“We should be happier to have a job than to have our savings protected”

– Christine Lagarde, president of the European Central Bank (ECB) as of today

If you work in the eurozone, and plan on retiring… at any point, ever, I encourage you to take a moment and reflect on the quote above.

If you live in the eurozone and have already retired, I encourage you to do the same. That, and take a look at nearby job vacancies.

The statement by itself is a curious one (job security can only be achieved by endangering savings, and vice versa..?). But it’s especially strange for a banker let alone a central banker to say, when you consider one of the most basic purposes of a bank is to protect the savings of its account holders.

But the protection of savings is now secondary to the other primary purpose of a bank: the creation of credit. And with Lagarde now in charge at the ECB, the extension of credit unleashed on central Europe will be on a scale never seen before. A grand flow of new money, created in a few keystrokes at the ECB, that will let governments and banks float, and those with savings and pensions sink.

Upon reading this incredible statement from the newest monetary overlord on the scene, I was reminded of an email a reader of this letter had sent in a while back. I sought it out, to find it’d arrived a year and a week ago in my inbox, and while this was intended as an aside, the way it was phrased stuck in my memory:

… (by the way, aren’t savings what give the “little people” access to capitalism?)

… I guess the “little people” should be happy just to get a job. Or just to keep one, if they were planning on doing anything other than knackering themselves to death at retirement age. And as for capitalism, well, the fellas at Bloomberg have a rather… different path for her in mind:

This has to clinch it for Worst Headline of the Year 2019

This has to clinch it for Worst Headline of the Year 2019

The fringe idea that the West is returning to a feudal system is made more plausible by events and commentary such as this. Passages from The Creature from Jekyll Island by G Edward Griffin, a classic of the financial conspiratorial genre, begin to seem less extreme:

… political leaders are becoming addicted to the IMF cash flow and will be unable to break the habit… countries are being conquered by money instead of arms. Soon they will no longer be truly independent nations. They are becoming mere components in the system of world socialism planned by Harry Dexter White and John Maynard Keynes. Their leaders are being groomed to become potentates in a new, high-tech feudalism, paying homage to their Lords in New York. And they are eager to do it in return for privilege and power within the “New World Order.” That is the final play.

… By this mechanism—and with the output of work battalions—government can operate entirely without taxes. The lifetime output of every human being is at [the state’s] disposal. Workers are allowed a color TV, state-subsidized alcohol and recreational drugs, and violent sports to amuse them, but they have no other options. They cannot escape their class. Society is divided into the rulers and the ruled, with an administrative bureaucracy in between. Privilege is now largely a right of birth. The worker class and even most of the administrators serve masters whom they do not know by name. But serve they do. Their new lords are the monetary and political scientists who created and who now control The New World Order. All of mankind is in a condition of high-tech feudalism.

Returning to reality however, and Lagarde has plenty of work on her hands if she wants to lead a “Cultural Revolution”. We argued that Lagarde’s unsaid mission was to create fiscal union within the eurozone back when she was nominated for the role (The silk noose – 8 July). Her work starts today, but she’s already begun naming her targets. From the Financial Times (emphasis mine):

Christine Lagarde has called on Germany and the Netherlands to use their budget surpluses to fund investments that would help stimulate the economy, in a sharp rebuke that comes only days before she becomes European Central Bank president.

The former head of the IMF said there “isn’t enough solidarity” in the single currency area, adding: “We share a currency, but we don’t share much budgetary policy for now.”

“Those that have the room for manoeuvre, those that have a budget surplus, that’s to say Germany, the Netherlands, why not use that budget surplus and invest in infrastructure? Why not invest in education? Why not invest in innovation, to allow for a better rebalancing?” asked Ms Lagarde.

The German government’s budget surplus, may ironically be diverted mending the rifts created by quantitative easing and low interest rates however. Some 40% of German defined benefit (DB) pension schemes are still open to new members, which on the face of it seems great, as at least some of the younger generations will be able to benefit from them upon retirement (only 20% of DB schemes are still open to new members here in Blighty). On closer inspection however, the reality is less rosy.

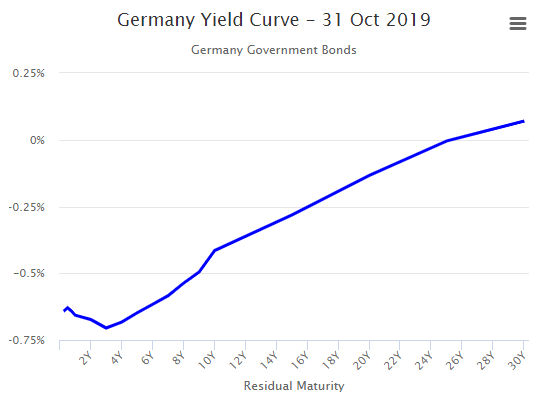

77% of German pension assets are invested in bonds. While most investors are aware that there is little in the way of income yielded by bonds, German bonds are particularly naked of returns, and it just so happens that it’s these bonds that German pension schemes own boatloads of:

German yield curve. Yield displayed left, duration of bond below.

German yield curve. Yield displayed left, duration of bond below.

Source: World Government Bonds

With German baby boomers reaching retirement age in large numbers (though Germany’s baby boom was admittedly weaker than other Western countries), these pension schemes will come under significant strain.

Those promised a retirement may well have to return to work – but of course, they should be happy to get a job in the first place. Such jobs are, after all, more important than their savings.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates