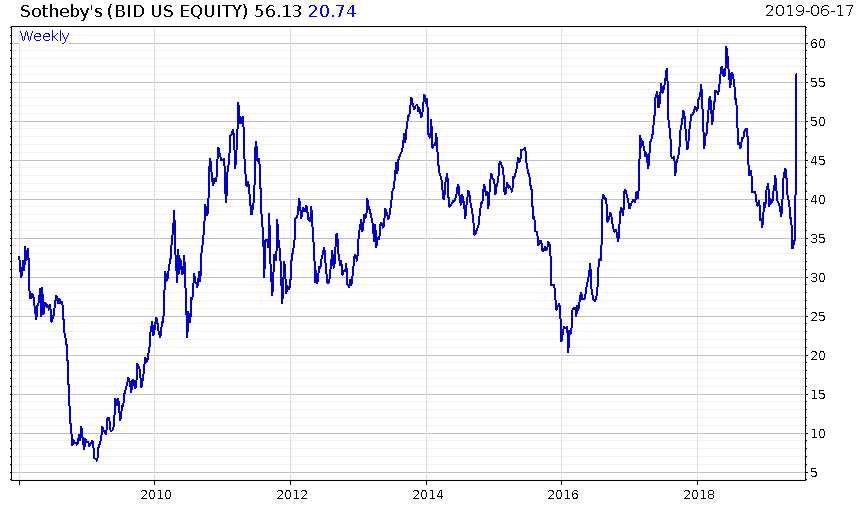

That’s where this stock comes in. Investors who’ve owned it have effectively taken a clip of the free money poured in by the central banks, just second hand: Sotheby’s ($BID).

The auction house has boomed multiple times since the crisis, booming roughly whenever the Federal Reserve has announced a round of quantitative easing.

Not only has the stock benefited from the very wealthy topping up their art collection with their freshly inflated wealth, but it also benefits from the rise of the alternative investment industry. Low interest rates have driven investors to esoteric assets like art and antiques in search of returns, and Sotheby’s has taken a clip of its ticket too.

With more stimulus on the way, further wealth inequality and the “reach for yield” are once more on the cards. With Sotheby’s primed to benefit, I wanted to tip it. But sadly, as you may have guessed from the vertical line at the far side of the chart, Sotheby’s is likely about to go private, thanks to a buyout offer from billionaire Patrick Drahi.

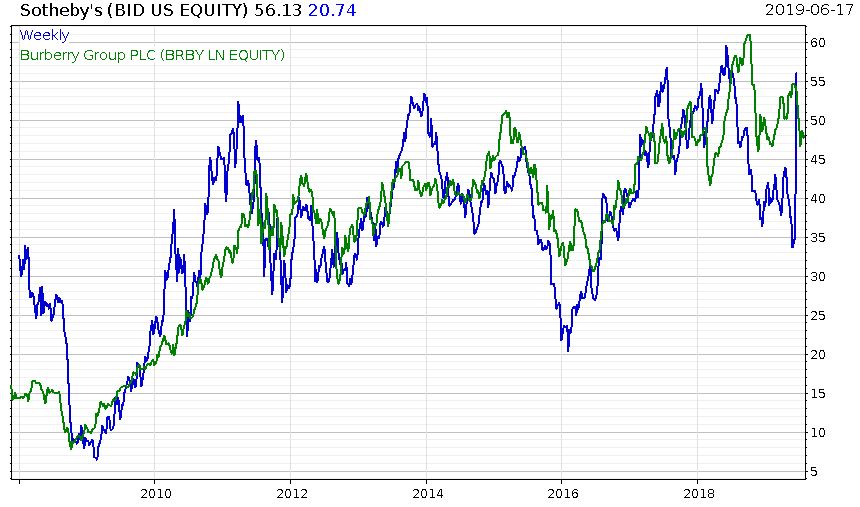

Luxury goods retailers are still primed to benefit from more stimulus, like Burberry (£BRBY) which has tracked Sotheby’s pretty tightly.

However, Burberry doesn’t offer exposure to the boom in art and alternative investments, and is exposed more to the rise of the nouveau riche in China (the Asia Pacific region accounts for 40% of its revenues) than Sotheby’s.

It’s somewhat ironic that this stock, a means for the retail investor to benefit from the rise of wealth inequality, is being taken private by a billionaire. There are multiple reasons for the growing wealth divide, like the rise of the Silicon Valley Lords, but central banks are still key to this gap.

Today in the US, the top 0.01% are now taking home a larger slice of the pie than they were at the height of the Roaring Twenties: 5.1% of total US income is earned by this tiny minority, surpassing the 4.8% reached by the “Robber Barons” in their 1920s prime.

And while I expect the next round of stimulus will further this divide and drive asset prices up further, at some point a political actor, buoyed by negative public sentiment, will direct the power of the government in an attempt to close it directly.

As Luke Gromen, a gold expert I had the pleasure of speaking to recently , wrote on the rise of populism, “It seems as though the financial crisis everyone has been looking for in the markets… has begun arriving in the ballot box!”

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates