Imagine an investment that made you rich… and made you feel like the planet’s saviour?

A winning combination, right? Great investment gains plus a higher self-esteem… who wouldn’t invest? It’s a Prozac investment play.

I think I’ve found what could become the ultimate “Prozac investment play”… though if I’m right, it’ll all end in tears.

Zealous attachment to your investments should be avoided of course, as emotions cloud judgement and lead to poor decisions. A financial market is no place to go looking for lasting happiness, even if it can yield riches. But some assets are a magnet for zealots.

Take gold for example. Now, I freely admit that I’m quite attached to my holdings of the yellow metal, and can’t really imagine a scenario where I would happily reduce those holdings to zero. But for some “gold bugs”, their attachment is much deeper – they see their ownership of the metal as a moral act, symbolising their rejection of fiat currency.

This can be seen too in the crypto space, where highly strung crypto enthusiasts scream of wresting back currency control from “the banksters”. With bitcoin reminding everybody that high volatility cuts both ways (dropping £400 in 25 minutes this morning), such an attitude is not conducive to high investment returns, or to a happy state of mind.

But it is conducive to the creation of asset bubbles, which is what today’s note is about. And if you can predict where the next bubble will emerge, you stand to make an awful lot of money (provided you too don’t get swept up in a tide of emotion and refuse to sell).

I have a candidate for you to consider.

A bubble in… smoke?!

In the last couple of weeks we’ve been looking at how central bankers may and the government does intervene in the economy in the name of fighting climate change.

Should the central banks start investing their reserves in green energy projects or (heaven forbid) printing money to fund them, I’ve no doubt there will be a bubble in that sector. But today I’d like to introduce the possibility of a bubble in green energy’s total opposite.

A bubble in CO2 emissions.

Before you dismiss me as a nut-job, I’m not referring to a bubble in smoke, or anything like that.

I’m referring specifically to CO2 emissions credits.

This is one of the most synthetic investments in the world. In a way, it is a commodity… but the demand for it, the supply of it, and the market upon which it is traded have all been created by government diktat.

Specifically, EU dictat, which requires carbon-emitting businesses within the EU to own and deliver unto the EU one such carbon credit (known as an EUA, or European Union Allowance) for every tonne of CO2 they emit per year.

Companies which buy too little, or too many, of these credits at the daily auctions can trade them with each other on the EU Emissions Trading System, or ETS. You effectively end up with a market price for one tonne of CO2.

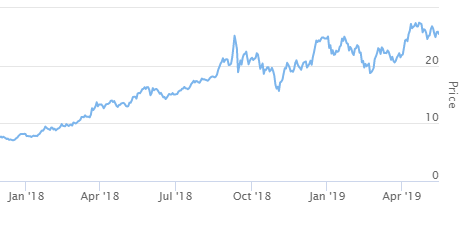

In recent years, this “commodity” has performed extraordinarily well, delivering triple-digit gains since 2018. And as a result, carbon-emitting businesses are paying more and more to emit carbon.

While it is possible for retail investors to own carbon futures, this silent boom has flown under the radar of many investors. But what if climate change activists cotton on to it?

Because if enough people invest in carbon credits, and increase their price, they will reduce the amount of carbon that all polluting companies (in the EU at least) can produce.

So by investing in carbon futures, and then telling all their activist buddies to as well (could work perfectly as a viral social media campaign), a climate activist could not only get the self-righteous satisfaction that they’re saving the planet, but get rich at the same time. A deadly combination, with bubbly consequences.

We’ll have to wait and see if the eco-warriors catch on to carbon, and inadvertently create a “Ponzi to save the planet” (“wealth lost in a puff of smoke” – can see that as a news headline).

The underground was recently full of ads inviting commuters to “make good money” (another Prozac investment invitation) in green investments, and the market for such investments is now bigger than ever. But while green and renewable tech is becoming ever more efficient, as a contrarian, this is making me bullish on coal.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

PS I’ll be writing Southbank Investment Daily next week, but will be back writing Capital & Conflict the week after. In the meantime, I’ll be leaving you in the capable hands of Nick Hubble who’ll be telling you just how awry things are going in the eurozone. Enjoy!

Category: Market updates