“I reached pension age and then I ran out of money. So it occurred to me – perhaps I could live for free if I lived in jail. So I took a bicycle and rode it to the police station and told the guy there: ‘Look, I took this.’

“… It’s not that I like [being in jail] but I can stay there for free, and when I get out I have saved some money. So it is not that painful.”

– Japanese pensioner

To many foreign observers, Japan is an enigma.

A land as incredibly advanced as it is socially conservative.

A land where you can buy everything from umbrellas, to hamburgers, to neckties from vending machines with the likes of Tommy Lee Jones on them…

Source: Flickr

Source: Flickr

A land where trains never run late, and operators apologise profusely when they leave 20 seconds early.

… and where pensioners commit crimes purely so they can go to jail.

I’m afraid it’s only the mysterious conditions which brought that last one about that are coming to this country.

Endgame strategies

Those who’ve played monopoly into the early hours will be familiar with the sometimes counterintuitive aspects of the endgame.

With all of the properties owned and loaded with hotels, going around the board carries significant risk of bankruptcy if, heaven forbid, you land on a property like Mayfair (if you didn’t buy it, that is).

As a result, landing on the “Go to Jail” square, being sent there by a Chance card, or rolling doubles three times in a row carries with it a sense of relief as while you’re in jail you live for free, with no chances of going bust in an encounter with the dark blue squares or any other.

Japan is in a similar stage of its economic “game”, where those who didn’t play their cards correctly earlier in their lives now seek shelter behind bars. And arguably they’re merely playing the same game that we are – they’re just at a more advanced stage.

As my colleague Tim Price was told by a Japanese fund manager back in 2000, “Japan was the dress rehearsal. The rest of the world will be the main event.”

Mrs Watanabe’s weakness

The Japanese are famous in the investment world for their prudent saving.

Japanese savers are often referred to as “Mrs Watanabe” as shorthand – a fictional Japanese matriarch who conservatively invests the family’s wealth.

Whenever stability is threatened in the financial markets, Mrs Watanabe sells risky foreign assets and takes the money back home, which strengthens the yen against other currencies, and causes bear markets in risk assets. In this way, the Japanese saver is a global market force to be reckoned with.

But for all her savings and global influence, it’s the magic of compound interest which makes a happy retirement for Mrs Watanabe. And at home, she hasn’t had that for a generation.

With the Bank of Japan setting interest rates below 1% since 1995, many of the elderly have struggled to stay afloat on their savings, to the degree that some commit crimes in order to live for free in retirement.

Though that’s not the only threat to old folks. And interestingly, it’s this other threat which helps explain the lack of interest rates too….

A killer chill

Old folks in Japan are dying in scores during the wintertime. This is not from exposure to the cold however.

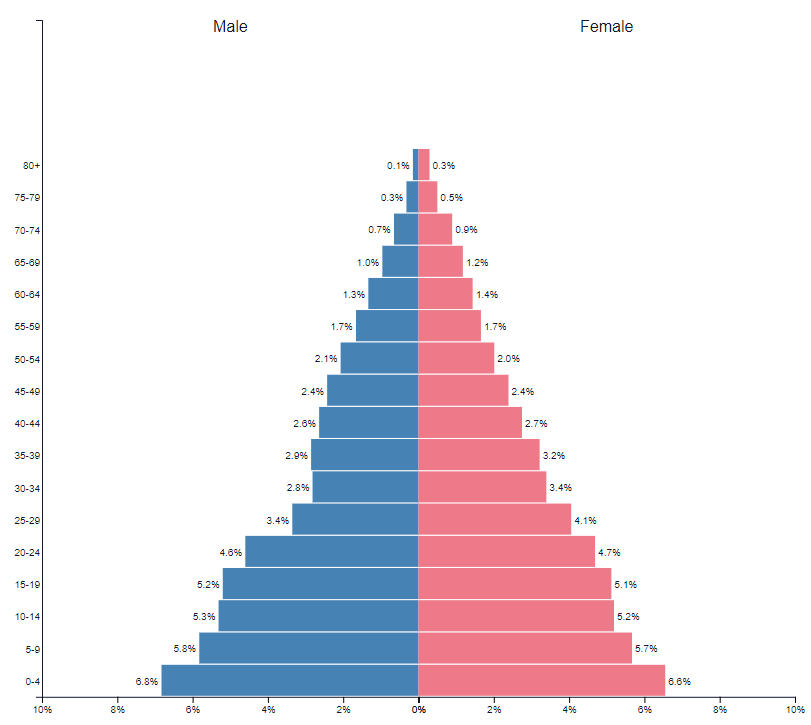

You see, back in 1950, Japan had an almost perfect population pyramid, with far more youngsters than there were adults:

Japan’s population distribution in 1950. Age left-hand scale, percentage of population bottom scale.

Japan’s population distribution in 1950. Age left-hand scale, percentage of population bottom scale.

Source: PopulationPyramid

The force of all those young people entering the workforce was great for consumption and economic growth. For almost 40 years after the war, the Japanese economy boomed, with many thinking Japan would come to rule the world and take over from the US.

The exceptional growth of Japan brought about a boom in consumption as the newly minted wealth was aggressively spent.

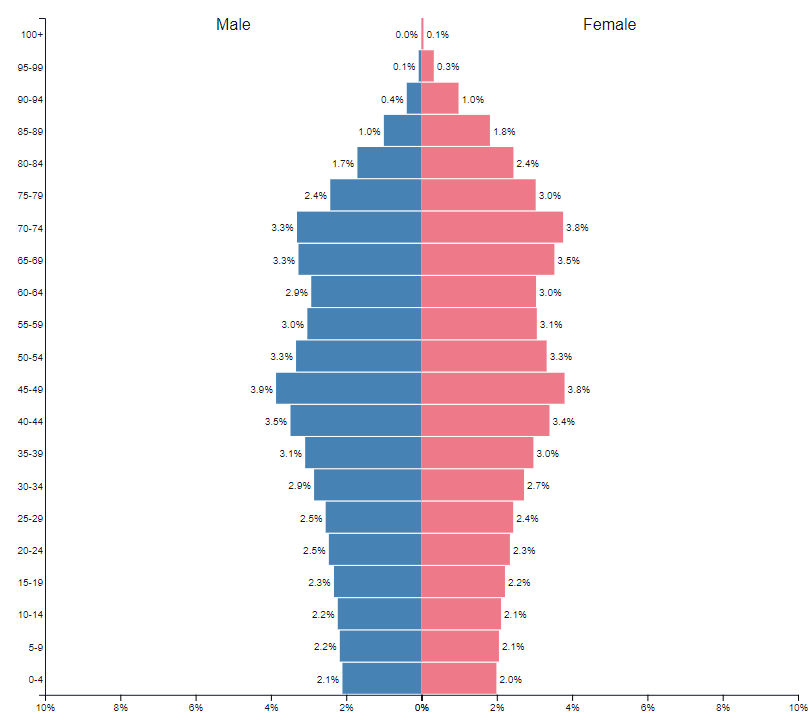

This brought about inflation, which in turn led to higher interest rates which Japanese savers could earn decent returns from. However, that population pyramid has since changed quite dramatically, now more closely resembling a dentist’s drill (or perhaps a sarcophagus):

Japan’s population distribution in 2019. Age left-hand scale, percentage of population bottom scale.

Japan’s population distribution in 2019. Age left-hand scale, percentage of population bottom scale.

Source: PopulationPyramid

There are now many towns in Japan where nobody is under 65. As a result, when there’s snowfall in winter, plenty of old folks die falling off the roof trying to clear the snow themselves, with no youngsters to do it for them.

Or as is also often the case, they don’t clear the snow at all, and the roof collapses on them. In effect, in Japan many old folks are being killed in their scores by the lack of young folks (the scarcity of labour contributes to Japan having the highest density of vending machines in the world).

Demographics are destiny as they say. Without the youngsters to join the workforce and boost consumption, inflation and the growth Japan enjoyed during the post-war years remain only in memory. The Bank of Japan has as a result reduced interest rates to lows to stimulate some kind, any kind, of economic activity.

Thus is the Japanese pensioner not only at risk of dying in the wintertime, but of going bust on his savings during the rest of the year as well.

It’s no wonder they’re playing the “Get into Jail” card – at least they clear the snow off the roofs there.

Pyramid scheme

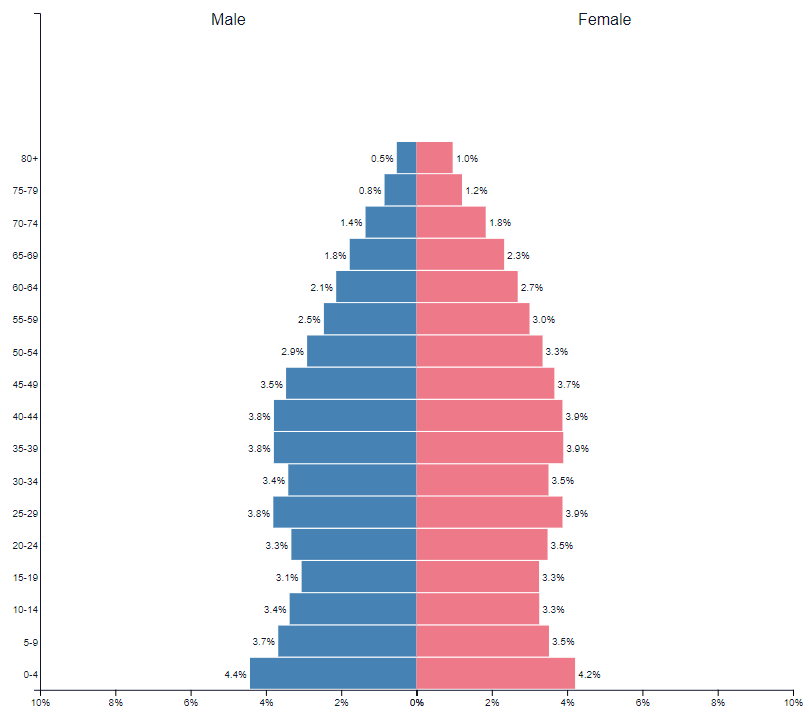

This stage of the monopoly game that Japan has been playing for so many years, we are beginning to enter in the West. Here’s the UK population in 1950:

UK population distribution in 1950. Age left-hand scale, percentage of population bottom scale.

UK population distribution in 1950. Age left-hand scale, percentage of population bottom scale.

Source: PopulationPyramid

The pyramid shape may not be as well defined as Japan’s was at the time (which is perhaps what helped Japan boom so strongly), but the base is still broader than what’s above it. With a larger workforce always in the wings, there was more economic growth always around the corner, and so more consumption, more inflation, and higher interest rates to counteract it.

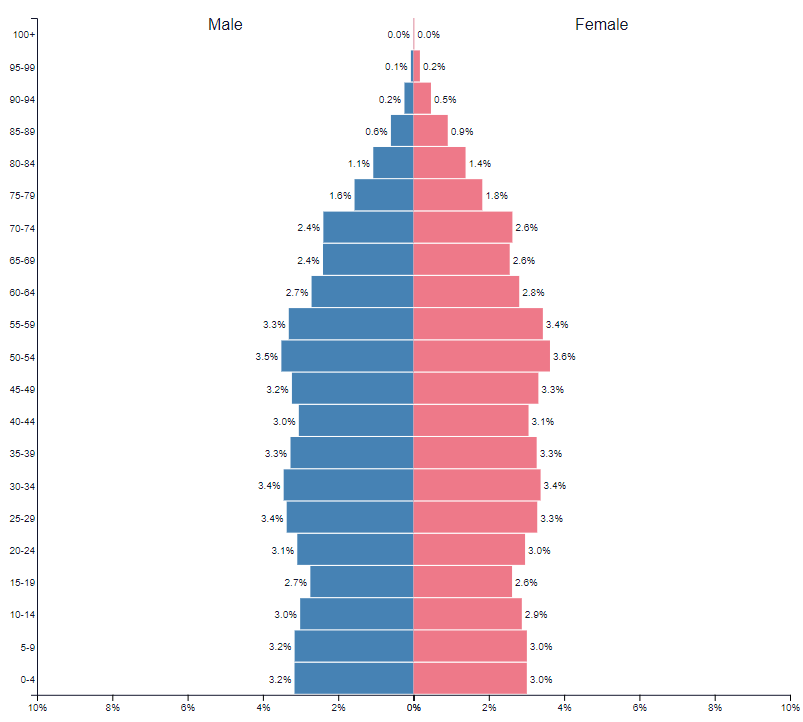

But if you take a look at it now, it’s gained a familiar shape:

UK population distribution in 2019. Age left-hand scale, percentage of population bottom scale.

UK population distribution in 2019. Age left-hand scale, percentage of population bottom scale.

Source: PopulationPyramid

Japan is still in the lead – you’ll notice that the Japanese distribution is much more top heavy, while the bulge in the UK population is still of working age.

But as our game of monopoly advances to the stage Japan is at and more of the population retires, then consumption, inflation, and interest rates will proceed to be pinned to the floor just like theirs. The British Mrs Watanabe (“Mrs Smith” perhaps), will need to make sure they have enough capital and income to survive in retirement.

It should be noted that in Japan the idea that stocks “go up over the long run” is laughed at (for reasons you will understand after a quick look at the Nikkei after 1989), and that it’s common for employees to receive a paycut every year due to the deflationary environment. Not a “cultural import” you can imagine many folks would welcome in this country (I think I’ll just stick to their whisky).

The historian Dan Carlin said in a recent history of Imperial Japan that the Japanese are “like everyone else, but more so” (a line originally said about Jewish folks by a rabbi called Lionel Blue I believe). Hopefully we won’t see folks playing the “Get into Jail” card everywhere else when the true cost of low interest rates begins to kick in – but this is an eventuality that is worth bearing in mind, just in case.

What may change this “demographic destiny” is if the Japanese decide to change the rules of the game. The adoption of Modern Monetary Theory, which limits a government’s spending not by taxation or by what it can borrow, but by the actual capacity of the economy, could be a game changer in bringing back inflation.

With the Japanese now on the path to rearmament (they’re aiming to develop their own future fighter jet, on their own if need be, beginning April next year), and with the government already so heavily indebted, such a radical new strategy may well be required.

With the Japanese so far advanced in the game, we’d do well to look over their shoulder.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates